U.S. Highlights

- A downturn in U.S. consumer confidence and rising political risks as the House began impeachment inquiries against President Trump, triggered volatility in global markets.

- U.S. personal incomes jumped in August (to 0.4% month-on-month from 0.1% previously), even as spending was subdued (0.1% in August vs. 0.5% in July).

- Activity in the housing market continued to perk up with larger-than-expected rises in both new and pending home sales on the heels of similar increases in housing starts and permits last week.

Canadian Highlights

- It was a generally weak week for Canadian markets, as falling oil prices helped send the TSX lower.

- In contrast, the Canadian economic data this week was generally encouraging. Wholesale trade gained nicely in July, as did construction activity. The payrolls data showed another month of gains, making it seven-for-seven so far this year.

- The data broke from the more modest reports earlier this month – continuing the trend of hot and cold economic data. All told, the Canadian economy appears to have started the third quarter on decent footing.

U.S. – Political Risks Heighten Economic Uncertainty

The financial news this week was highlighted by old-fashioned political words like “prorogation” and “impeachment.” In the U.K., the Supreme Court ruled that Prime Minister Johnson acted unlawfully when he prorogued Parliament earlier this month. The ruling is expected to intensify Brexit tensions in the weeks ahead.

In the U.S., House Speaker Nancy Pelosi announced an official impeachment inquiry into President Trump after a whistleblower report suggested that he withheld aid to Ukraine while pressing the country to investigate Democratic presidential candidate Joe Biden and his son. The threat of ousting the president from office contributed to market volatility, but with few believing it will hit the two-thirds of the Senate required for conviction, market reaction was relatively muted, with stock markets edging modestly lower and bond yields down a few basis points.

Meanwhile the U.S.-China trade dispute continues to simmer. Washington and Beijing, sent out mixed signals throughout the week. Mr. Trump noted that he wouldn’t accept a “bad” trade deal with China, but by Wednesday stated that a trade deal with China “could happen sooner than you think.” China, on the other hand, called trade talks “productive” and “constructive” and there are reports that Chinese companies are preparing to increase their purchases of U.S. pork and soybeans, notwithstanding the cancellation of scheduled U.S. farm visits by Chinese delegates.

On a more positive note, Mr. Trump and Japan’s Prime Minister signed a trade-enhancement agreement that will lower agricultural tariffs in Japan, industrial tariffs in the U.S. and set new rules for digital trade between the two countries. The limited accord is potentially the first step in a broader trade agreement between the two countries.

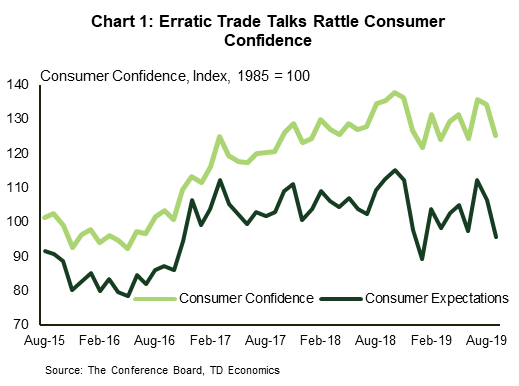

The erratic nature of trade talks has undoubtedly contributed to a falloff in consumer confidence. The Conference Board’s index fell by the most in nine months in September to 125.1, from a downwardly revised 134.2 the month before (Chart 1). The reading was well below market expectations. The expectations index also declined to 95.8 from 106.4 previously. The downturn in expectations could see consumers hold back on spending. Indeed, consumer spending slowed more than expected in August, nudging up just 0.1% month-on-month. On the upside, incomes rose by a solid 0.4%. Price pressures were steady, with PCE inflation holding at 1.4% year-on-year, but the core measure ticked up to 1.8% (from 1.7%).

Activity in the housing market fared better. New home sales increased 7.1% in August and pending home sales rose a better-than-expected 1.6%. Residential investment is likely to add a small, but positive, amount to third quarter GDP – a welcome development after several quarters subtracting from growth. On the price side, the Case-Shiller index slowed in July to the slowest pace since September 2012 (Chart 2). The deceleration in price growth may not be such a bad thing, easing affordability pressures and helping to sustain the recent pickup in housing demand.

Canada – More Mixed Messages

Canadian markets were generally soft this week, with the S&P/TSX composite index trending steadily lower, in near-lockstep with falling oil prices. Notably, the declines were widespread, with only the utilities and financials subcategories shaping up to end the week higher at the time of writing. South of the border, markets withstood some spicy political headlines and managed to turn out a mixed performance across the major indices.

Turning to the domestic dataflow, releases were mainly ‘second tier’; the type that typically don’t get as many headlines, but still contribute to the economic picture. In contrast to last week’s generally weak data releases (such as the retail sales report that showed effectively no growth in volumes over the past year), the data this week was more constructive.

Top of the list was the wholesale trade report. Sales volumes in this industry were up an impressive 1.9% m/m in July – the strongest showing in nearly three years (Chart 1). As strong as sales were, rising inventories meant the inventory-to-sales ratio was down only a touch, and remains elevated after surging higher in early 2018 – matching the trend seen among manufacturers.

The July construction investment data was also encouraging. Residential construction was up 0.8%, helped by healthy gains in single dwelling activity (multis were down on the month). The pace of growth may have cooled a bit after a strong run earlier this year, but activity is still well above the low levels seen late last year. Non-residential construction grew at the same 0.8% monthly pace, for an eighth straight month of expansion, with all major categories (industrial, commercial, and government) up in July.

Finally, the July payrolls report – often overshadowed by its much timelier cousin the Labour Force Survey (which gives us the unemployment rate) – also painted an encouraging picture. Payroll employment continued its so far unbroken climb this year, up 75.4k month-on-month in July. Hours worked were basically unchanged, but the somewhat more volatile weekly earnings figure ticked back up to hit 2.9% y/y (Chart 2). Over the past six months, earnings gains have averaged 2.4% – above inflation, but still shy of the 3.5% mark associated with tight labour conditions.

Looking ahead to next week’s monthly GDP report, things are shaping up well. Despite the mixed messages in the monthly data, we look for another month of decent economic growth in July (See the Upcoming Releases section of this report).

So where does this leave the Bank of Canada? With the election cycle in full swing, we won’t be hearing much (if anything) from Poloz and company this month, making their post-election forecast update even more important than usual. But perhaps it is just as well for them: divergent trends, global developments and potential changes in fiscal policy all mean the economic landscape may look quite a bit different in a month’s time. While the data and near-term silence augur for another hold in October, expect to see some shifts in tone when Poloz next faces the media.

U.S: Upcoming Key Economic Releases

U.S. ISM Manufacturing Index – September

Release Date: October 1, 2019

Previous: 49.1

TD Forecast: 50.8

Consensus: 50.3

We look for a rebound in the ISM index to 50.8 in September after its drop to contractionary territory in August (49.1), as we expect easing trade tensions to have marginally boosted business sentiment in September. Indeed, the average of the ISM-adjusted regional surveys is pointing to some improvement since August. In addition, a recent spate of steady capex orders and a firmer Markit PMI also boost the odds for a positive surprise, in our view.

U.S. Employment – September

Release Date: October 4, 2019

Previous: 130k, unemployment rate: 3.7%,

TD Forecast: 150k, unemployment rate: 3.7%

Consensus: 140k, unemployment rate: 3.7%,

We expect payrolls to increase by 150k in September, following the below-consensus 130k August print. Jobs in the goods sector should remain soft as manufacturing employment is expected to remain subdued, while we look for a modest rebound in services partly due to a recovery in job gains in the education sector. We also note that temporary census hiring for canvassing purposes should continue to boost employment figures this month: we pencil in a 15k increase federal hires. All in, the household survey should show the unemployment rate remaining steady at 3.7% in September, while wages are expected to rise 0.2% m/m, leaving the annual rate unchanged at 3.2% y/y.

Canada: Upcoming Key Economic Releases

Canadian Real GDP – July

Release Date: October 1, 2019

Previous: 0.2%

TD Forecast: 0.1%

Consensus: 0.1%

Industry-level GDP growth is forecast to rise by a muted 0.1% in July due to continued softness in the goods-producing sector. Real manufacturing sales fell by 1.6% for their largest one-month drop since April 2018 which suggests that some of the weakness projected by softer PMIs is now showing up in the activity data. Energy production is also forecast to edge lower on the heels of a strong Q2; production caps were unchanged in July but scheduled increases of 25k/month for August-October should support growth in the coming months. One offset is an anticipated rise in utilities output, driven by heat waves across Eastern Canada for part of the month. Solid momentum in services should provide another source of strength, with a large contribution from wholesale trade and real estate, while retail trade will exert a modest drag. A 0.1% increase would leave Q3 tracking in the low-1% range, slightly below BoC projections from July.

Canadian International Trade- August

Release Date: October 4, 2019

Previous: -$1.124bn

TD Forecast: -$1.50bn

Consensus: -$1.05bn

The international merchandise trade deficit is forecast to widen to $1.5bn in August on account of higher imports, which have yet to fully recover from a 4% decline in June. Non-energy exports will provide a partial offset on higher auto production alongside higher forestry exports, which will benefit from a recent pickup in US homebuilding activity. Meanwhile, lower crude oil prices will weigh on nominal export activity.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals