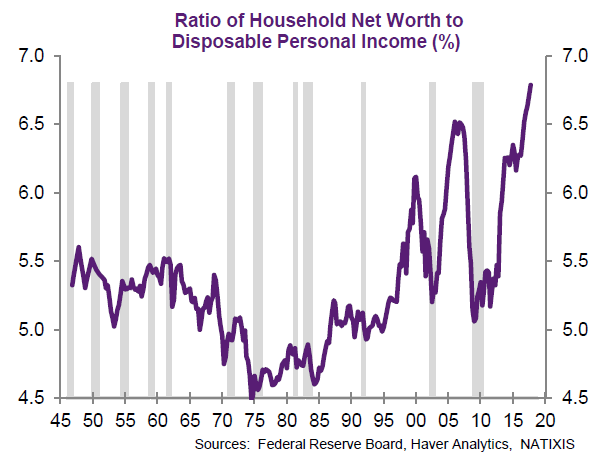

Total American net worth ratio reaches new high — which in the past signaled a recession was not far away

Nine years into the second-longest bull market run in history, the level of total net worth compared with income has reached a record, according to Joe LaVorgna, chief economist for the Americas at Natixis, citing Federal Reserve data. Since the...

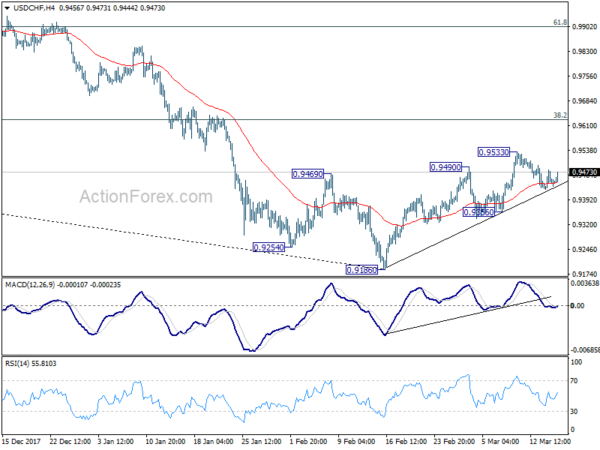

Euro Reverses as Germany Outlook Worsened Considerably, Sterling Pare Gains after CPI Miss

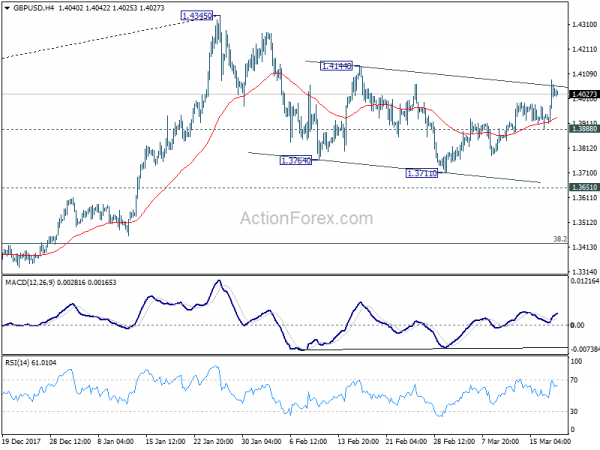

Euro and Sterling trade notably lower today as economic data missed expectation. Sterling remains relatively firm and stays as the strongest major currency for the week. The CPI miss was just 0.1% yoy, and Brexit transition deal should still give...

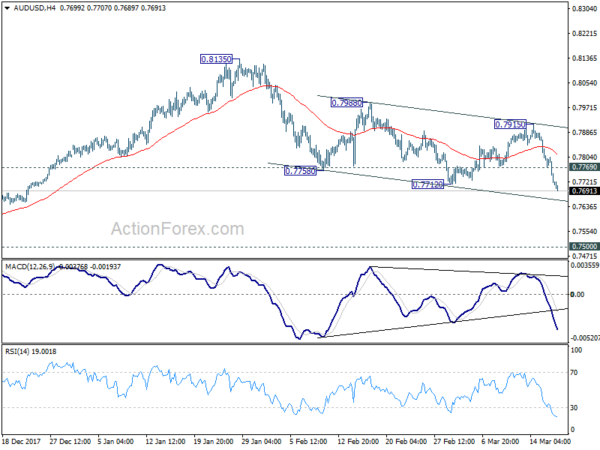

RBA Minutes Reiterated The Impacts Of Low Wage Growth On Inflation

Aussie remains under pressure although the RBA minutes contained little surprise. The minutes signaled that policymakers were encouraged by recent economic growth. However, subdued wage growth and elevated household debt have suggested that policymakers would keep the powder dry. Meanwhile,...

UK CPI Could Trigger Sterling Bulls and BoE Hawks

Sterling remains the strongest one as markets is now preparing for inflation data from UK today. The progress in Brexit negotiation removed one key obstacle for BoE to hike again in May. And CPI data will be a key factor...

Trade War a Major Theme in Busy Week of Central Banks, Data and Politics

The week open relatively quietly again with Swiss Franc leading the way down, followed by Aussie and Kiwi. Dollar strengthens broadly but it’s again out shone by Japanese Yen. Asian markets are mixed with Nikkei trading down -0.8% at the...

CAD, AUD, NZD All Suffered as Trump Stepping on Protectionist Acceleration Pedal

Yen maintained solid strength throughout last week as it ended as the strongest one. Meanwhile, the fortunes of commodity currencies suddenly reversed towards the end. Canadian, Australian and New Zealand Dollar ended as the three weakest ones. Some blamed the...

Safe Haven Theme Dominates, Yen Strong, Commodity Currencies Weak

Safe haven flows remain the main theme in the forex markets today even though global equities are rather resilient. Yen and to a lesser extend Swiss Franc are trading generally higher. Meanwhile, commodity currencies, Canadian, Australian and New Zealand Dollars...

Regulatory plans to clamp down on retail FX leverage divide opinion

Regulators have long expressed concern that the availability of excessive leverage in the retail FX market represents a notable risk, both for individual traders – who might lose more money than they can afford – and for the system as...

Dollar Mildly Higher after Solid Data but Upside Limited, Franc Shrugs off SNB

Dollar strengthens mildly in early US session after some solid economic data. But gain for the greenback is so far limited. While Dollar follow Yen as the second strongest major currency for today, it’s still down again all but Aussie...

SNB Warned Of Franc Appreciation Against US Dollar, Kept Commitment To Intervene

As widely anticipated, the SNB kept the sight deposit rate unchanged at -0.75%, while the target range for the three-month Libor stayed at between –1.25% and –0.25%. Again, the SNB maintained the commitment to intervene the FX market when needed,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals