As summer draws to a close, it will be another lacklustre week for economic data in the coming seven days. The biggest weight will therefore fall on PCE inflation numbers out of the US, GDP figures from Canada and Australian quarterly capital expenditure data to keep the markets alive, barring of course any fresh developments on the trade front or in the Brexit negotiations. Other notable releases will include Eurozone flash inflation estimates, Chinese manufacturing PMIs and the second reading of US GDP growth for the second quarter.

Australian capex eyed for GDP clues

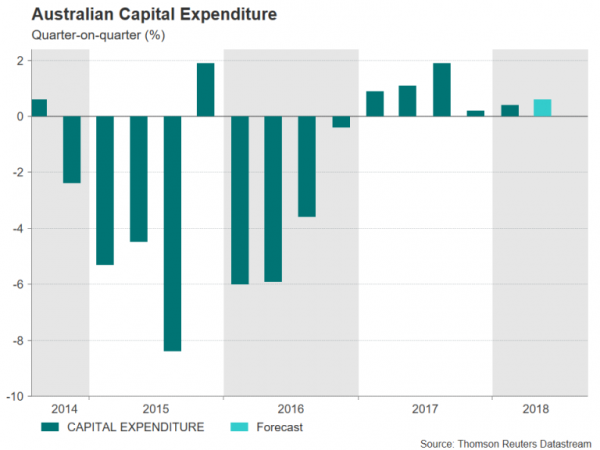

After the past week’s quarterly construction data, investors will get another chance to gauge the strength of the Australian economy in the three months to June with the release of quarterly capital expenditure figures on Thursday. The indicator for construction work done beat expectations by a wide margin and healthy business spending numbers next week would further point to another solid quarter of GDP growth following the robust first quarter performance. Capital expenditure is forecast to come in at 0.6% quarter-on-quarter, ahead of the Q2 GDP estimates scheduled for September 5. Meanwhile, traders should additionally keep an eye out for July figures on building approvals, also due on Thursday, and private sector credit data on Friday.

The Australian dollar could be in line for a significant boost from better-than-expected capex numbers, having already rallied late this week after major political uncertainty was removed following the resignation of the prime minister, Malcolm Turnbull, and his replacement by the finance minister, Scott Morrison.

Another risk for the aussie next week are China’s official PMI releases. The manufacturing and non-manufacturing PMIs are both due on Friday. The manufacturing PMI is expected to ease from 51.2 to 51.0 in August, which would mark a six-month low. Australia’s currency is viewed as a liquid proxy for China-related trades as China is Australia’s biggest export destination. Any evidence that the Sino-US trade war is starting to hurt business activity in China would likely be negative for the aussie.

Japanese industrial production to nudge up in July

Japan’s economy grew by a better-than-expected 1.9% annualized rate in the second quarter, bouncing back impressively from a first quarter dip. However, with trade tensions remaining high, growth could be cooling again in the third quarter, with industrial output falling sharply in June and exports rising at a slower pace in July. Industrial production is forecast to post a small rebound in July, growing by 0.2% month-on-month in the preliminary estimate. A negative print could weigh on the yen as it would make it difficult for the Bank of Japan to exit from its massive stimulus program anytime soon. Other data though is more likely to underline the bright spots in Japan’s economy. Retail sales figures on Thursday and the unemployment rate on Friday, both for July, will be looked at to assess the strength of domestic demand. It follows recent encouraging signs that a tightening labour market is finally starting to lift Japanese wages, which in turn is boosting household spending.

Business sentiment gauges and flash CPI to be European focus

With the third quarter now well underway, there’s been little sign of the Eurozone economy regaining the strong momentum it had enjoyed in 2017, even though the slowdown seen in the first half of this year was anticipated to be temporary. While recent indicators suggest some improvement in Eurozone growth in Q3, new risks, mainly trade protectionism, look set to continue to weigh on regional business confidence in the coming months. The Eurozone composite PMI released this week showed only a marginal recovery in economic activity in August. Germany’s Ifo business climate barometer, due on Monday, and the European Commission’s measure of economic sentiment out on Thursday are not expected to paint a different picture. The Ifo business climate index is forecast to edge up to 101.9 in August, while the economic sentiment index is expected to fall slightly to 112.0. The disappointing growth hasn’t acted as too much of a drag on prices however, as the bloc’s consumer price index hit a 5½-year high of 2.1% in July. It is expected to remain unchanged in August when released on Friday.

With expectations of a major turnaround in the Eurozone economy running low, any positive surprises in the data could buoy the euro, helping it recover further from last week’s 14-month low of $1.1300.

Across the channel, speculation about the direction of the Brexit negotiation will probably remain the main driver for sterling as there will be no major data releases coming out of the UK. However, comments from the Bank of England Governor, Mark Carney, might move the pound when he testifies on the Bank’s inflation report before a Parliamentary committee on Tuesday.

US PCE inflation to underscore Fed rate hike path

There will be several key releases coming out of the United States next week, starting with the Conference Board’s closely watched consumer confidence index on Tuesday. The index is forecast to slip to 126.5 in August from 127.4 in July, sticking close to the 18-year high of 130.0 it set in February. On Wednesday, pending home sales for July are due but a bigger attraction that day will be the second estimate of GDP growth for the second quarter. The preliminary print produced an annualized figure of 4.1% – the highest since Q3 2014. A modest downward revision to 4.0% is expected in the second publication. A bigger negative revision, specifically, one below 4%, could erode some of the bullish perception for the US economy.

However, any possible knock to the US dollar from a downward revision would likely be short-lived as the personal consumption expenditures (PCE) report on Thursday is anticipated to show an uptick in the Fed’s preferred measure of inflation. Last month’s report saw major revisions to past data, revealing that the core PCE price index hit the Fed’s 2% target earlier than thought, in March, before dropping to 1.9%, where it has held for the past three months. It is projected to inch back up to 2.0% in July, which, if confirmed, would reinforce expectations of two more rate increases by the Fed for the remainder of 2018. Alongside the PCE inflation figures, the latest monthly numbers on personal income and spending are also due.

Finally, on Friday, the Chicago PMI for August should be watched together with the final consumer sentiment reading by the University of Michigan, also for August.

Canadian GDP data could seal a September rate hike for the BoC

While most investors are convinced that there will be at least one more rate rise by the Bank of Canada in 2018, the timing is still open to discussion. The odds for a September move currently stand at about 40% (increasing to over 90% for October). Should incoming data surprise to the upside, a rate hike as early as the September 5 meeting could become more probable, giving the Canadian dollar a lift. The first opportunity for a positive data read is Thursday’s GDP figures for the second quarter. Canada’s economy is forecast to have expanded by an annualized rate of 2.3% in the three months between April-June. Given the recent run of upbeat economic indicators, a GDP beat is more likely than a miss. Also worth monitoring out of Canada next week are July producer prices scheduled for Friday.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals