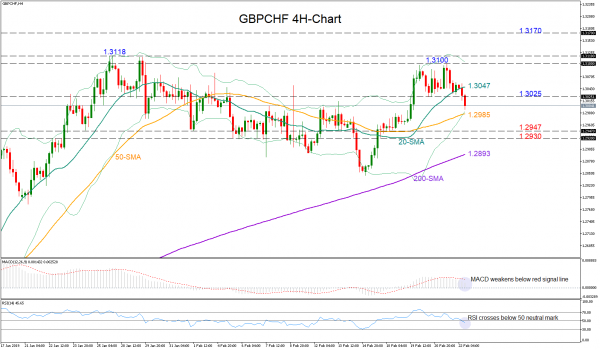

GBPCHF has been pushing hard to overcome the 1.31 resistance the past two days, but the bulls soon got exhausted, letting the bears to take control. The pair is currently trading below its 20-period moving average (MA) in the four-hour chart, while in momentum indicators, the RSI has exited the bullish territory and the MACD keeps losing steam below its red signal line, giving bearish warnings for the short term.

If the sell-off strengthens, the price could rebound once it touches the lower Bollinger band and the 50-period MA around at 1.2985. Should the negative pressure persist, support could run straight down to the 1.2947-1.2930 zone, a familiar spot for the bears. Beating that region too, the focus will shift to the 200-period MA which currently stands at 1.2893.

Alternatively, a reversal to the upside could retest the 1.3025 barrier before reaching the 20-period MA at 1.3047. Crossing that line, the way would open towards the 1.31 round level and the previous peak of 1.3118, where a closing breakout above the latter would pull the market back into a positive course.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our forex ea download

Signal2forex reviews

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals