Shady US CPI Data; 10 Year Auction and ECB ahead

The highly anticipated CPI data for February was released earlier today, and the core data was slightly worse than expected. The headline CPI print for the more closely watched YoY rate was in line at 1.7% vs 1.4% in January. ...

Shady US CPI Data; 10 Year Auction and ECB ahead

The highly anticipated CPI data for February was released earlier today, and the core data was slightly worse than expected. The headline CPI print for the more closely watched YoY rate was in line at 1.7% vs 1.4% in January. ...

Bank of Canada to Stand Pat, Keep One Eye on the Loonie as Recovery Gathers Steam

The Bank of Canada meets this week to set policy and will announce its decision on Wednesday at 15:00 GMT. No change is expected in either interest rates or the pace of asset purchases. But following the better-than-anticipated GDP performance...

Oil Rally Continues, Gold Gains Ground

Oil resumes rise After tanking more than 3% in the previous session, oil is clawing its way higher as fears over supply disruption in Saudi Arabia ease and the US dollar rally pauses for breath. Oil markets fell overnight as...

Oil Rally Continues, Gold Gains Ground

Oil resumes rise After tanking more than 3% in the previous session, oil is clawing its way higher as fears over supply disruption in Saudi Arabia ease and the US dollar rally pauses for breath. Oil markets fell overnight as...

The US Dollar Pushes Higher Again

US dollar gains on US yields, inflation fears The dollar index pushed higher again overnight, rising 0.37% to 92.31. Rising US yields, structurally short positioning and a myopic fixation on growth-driven inflation continue to lift the greenback, notably versus G-7...

March Flashlight for the FOMC Blackout Period: No Major Policy Changes but Perhaps Some Technical Tweaks

Summary We do not look for the FOMC to make any major monetary policy changes at its March 16-17 meeting. Moreover, we expect the Committee to clearly articulate that it has no intention of raising rates or otherwise removing policy...

Yield Continue To Drift Higher

Notes/Observations Focus remains on rising bond yields US $1.9T stimulus seen passing the House later this week ECB meets on Thursday and likely to emphasize its readiness to use the flexibility of the Pandemic Emergency Purchase Program to counteract tightening...

Weekly Economic & Financial Commentary: International Bond Yields Continue to Push Higher

U.S. Review Moving On Up Most of this week’s economic data came in at or above expectations, contributing to growing anxiety about how the Fed will unwind the extraordinary stimulus it put in place. The ISM manufacturing survey rose 2.1...

The Weekly Bottom Line: Coming Out of the Winter Lull

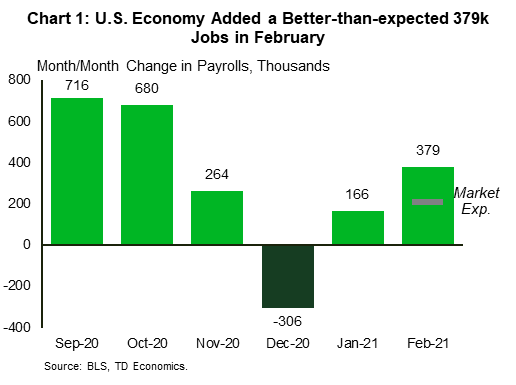

U.S. Highlights The ISM indexes diverged in February, with manufacturing improving and services falling on the month. However, both remain well in expansionary territory. Vehicle sales, meanwhile, fell 5.7% to 15.7 million (SAAR) units. U.S. job growth picked up steam...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals