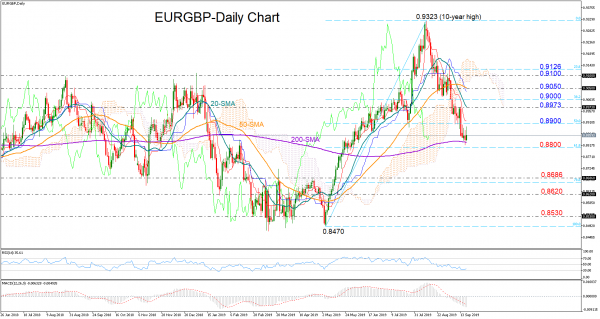

EURGBP seems to have reached oversold levels near the 200-day simple moving average (SMA) as the RSI is showing some positive movement after flatlining near its 30 oversold levels. The MACD and the red Tenkan-sen are also looking ready to change direction, though as long as the indicators hold in bearish territory, downside pressure is expected to dominate. Besides that, the bearish intersection of the 20- and 50-day SMAs should also keep traders cautious if the lines remain negatively aligned.

An extension below the 200-day SMA and the 61.8% Fibonacci of 0.8800 of the upleg from 0.8470 to 0.9323 could weaken the case for a sustainable upside move, shifting the focus towards the 0.8686 former support level which is placed slightly above the 78.6% Fibonacci. Beneath that, the sell-off could next pause near the 2018 trough of 0.8620 before attention shifts to the 0.8530 barrier.

On the flip side, a remarkable bounce above the 50% Fibonacci of 0.8900 could see a retest of the 0.8973-0.9000 resistance area, while beyond the 50-day SMA currently around 0.9050, a bigger battle could start near the 0.9100 level and the 23.6% Fibonacci of 0.9126. Nevertheless, only a climb above the Ichimoku cloud would restore confidence on May’s uptrend.

Meanwhile in the three-month picture, the stabilization in the 50-day SMA mirrors neutral conditions. Yet as long as the line holds above the 200-day SMA, the odds for a bullish outlook remain high.

In brief, EURGBP continues to lack clear bullish signals in the short-term as the momentum indicators keep fluctuating in bearish territory. In the medium-term, the pair is in a sideways move but hopes for an outlook reversal remain alive.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals