Forward Guidance: Job Growth to Return as Optimism Fills the Air

We look for next week’s Canadian employment report to show that the 2-speed labour market persisted in February with travel and hospitality services remaining exceptionally weak while other sectors continue to grow. We expect roughly 75K jobs returned in February...

Week Ahead: And You Thought Last Week Was Interesting? ECB, US Auctions, and Inflation

Last week, markets were on edge as yields and the US Dollar continued to rise and stocks were mixed. Federal Reserve Chairman Jerome Powell spooked traders when he reiterated that the Fed is not concerned with rising yields nor rising...

Week Ahead: Dollar Rally Continues as US Yields Rise

The taperless tantrum could continue across financial markets now that it seems clear Fed Chair Powell won’t react until he sees disorderly market conditions or if financial conditions tighten further. Positive economic, such as this past employment report might continue...

Week Ahead – Will ECB Make a Stand Against Rising Yields?

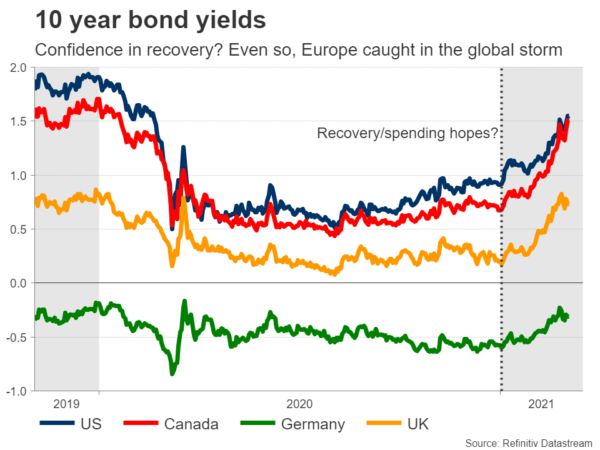

With bond markets going berserk lately, investors will turn to the European Central Bank meeting on Thursday. Some senior policymakers have been vocal about ‘fighting’ this rise in yields, but immediate action seems unlikely. Meanwhile, the Bank of Canada will...

Focus Remains On Yields Ahead Of US Jobs Report

Notes/Observations Global bond yield rally fuels concerns and curbs risk appetite. Traders note the lack of a well-defined red line being set by the Fed had convinced many that key interest rates would likely continue to rise BOJ’s Kuroda helped...

NFP Preview: When Will Jobs Growth Get Back into Gear?

After a blistering recovery from the pandemic-induced recession through Q2 and Q3 of last year, the US labor market has downshifted sharply. Over the last three months, the NFP report has shown total job creation of just 86k jobs, a...

US Yields Rise, FTSE Slips, Powell in Focus

European bourses are trading on the back foot following a weak handover from Wall Street and a sustained sell-off in Asia. Bond yield concerns are back to haunt investors after yields on the 10-year treasury spiked to 1.49% overnight. The...

Crude Oil Shrugs Off OPEC+ Output Cuts Rollover

Bond-driven risk aversion dominated broader markets on Wednesday but crude shrugged it off on optimism that OPEC+ will rollover cuts. The US dollar as the top performer while the kiwi lagged. Comments from Powell are key in the day ahead....

New Zealand Dollar Slips

The New Zealand dollar is down considerably in Wednesday trading. Currently, NZD/USD is trading at 0.7245, down 0.65% on the day. New Zealand dollar stabilizes The New Zealand dollar finds itself in calm waters this week, after taking the market...

European Open: Australian GDP Beats, Index Futures Point Higher

Europe is set for a positive open after sentiment remained buoyant overnight, whilst the dollar could face further pressure over the coming session/s. Asian futures: Australia’s ASX 200 index rose by 55.7 points (0.82%) to close at 6,818 Japan’s Nikkei...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals