Global Market Volatility: Fed Insider Shares Why 2019 Could Be Pivotal

Key points discussed in this interview Global market volatility Signs of a market focused Fed Economic powershift: The influence of central bankers Unique insights from a Fed insider Going with the flow: A cautionary note for passive investors Former Federal...

How to Read Currency Pairs: Forex Quotes Explained

NOTE: You can not find the right trading strategy? if you have no time to study all the tools of the trade and you have not funds for errors and losses – trade with the help of our best forex...

GBP and UK Asset Aftermath on Brexit & No-Confidence Vote | Podcast

Key points discussed in this conversation The vote outcome relative to expectations How UK Indices could favor, and which index may be more attractive Brexit vote impact on GBP-crosses Key quote, “Instead of selling rallies in GBP/USD as many were...

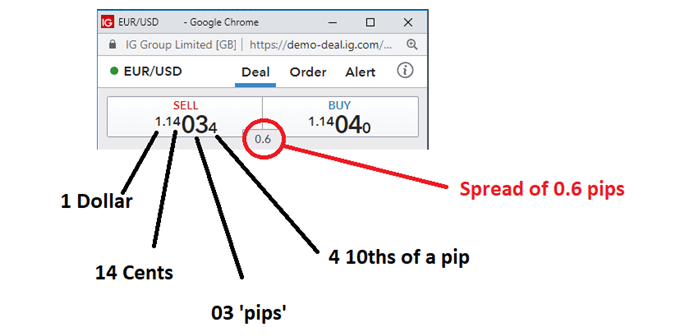

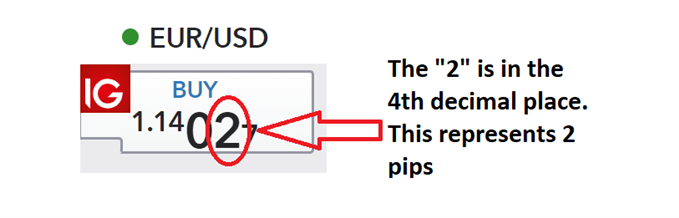

What is a Pip? Using Pips in Forex Trading

What are pips in forex trading? “PIP” – which stands for Point in Percentage – is the unit of measure used by forex traders to define the smallest change in value between two currencies. This is represented by a single...

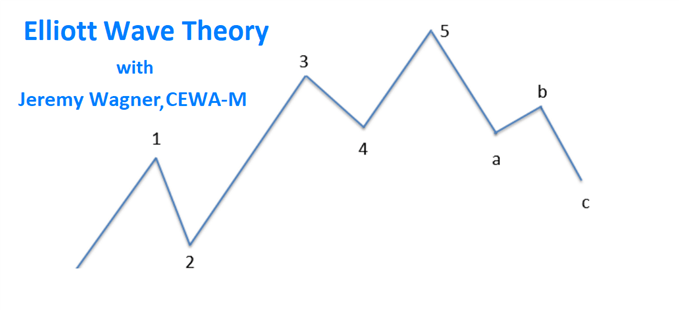

Jeremy Wagner, CEWA-M Gives you Insight on Advanced Technical Analysis

Key Points Discussed in this interview Jeremy’s early trading experience Why Jeremy pays little attention to the news Student to master: overcoming the initial challenges of Elliott wave analysis This article presents the highlights of the podcast so be sure...

Top 5 Emerging Market Currencies & How to Trade Them

Emerging market currencies are currencies backed by emerging market countries, such as the South African Rand, Mexican Peso or Brazilian real. Traders seek them out because they are generally more volatile than developed market currencies.Highly volatile currency pairs can offer...

Forex Market Size: A Traders Advantage

Forex Market Size Talking Points: The forex market is the largest and most liquid market in the world The US dollar makes up the majority of forex transactions The forex market’s deep liquidity is advantageous to traders by allowing them...

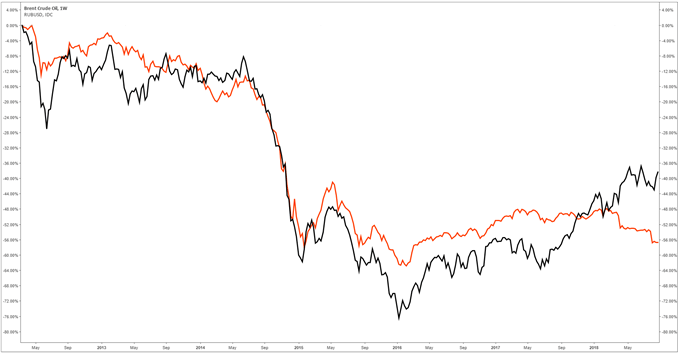

How to Know If You Are Invested in the Right Emerging Market

Most investors like to explore the emerging markets for potentially higher returns. Why is this? Simply because the higher the risk, the higher the potential return. Emerging markets rely heavily on foreign investments to be able to fund projects to...

How to Become a Better Trader: Psychology and Process |Podcast

Key Points Covered in This Podcast How simplifying your strategy can pay off Considering the market’s reaction to news flow rather than the news itself Developing a disciplined approach Not all emotion is bad When looking at how to become...

Crude Oil Price 2019 & Insights from Daniel Lacalle

Key Points Discussed The Texas oil revolution Diminishing effectiveness of monetary policy Commodity prices and the Trade War ‘facade’ Perverse incentives and the inverted credit cycle The Chinese debt load Forecasts and trading strategies for 2019? In this interview senior...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals