LatAm country risk analysts agitated over prospects, but region is diverse

The different faces of Latin America – an improving average regional risk rating belies the exceptional cases of Argentina and Venezuela Latin America’s average risk score improved in 2018 as its constituent economies grew. Yet the gap in average risk...

Bankers weigh in on JPM’s new digital coin

JPMorgan got hearts racing on Valentine’s Day, when it announced that it will be the first American bank to roll out its own digital coin. The coin, which will be 1:1 redeemable to fiat currency held by JPM, will be...

Gulf country risk: Qatar, Saudi Arabia on shakier ground

Oil volatility continues to hamper the region, clipping the wings of investment growth Several countries in the Gulf region saw some improvement in their investor risk scores towards the end of 2018, as public spending cuts and better oil prices...

International Bank of Azerbaijan creditors notch London legal victory

Holdouts in 2017’s debt restructuring by the International Bank of Azerbaijan (IBA) scored a legal victory on December 18 when a judgement forcing the lender to recognize their claims was upheld by the Court of Appeal in London. The decision...

FX: Drawing a line under market movements

Stops are an important risk and trade flow management tool, especially in managing books of smaller FX trades spread across multiple venues and counterparties. As trading has become more electronic and automated, stop-loss orders have become even more useful and...

China banking: Opportunity knocks – so does risk

You only have to read the headlines on the research reports coming out of Asia to get a sense of the mood – and it’s sombre. “Always darkest before the dawn” (Nomura). “Steadying the ship in a stormy world” (BNP...

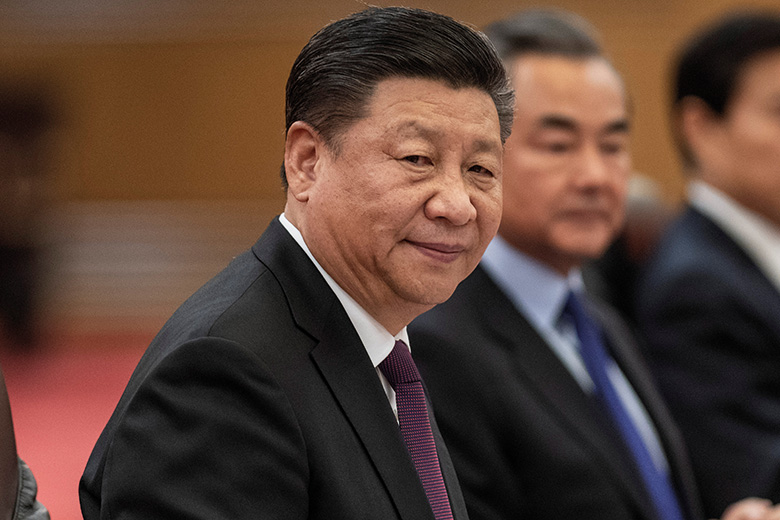

China leveraged loans face new hurdle from EU M&A rule

By Pan Yue China’s firms already face trouble from tensions between China’s president Xi Jinping and US counterpart, Donald Trump A decision by the European Parliament, the European Council and the European Commission to scrutinize foreign investments more closely for...

Capital markets: Happy new year?

For any European capital markets bankers mulling their prospects in 2019, here are a couple of sobering statistics. First, debt. Through its quantitative easing (QE) programme, the European Central Bank has been hoovering up about €8 billion to €9 billion...

Explosive growth pushes CEE risk to new lows

Several countries in Central and Eastern Europe were among the star performers in Euromoney’s country risk survey in 2018, spurring the region’s unweighted average risk score to reach its highest since the turmoil in 2008-2010, caused by the collapse of...

Why Malaysia is riskier than its credit ratings suggest

Too high: But much like the base jumpers in Kuala Lumpur, agencies appear unconcerned by their A-grade credit ratings The Pakatan Harapan alliance, which claimed a stunning victory in the elections seven months ago, has produced a budget bill for...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals