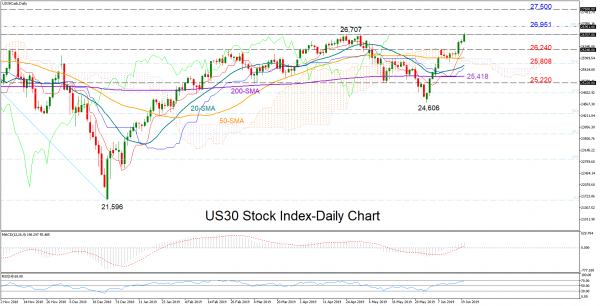

US30 stock index (Dow Jones) is currently flirting with May’s peak of 26,707 but the positive momentum in the MACD, which trends above its red signal line, suggests that September’s record high of 26,951 could be achievable as well. Still, the RSI warns that the market is approaching overbought territory and hence downside corrections cannot be ruled out.

Clearing the 26,951 ceiling, the bulls would aim to test the uncharted area between 27,000 and 27,500.

Otherwise, if the market weakens below the 26,240 resistance level, the 78.6% Fibonacci of 25,808 of the downleg from 26,951 to 21,596 could next halt bearish action. Moving lower, the 25,220 number could provide a stronger base to prevent more aggressive declines.

In the medium-term picture, a bull market could officially begin comfortably above 26,951, while a bearish outlook would resume under 24,606.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals