Weekly Economic and Financial Commentary: Piecing Together an Outlook with Limited Data

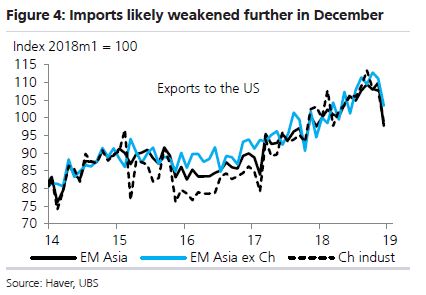

U.S. Review Catching Up On What Was Missing From Q4 The ISM non-manufacturing index fell 1.3 points in January to a still relatively robust 56.7. The U.S. trade deficit narrowed by a surprising $6.4 billion in November, as imports slowed...

The Weekly Bottom Line: Central Banks Have Cause For a Pause

U.S. Highlights Global central banks have followed the cue set by the Fed, as they too take a break from tighter monetary policy to assess mounting risks to global growth. Activity in the U.S. services sector cooled a bit in...

Week Ahead: China Returns, Lots of Macro Events and Brexit

We saw a U-turn in risk-sensitive assets in mid-week as stocks, crude oil and commodity dollars all fell after a bright start. The “risk-off” trade continued to dominate the agenda on Friday when this report was written, with US indices...

Dollar’s Next Move Depends on Trump’s Trade Progress and Border Wall Funding Concession

The relief rally in equities appears to have run out of steam as risk aversion gained momentum on concerns trade talks are not progressing fast enough and global growth fails to show signs of stabilization, despite accommodative stances globally. The...

Third Point dissolves stakes in Netflix, Microsoft and Alibaba

Daniel Loeb’s Third Point dissolved its stakes in Netflix, Microsoft and Alibaba as of Dec. 31, according to a Friday filing with the Securities and Exchange Commission. The hedge fund previously held 1.25 million shares of Netflix, 4.1 million shares...

Bank of America boosts CEO Brian Moynihan’s pay 15% to $26.5 million after record profit last year

Bank of America CEO Brian Moynihan got a 15 percent raise, the biggest increase among bank chiefs to disclose pay so far, after the lender reported record earnings last year. Moynihan’s compensation rose to $26.5 million from $23 million in...

Trade could be the biggest catalyst in week ahead

The earnings deluge continues and inflation reports are due, but it will be the tone of trade talks in Beijing that could have the biggest impact on markets in the week ahead. U.S. Trade Representative Robert Lighthizer and Treasury Secretary...

The fate of the market this year could be in the hands of the ‘Powell Put’

Call it the “Powell Put” or the “Powell Pivot” or something else, but the Federal Reserve chairman’s recent change in approach to monetary policy is reverberating through the markets. In just a matter of a few months, central bank chief...

Trade war headlines could get much worse before they get better as the US looks to Europe

With little apparent progress in U.S.-China trade talks, the Trump administration could be about to open up a new front in the trade wars by taking on the European auto industry — and that could spook markets. U.S. negotiators head...

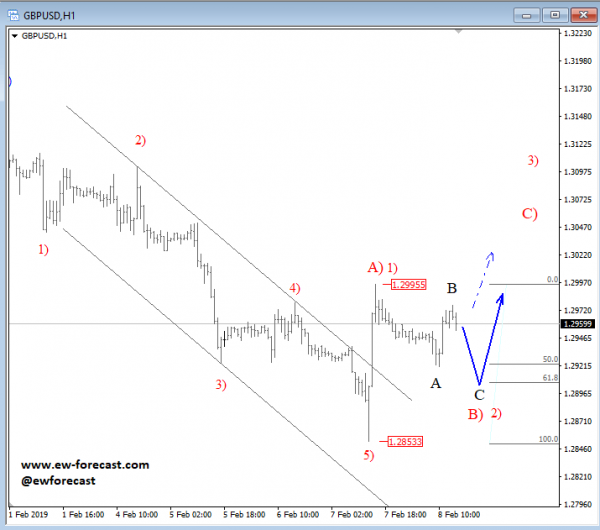

Elliott Wave Analysis: GBP/USD Unfolding A Minimum, Three-Wave Bullish Reversal

GBPUSD made a nice break higher, through the upper Elliott wave channel line, which is the first evidence of a completed decline and that a minimum three-wave recovery in is progress. We labelled wave A)/1) as completed, that is now...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals