U.S. Highlights

- Spring is coming to the U.S. economy after a tough winter. An impressive bounce back in retail sales in March indicates that consumer spending will bounce back in the second quarter after a disappointing start.

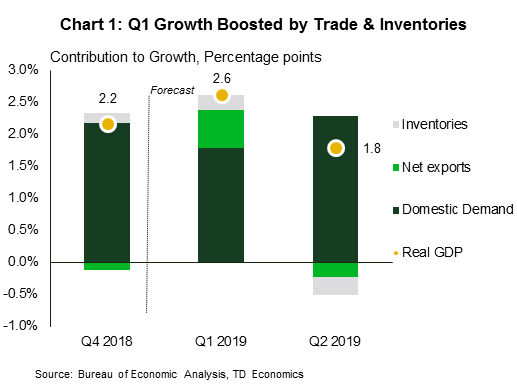

- First quarter GDP growth is released next week, and it is likely going to be messy. A strong headline is likely to belie weakness domestically, while the reverse is likely to be the case in Q2.

- Overall growth in the first half of the year is tracking close to our March forecast, the quarterly pattern is somewhat reversed. The overall story that the economy has slowed from its 2018 pace, but remains above trend, remains intact.

Canadian Highlights

- This week saw a slew of data releases confirming the moderating growth narrative, ranging from a slight change in tone in the Business Outlook Survey, weak manufacturing and trade data releases, and modest upticks in retail and home sales.

- Consumer price inflation was the odd one out, showing a firming in both headline and core measures nearer to the Bank of Canada’s target.

- Regionally, Alberta’s provincial elections saw the UCP win a majority government, while Newfoundland & Labrador’s government tabled its pre-election FY2019-20 budget.

The U.S. economy had a tough winter. A government shutdown, stock market rout, and some bad weather patterns weighed on activity. The good news is that spring is coming.

The first estimate of Q1 economic growth will be released next week. The story is likely to be muddy. Headline GDP is forecast to post a reassuring 2.6% print, but that hides a much softer picture for domestic demand (1.7%, annualized). The combination of an inventory build and a decline in imports is forecast to add nearly a percentage point to growth (Chart 1). Domestic demand, meanwhile, was held back by weakness in both consumer spending (+1.2%) and business investment (+1.6%).

Soft consumer spending is likely to prove temporary. The combination of plummeting stock markets, government shutdown, and bad weather helped send consumers into hibernation at the end of 2018 and early 2019. But, March retail sales showed consumers awakening from their slumber, enough to lift consumer spending to roughly 2 ½% in the second quarter.

Headline retail sales rebounded 1.7% in March, after falling in three of the last four months. That was a bit stronger than we had anticipated, and it lifted our tracking for growth in the first quarter by 0.2 percentage points. Strength was broad based. Sales at motor vehicle dealers were up sharply, as expected, and in line with the bounce reported in unit sales.

Retail weakness had stood out against stronger fundamentals in terms of income growth, low unemployment and confidence surveys. That said, the 3%-plus readings on real consumer spending we saw last year are behind us. We expect continued solid quarterly growth in outlays in the 2-2.5% range for the remainder of the year. This downshift in growth is apparent in the smoothed year-on-year growth in retail sales (Chart 2).

The Fed’s latest Beige Book – its qualitative snapshot of the U.S. economy – reinforces this view of the economy slowing from last year’s pace, but still growing solidly. Labor markets were characterized as tight, restraining hiring growth in some regions. Some weakness is evident in manufacturing, consistent with weaker demand from abroad. Trade uncertainty restrained expansions in some districts. The clouds hovering over the global outlook have not cleared, despite a better-than-expected first quarter growth report out of China.

Trade peace with China and Europe would certainly help global sentiment. China and U.S. negotiators plan two more rounds of face-to-face talks, and are working towards a signing ceremony in late May/early June. It remains to be seen whether a deal lifts the tariffs already in place, or if these are kept on as an incentive for compliance. If they are lifted, it would provide a tailwind to Chinese, and likely global, growth.

Canadian financial markets were quiet this week, with the S&P/TSX up 1%, and the loonie and oil prices relatively flat. Instead, this week’s news flow was heavily dominated by a slew of data releases (Chart 1), which together served to reinforce the view that the Canadian economy started the year in a soft spot. Provincial developments were also in the spotlight, with Alberta’s election front and center.

On the consumer side, existing home sales kicked off the release schedule, with a modest 0.9% m/m uptick. The lacklustre recovery left overall Q1 sales down 2.7%. Prices disappointed further, with annual growth in the composite price index now at its slowest pace since late-2009. Rounding off the week was a ho-hum retail sales report, where the above-consensus headline print (0.8% against 0.4%) came with only a modest volume uptick (0.2%) and negative revisions to January’s data. Retail sales volumes look set to contract in Q1, absent a strong March rebound.

Business-related indicators didn’t fare better. The Bank of Canada’s Business Outlook Survey for Q1 offered a slight change of tone relative to prior surveys. Its summary indicator fell into negative territory for the first time since 2016, suggesting weakening business sentiment (Chart 2). At the same time, forward-looking indicators of investment intentions, and indicators of capacity constraints, while still positive, have moderated. There can be a disconnect between the survey and Statistics Canada data, but the change in tone matches recent disappointments in business investment and moderation in manufacturing and exports.

Canadian financial markets were quiet this week, with the S&P/TSX up 1%, and the loonie and oil prices relatively flat. Instead, this week’s news flow was heavily dominated by a slew of data releases (Chart 1), which together served to reinforce the view that the Canadian economy started the year in a soft spot. Provincial developments were also in the spotlight, with Alberta’s election front and center.

On the consumer side, existing home sales kicked off the release schedule, with a modest 0.9% m/m uptick. The lacklustre recovery left overall Q1 sales down 2.7%. Prices disappointed further, with annual growth in the composite price index now at its slowest pace since late-2009. Rounding off the week was a ho-hum retail sales report, where the above-consensus headline print (0.8% against 0.4%) came with only a modest volume uptick (0.2%) and negative revisions to January’s data. Retail sales volumes look set to contract in Q1, absent a strong March rebound.

Business-related indicators didn’t fare better. The Bank of Canada’s Business Outlook Survey for Q1 offered a slight change of tone relative to prior surveys. Its summary indicator fell into negative territory for the first time since 2016, suggesting weakening business sentiment (Chart 2). At the same time, forward-looking indicators of investment intentions, and indicators of capacity constraints, while still positive, have moderated. There can be a disconnect between the survey and Statistics Canada data, but the change in tone matches recent disappointments in business investment and moderation in manufacturing and exports.

U.S. Real GDP – Q1 Advanced

Release Date: April 26, 2019

Previous: 2.2%

TD Forecast: 2.6%

Consensus: 2.0%

We expect GDP to advance 2.6% q/q saar in Q1. The strong headline is likely to be flattered by an inventory build and a decline in imports. Domestic demand is forecast to be weaker thanks a notable slowdown in consumer spending. Also notable, and reflecting the recent pick-up in the housing sector, residential investment likely contributed positively to growth for the first time since 2017. All in, a more solid Q1 print will likely borrow from Q2 growth, which is currently forecast to come in below 2%.

Bank of Canada Rate Decision

Release Date: April 24, 2019

Previous: 1.75%

TD Forecast: 1.75%

Consensus: 1.75%

We look for the Bank of Canada to hold rates unchanged at 1.75% at next week’s meeting while updated projections and a tweak to forward looking language should give a dovish tone. We except the MPR to include a 0.2pp downgrade to 2019 GDP growth and with the softer outlook, we look for the Bank to all but confirm market pricing and remove the reference to future rate increases in the communique. We also look for the Bank to shift its range for the neutral rate 0.25% lower (leaving the lower bound at 2.25%) although we still think the Bank will end the cycle at 1.75%.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals