GER 30 Stock Index Set for the Fifth Monthly Loss

The GER 30 stock index (DAX 30) is heading for its fifth monthly loss, dropping to a fresh 2-year low of 10,301 on Thursday. According to the RSI and the Stochastics which have entered oversold terittory, the market could see...

Buying Momentum Falters, Shutdown and Consumer Confidence to Move Dollar

Asian markets pushed higher overnight, with the exception of the Shanghai Index, which was nursing losses following dismal Chinese industrial profits. Europe also started in the black, although European bourses were back in the red by midway through the European...

Stocks and Commodity Currencies Drop as Caution Returns to Wall Street

The best post-Christmas rally is over and most of the gains are already gone. Europe returned to the markets and traded mix. What was discerning for the equity rebound was that it did not take to the news that China...

Your first trade for Thursday, December 27

The “Fast Money” traders shared their first moves for the market open. Pete Najarian was a buyer of Alibaba. Chris Harvey was a buyer of the Real Estate ETF. Gene Munster was a buyer of Apple. Brian Kelly was a...

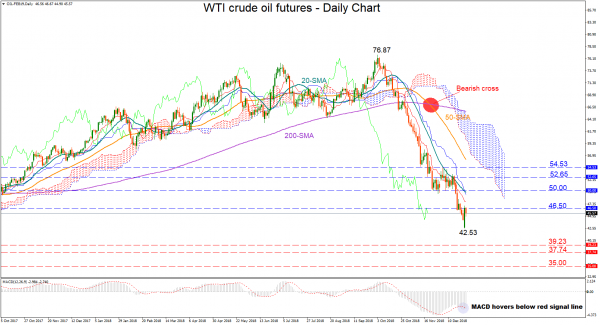

WTI Crude Oil Futures Bounce Off 1 ½-Year Lows But Still Bearish

WTI crude oil futures (for February delivery) jumped by 9% on Wednesday after extending the steep slippery slope to a 1 ½-year low of 42.53. On Thursday, though, the market resumed its bearish mode, with the technical indicators suggesting that...

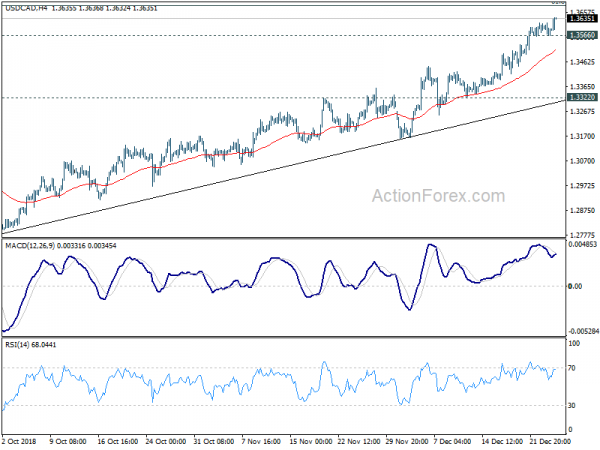

Wobbly Canadian Dollar Back above 1.36. US Jobless Claims Within Expectations

USD/CAD has gained ground in the Thursday session. Currently, the pair is trading at 1.3639, up 0.46% on the day. On the release front, the U.S. unemployment claims rose slightly to 216 thousand, just shy of the estimate of 217...

Yen and Swiss Franc Higher as Sentiments Turn Sour Again

While the US markets staged an historic comeback yesterday, sentiments didn’t stay long. After Asian markets turned mixed, European markets are now trading broadly lower. DOW’s over 1000pts rebound yesterday was impressive. But futures suggest that it’s going to give...

Jobless claims signal labor market strength, consumer confidence tumbles

The number of Americans filing applications for jobless benefits fell marginally last week in a sign of labor market strength, with claims appearing to stabilize after drifting higher in recent months. Initial claims for state unemployment benefits dropped 1,000 to...

DAX Slides As U.S Stock Surge Fizzles In Europe

The DAX Index has posted sharp losses in the Thursday session. Currently, the index is at 10,452 down 1.7 percent. There are only a handful of eurozone events this week, with no data indicators on Thursday. The U.S. releases employment...

No Follow Through in Risk Appetite after US Stocks Rebound

US equities staged a impressive rebound overnight and that’s actually the strongest since 2009. DOW closed up 4.98% or 1086.25 pts at 22878.45. S&P 500 rose 4.96% to 2467.70. NASDAQ jumped even more by 5.84% to 6554.36. Reactions in Asia...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals