With concerns about the nascent global trade war escalating and the Treasury yield curve inverting, Federal Reserve Governor Jerome Powell had a clear opportunity to tap the brakes on the central bank’s hawkish lean in today’s semi-annual testimony to the Senate Banking Committee. Instead, Powell generally downplayed concerns about the US economy, prompting traders to increase bets that the Fed would hike interest rates twice more this year.

Highlights from Powell’s comments follow:

- The US economy has grown at a solid pace.

- Second-quarter economic performance was considerably stronger than in the first quarter.

Unemployment is expected to fall further. - It’s hard to predict the outcome of trade tensions and fiscal stimulus, but the best policy is to keep gradually raising rates

- Recent inflation readings are encouraging; The Fed is just shy of achieving symmetrical inflation goal.

- Countries that are open to trade have generally grown faster; Protectionist countries have fared worse.

- The importance of yield curve is the message it gives about the neutral rate.

While the Fed Governor did give traders’ biggest concerns a passing mention, he was at pains to highlight the underlying strength of the US economy. As a result, the market-implied odds of two more interest rate hikes have risen to 63% from 60% yesterday, according to the CME’s FedWatch tool. The US dollar has accordingly seen a rally against most of its major rivals.

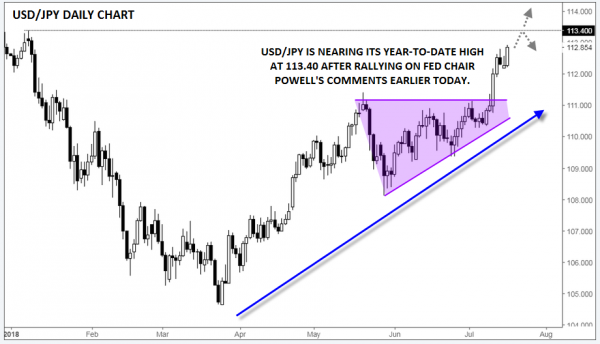

Keying in on USD/JPY specifically, rates have rallied to approach their year-to-date highs in the 113.00 area, building on last week’s impressive 200-pip rally. Technically speaking, the consolidation on Friday and Monday has alleviated some of the near-term froth, though the pair is still stretched on a medium-term basis.

To the topside, the next level of resistance to watch is the early-January high at 113.40, followed by the December high near 113.75 and last year’s major resistance zone starting around 114.50. Meanwhile, any dips back toward the May high near 111.00 may find support as traders look to join the established uptrend at value.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals