RBA to Stand Pat, Focus on Yield Containment as Aussie Settles Lower

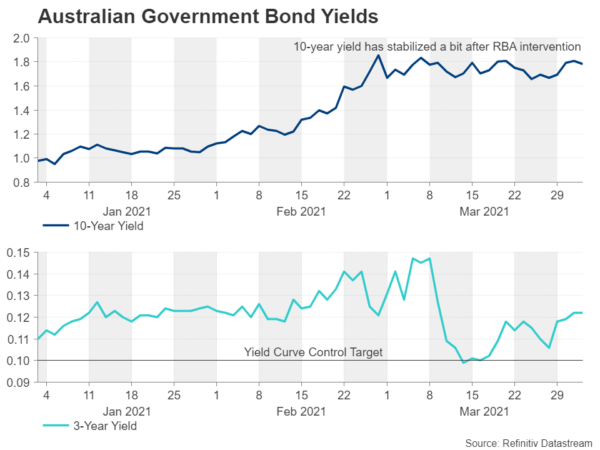

The Reserve Bank of Australia meets on Tuesday for its policy meeting, with a decision expected at 05:30 GMT. No change in policy is anticipated at the April meeting despite a turbulent month for bond markets that prompted some heavy...

Week Ahead – A Battle of Yields as RBA Meets, Fed and ECB Publish Minutes

With most markets closed on Monday for the Easter celebrations, it will be a fairly muted week as there’s not a lot on the agenda that can excite markets. The Reserve Bank of Australia’s policy decision will be the main...

Week Ahead: Coronavirus Worsens, and the Bickering Begins Over Biden’s Infrastructure Plan

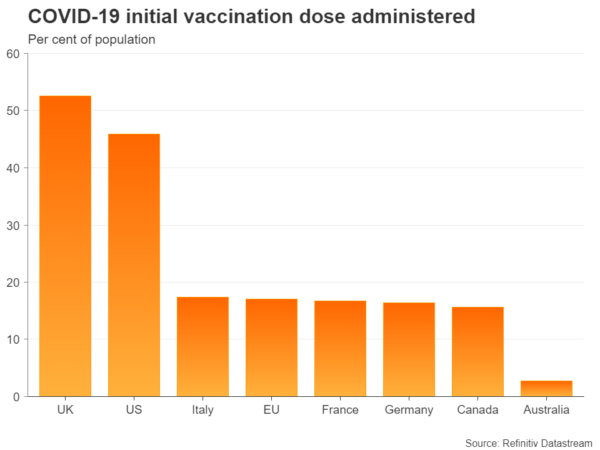

Monday is a holiday and many of the major markets will be closed. Now that month-end and quarter-end are behind us, as well as Non-farm payrolls and OPEC, the focus for the markets will turn back to the rising number...

US March Employment: Real Progress

Summary Hiring stepped up in a major way in March, with employers adding 916K new jobs. More workers returned to the job market and the unemployment rate edged down to 6.0%. While there is still a lot of ground to...

NFP React: Jobs Roaring Back, Stocks Pop, Dollar Strengthens, Yields Higher, Oil and Metals Markets Closed, Bitcoin Higher

The hiring spree has officially started in the US and Wall Street knows that it will take several months of monstrous job gains to trigger the taper tantrum. The equity market party is in the early stages as the US...

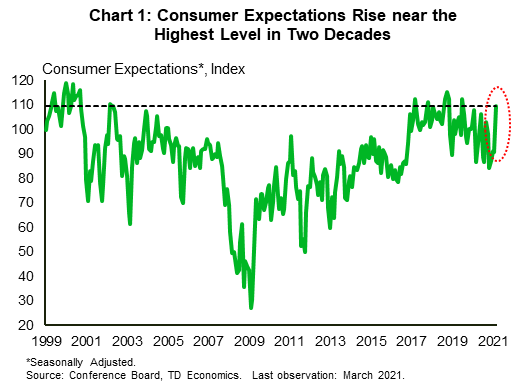

The Weekly Bottom Line: Emerging Markets Are Weathering the Storm

U.S. Highlights Economic data tilted positive this week, with consumer confidence and the ISM manufacturing index rising respectively to one-year and 37-year highs, auguring for a strong showing for Friday’s jobs report. President Biden unveiled a new $2.3 trillion spending...

RBA: The Dynamics of QE and Yield Curve Control

The Reserve Bank Board meets next week on April 6. We expect that the Board will decide to maintain its current policy settings. These settings are the targets of 10 basis points for the cash rate and the yield on...

Dollar Could Hold Strong Again Today

Markets Biden’s leaked $2.25tn stimulus plan supported risk sentiment on US markets yesterday. Despite ambitions to fully fund the proposal by raising corporate taxes, WS finished a tech-lead rally up to 1.5% (Nasdaq) higher. Some end-of-month rebalancing from surging value...

German Retail Sales, PMIs Eyed

The euro has recorded slight gains in the Wednesday session. Currently, the pair is trading at 1.1743, up 0.25% on the day. Will German Retail Sales lift euro? It has been a tough 2021 for the euro, which started the...

Euro Area Inflation On The Rise But Far From Target

ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Contact...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals