Yen and Dollar are trading as the strongest ones for today so far. Slightly lower than expected ADP job growth in February was offset by larger upward revision in January’s data. US trade deficit surged for 2018 as a whole jumped to highest in a decade. But these data are largely ignored by the markets. US growth and trade outlook will very much lie on result of trade negotiation with China, with turned quiet this week. Also, markets ignored OECD’s downgrade of global growth forecast.

Meanwhile, Australian Dollar remains the weakest on for today as traders increased bet on RBA rate cut this year after dismal Q4 GDP. Sterling is the second weakest as there is no breakthrough on Irish backstop while next week’s crucial Brexit votes are approaching. Canadian Dollar is not too far behind as traders await BoC rate decision. Recent economic data from Canada pointed to slowdown in growth momentum. Yet BoC Governor Stephen Poloz maintained tightening bias in recent comments. There is risk of a mild dovish twist in today’s BoC statement. If that happens, the Loonie will likely suffer another round of selling.

In other markets, FTSE is up 0.34%. DAX is up 0.03%. CAC is up 0.26%. German 10-year yield is down -0.257 at 0.144. Earlier in Asia, Nikkei dropped -0.60%. Hong Kong HSI rose 0.26%. China Shanghai SSE rose 1.57%. Singapore Strait Times dropped -0.35%. Japan 10-year JGB yield dropped -0.0132 to -0.005, turned negative.

US trade deficit widened to USD 621B in 2018, highest in a decade

US ADP report showed 183k growth in private sector jobs in February, slightly below expectation of 190k. But January’s figure was revised up from 213k to 300k. US trade deficit widened to USD -59.8B in December versus expectation of USD -57.8B. For 2018, total trade deficit was at USD 621B, highest in a decade, with goods deficit with China, Mexico and EU widened to records. From Canada trade deficit widened to CAD -4.6B in December versus expectation of CAD -1.7B. Labor productivity dropped to -0.4% qoq in Q4 versus expectation of 0.2% qoq.

No solution on Irish backstop after difficult discussions with robust, strong views

UK Attorney General Geoffrey Cox talked about his meeting with EU in Brussels yesterday. He told Sky News that “we’ve put forward some proposals, they’re very reasonable proposals, and we’re now really into the detail of the discussions,” regarding the changes needed on Irish backstop. Cox added that “both sides have exchanged robust, strong views and we’re now facing the real discussions, talks will be resuming soon.”

European Commission spokesman Margaritis Schinas said chief Brexit negotiator Michel Barnier has informed the Commission that “while the talks take place in a constructive atmosphere, discussions have been difficult.” Also, “no solution has been identified at this point that is consistent with the Withdrawal Agreement, including the protocol on Ireland and Northern Ireland, which will not be reopened,”

Separately, UK Trade Minister Liam Fox said the government will laid out the tariffs it plans to levy if the parliament chooses a no-deal Brexit. Fox personally prefer to present the tariff plan to MPs before no-deal vote next week. But he said it was not his decision to make.

Australia GDP slowed to 0.2% in Q4, RBA may need to revise down forecasts in May

Australia GDP grew only 0.2% qoq in Q4, slowed from prior quarter’s 0.3% qoq and missed expectation of 0.5% qoq. Annual growth slowed to 2.3%, down from Q3’s 2.7%. Looking at some details, terms of trade rose 3.2% qoq, 6.1% yoy. But consumer spending rose only 0.4% qoq, 2.0% yoy. Home building contracted -3.4% qoq, slowed to 2.5% yoy. Farm output dropped -4.0% qoq, -5.8% yoy.

Australian Treasurer Josh Frydenberg tried to talk down the slowdown. He noted that “the moderation in part reflects the impact of the drought, lower mining investment and as we continue to move from the construction to the production phase, as well as a decline in residential construction activity from record levels”.

However, the country “continues to grow faster than any G7 nation except for the United States”. And, 0.2% growth was “within the range of market expectations” to him. Also, “over the past 12 months, more than 270,000 new jobs were created and more than 8 out of every 10 of these jobs were full-time.”

Westpac noted that the data now posts a “challenge” for RBA to “credibly maintain its GDP growth forecasts at 3% in 2019 and 2.75% in 2020”. Thus RBA is likely to revise down its growth forecasts in May SoMP. And the policy stance could then shift to steady with a clear easing bias. Westpac continued to expect RBA to cut twice this year in August and November.

RBA Lowe: Income growth to provide counterweight to falling house price

RBA Governor Philip Lowe said in a speech that nationwide housing prices have fallen by 9% since peaking in 2017, bringing them back to level in mid-2016. He noted that “declines of this magnitude are unusual, but they are no unprecedented”. Movement in house prices would influence consumer spending, building activity, access to finance by small businesses and profitability of financial institutions.

Though, labor market is expected to continue to tighten with gradual increase in wage growth and faster income growth. That should “provide a counterweight to the effect on spending of lower housing prices.” And overall, Lowe said the adjustment in our housing market is manageable for the overall economy. It is unlikely to derail our economic expansion. It will also have some positive side-effects by making housing more affordable for many people.”

On monetary policy, Lowe also noted that a “strong labour market is the central ingredient in the expected pick-up in inflation”. Wag growth would “boost household income and spending and provide a counterweight to the fall in housing price”. And, “a lot depends upon the labour market”. RBA will “continue to assess the shifts in the global economy, trends in household spending and how the tension between the labour market and output indicators resolves itself. ”

Lowe also reiterated that the probabilities for the next move to go up or down are “reasonably evenly balanced”.

BoJ Harada: Should strengthen monetary easing without delay if economy deteriorates

BoJ board member Yutaka Harada warned that the economy is facing increasing risks, including slowdown in China, trade tensions and weak private consumptions. Also, subdued inflation could reinforce the public view of low inflation, which would delay the achievement of the 2% target. He urged that “if the economy deteriorates to the extent that achieving the inflation target in the long term becomes difficult, it’s necessary to strengthen monetary easing without delay.”

For now, Harada said BOJ should commit to loose monetary policy “unless prices show stronger movements than currently anticipated.” And the conduct of monetary policy should be “data-dependent, not calendar-based”. He also warned that “past episodes of premature monetary tightening worsened the economy, driven down prices and output, and led to declines in interest rates in the longer-term.”

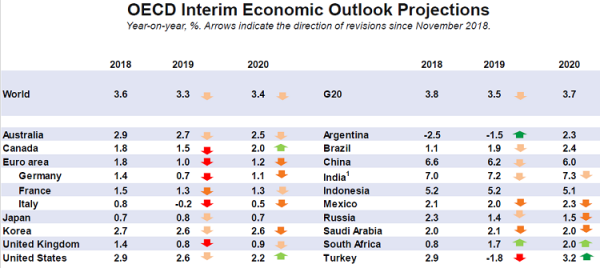

OECD lowers global growth forecast to 3.3% in 2019 on China and Europe slowdown

OECD lowered global growth forecast by -0.2% to 3.3% in 2019 and by -0.1% to 3.4% in 2020. G20 growth forecast was lowered by -0.2% to 3.5% in 2019, and kept unchanged at 3.7% in 2020.

In the Interim Economic Outlook, it’s noted that Chinese and European slowdown, and weakening global trade growth are the principal factors weighing on the world economy. Also, OECD warned that further trade restrictions and policy uncertainty could bring “additional adverse effects”. For China, while policy stimulus should offset weak trade development, “risks remains of a sharper slowdown” that would hit global growth and trade.

“The global economy is facing increasingly serious headwinds,” said OECD Chief Economist Laurence Boone. “A sharper slowdown in any of the major regions could derail activity worldwide, especially if it spills over to financial markets. Governments should intensify multilateral dialogue to limit risks and coordinate policy actions to avoid a further downturn,” Ms Boone said.

Here are some details:

- World growth forecast is lowered from 3.5% to 3.7% in 2019.

- World growth forecast is lowed from 3.5% to 3.4% in 2020.

- G20 growth forecast is lowered from 3.7% to 3.5% in 2019.

- G20 growth forecast is unchanged at 3.7% in 2020.

- US growth forecast is lowered from 2.7% to 3.6% in 2019.

- US growth forecast is raised from 2.1% to 2.2% in 2020.

- Eurozone growth forecast is lowered from 1.8% to 1.0% in 2019.

- Eurozone growth forecast is lowered from 1.6% to 1.2% in 2020.

- UK growth forecast is lowered from 1.4% to 0.8% in 2019.

- UK growth forecast is lowered from 1.1% to 0.9% in 2020.

- Japan growth forecast is lowered from 1.0% to 0.8% in 2019.

- Japan growth forecast is unchanged at 0.7% in 2020.

- China growth forecast is lowered from 6.3% to 6.2% in 2019.

- China growth forecast is unchanged at 6.0% in 2020.

Latest OECD forecasts:

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1284; (P) 1.1313; (R1) 1.1338; More…..

With 1.1345 minor resistance intact, intraday bias in EUR/USD remains on the downside for 1.1215 low. Decisive break there will resume larger down trend from 1.2555. On the upside, above 1.1345 minor resistance will turn bias to the upside for 1.1419 resistance to extend the consolidation from 1.1215.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | GDP Q/Q Q4 | 0.20% | 0.50% | 0.30% | |

| 13:15 | USD | ADP Employment Change Feb | 183K | 190K | 213K | 300K |

| 13:30 | CAD | International Merchandise Trade (CAD) Dec | -4.6B | -1.70B | -2.06B | -2.0B |

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -0.40% | 0.20% | 0.30% | 0.20% |

| 13:30 | USD | Trade Balance (USD) Dec | -59.8B | -57.8B | -49.3B | -50.3B |

| 15:00 | CAD | BoC Rate Decision | 1.75% | 1.75% | ||

| 15:00 | CAD | Ivey PMI Feb | 55.1 | 54.7 | ||

| 15:30 | USD | Crude Oil Inventories | 1.2M | -8.6M | ||

| 19:00 | USD | Federal Reserve Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals