Investment banks in 2Q18, part 3: FICC and equities

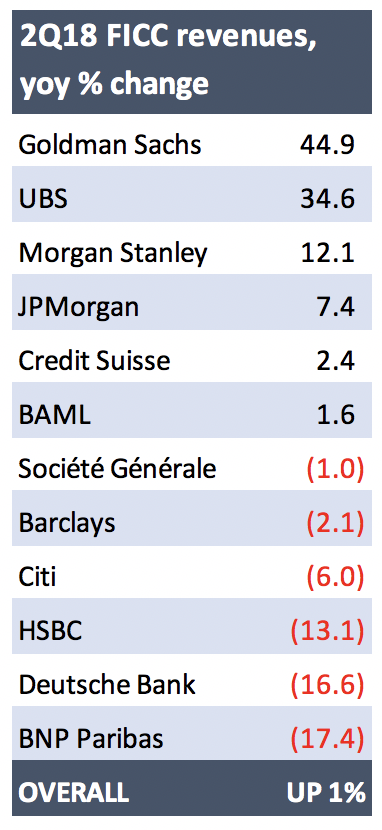

[Part 1 of our analysis dealt with group and CIB results; part 2 was about DCM, ECM and advisory] FICC 2Q18: UP 1%Biggest rise: Goldman Sachs (45%)Biggest fall: BNP Paribas (-17%) TTM: DOWN 11%Smallest fall: Credit Suisse (-2%)Biggest fall: BNP...

World Bank launches first bond on blockchain

The World Bank priced a two-year A$110 million bond issue with a 2.2% coupon on August 23 through lead manager Commonwealth Bank of Australia (CBA) to yield 2.251%. It had mandated the deal two weeks earlier and the issuer and...

Macaskill on markets: False valuations threaten deal fees

Saudi Aramco’s Ras Tanura oil refinery and oil terminal in Saudi Arabia It turns out Saudi Aramco won’t be going public after all, or Tesla going private. Not any time soon, at least. The twin failures of what would have...

Amlo’s pay cuts spark ‘flood’ of IB applicants

Andrés Manuel López Obrador Investment bankers in Mexico say they have been flooded with CVs since the victory of Andrés Manuel López Obrador (Amlo) in the country’s presidential election in July. One of Amlo’s campaign promises was to reduce the...

Libor challengers: ARRs get a boost in August

Barclays became the latest issuer of cash instruments linked to Sofr, the Federal Reserve’s preferred alternative to Libor, when it sold an unusually large asset-backed commercial paper (ABCP) deal from its flagship Sheffield Receivables Corp ABCP shelf on August 24....

PSD2: Real-time processing? Not so fast

The 2018 UK business payments barometer report published by Bottomline Technologies notes that financial decision-makers recognise the change that PSD2 can bring to payments within their businesses. Few observers expect large numbers of corporates to become payment-initiation service providers, offering...

Goldman-backed Circle sees tokenization coming to all markets

– that would have allowed them to trade shares of various exchange-traded funds (ETFs) that go long and short . Excitement had been growing in the crypto world that the arrival of such ETFs would herald a new era of...

Banks diverge on dynamic discounting

The growth in the use of dynamic discounting is highlighted in the most recent AP & Working Capital Report published by PayStream Advisors, which found that the proportion of companies using it to capture rebates and discounts increased by 50%...

Is eurozone consolidation happening behind the scenes?

Talk about bank mergers rarely comes to fruition – especially in Germany and Italy, where it is most needed. A degree of cynicism about bank consolidation is therefore forgivable. However, when Euromoney speaks to Ignazio Angeloni, board member at the...

Small steps for Greece along a risky path

Forever the Achilles heel of the euro project, the interminable Greek tragedy has become more curious this week after the borrower’s exit from its latest bailout programme. The terms of the three-year emergency loan from the eurozone’s European Stability Mechanism...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals