Could US Treasuries Draw Some Support From A More Fragile Risk Environment?

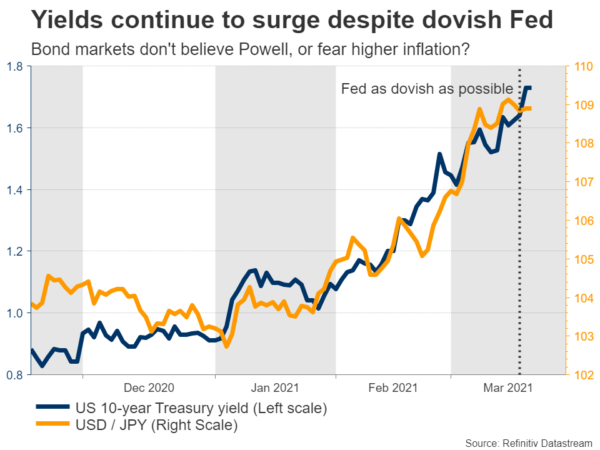

Markets Markets were still looking for a post-Fed equilibrium last Friday. US yields stayed near recent peak levels, but changes were limited (5& 10y + 1.5 bps, 30y -0.5bps). German Bunds outperformed with yields easing up to 2.7 bps/3 bps...

Weekly Economic & Financial Commentary: Still on Track for a Robust Recovery Even After Soft Data This Week

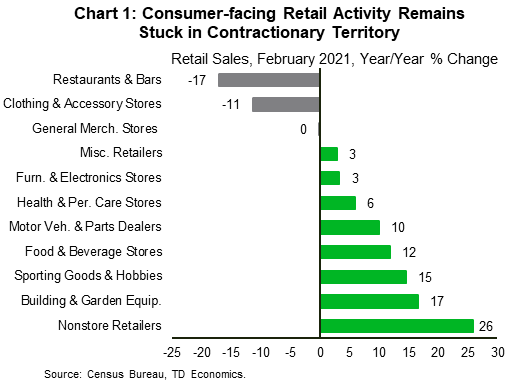

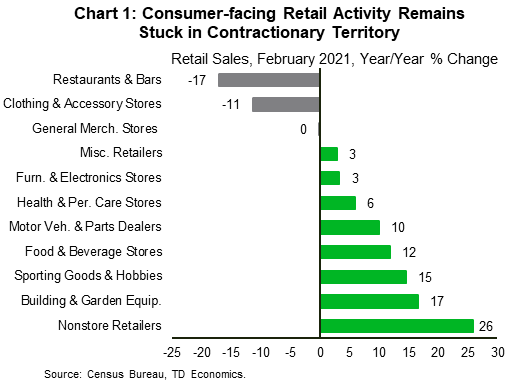

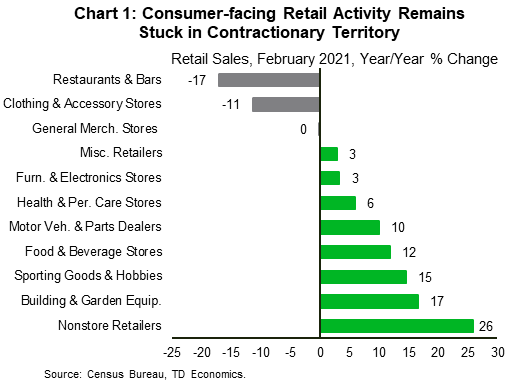

U.S. Review Still on Track for a Robust Recovery Even After Soft Data This Week The worse-than-expected outcomes for February retail sales, industrial production and housing starts were in part due to the severe winter weather that hit much of...

Forward Guidance: Race Between Vaccine Rollout and Virus Spread Heating Up

It would not be at all surprising to see flash Canadian wholesale and manufacturing sale reports for February soften albeit after very solid January gains (wholesale sales rose 4.0%, manufacturing up 3.1% in January). The latter will likely continue to...

The Weekly Bottom Line: Spring is Just Around the Corner

U.S. Highlights Most Federal Open Market Committee members see no interest rate hikes until at least 2024 despite a sharp upgrade to the growth outlook. Retail sales weakened on the back of frigid temperatures, but additional support to households through...

The Weekly Bottom Line: Spring is Just Around the Corner

U.S. Highlights Most Federal Open Market Committee members see no interest rate hikes until at least 2024 despite a sharp upgrade to the growth outlook. Retail sales weakened on the back of frigid temperatures, but additional support to households through...

The Weekly Bottom Line: Spring is Just Around the Corner

U.S. Highlights Most Federal Open Market Committee members see no interest rate hikes until at least 2024 despite a sharp upgrade to the growth outlook. Retail sales weakened on the back of frigid temperatures, but additional support to households through...

Week Ahead: Coronavirus, MOAR Powell, and US Treasury Auctions

After a jam packed, Central Bank dominated week, things will begin to slow down as spring arrives. There were no major surprises from the FOMC, BOE, and BOJ last week, however the peripheral central banks of Turkey and Norway were...

Week Ahead: Coronavirus, MOAR Powell, and US Treasury Auctions

After a jam packed, Central Bank dominated week, things will begin to slow down as spring arrives. There were no major surprises from the FOMC, BOE, and BOJ last week, however the peripheral central banks of Turkey and Norway were...

Week Ahead: Financial Markets Remain Fixated with Bond Market Moves and Brace for Lots of Central Bank Speak

The focus for the upcoming week will stay with the bond market. Financial markets are worried with how high Treasury yields can go. Treasuries have declined for seven straight weeks and that has triggered been the primary driver for US...

Week Ahead – European PMIs to Chart the Euro’s Course

It seems like a relatively calm week for global markets. The sole central bank meeting will be that of the Swiss National Bank, which will likely be thrilled about the recent demolition of the franc. There is also an overload...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals