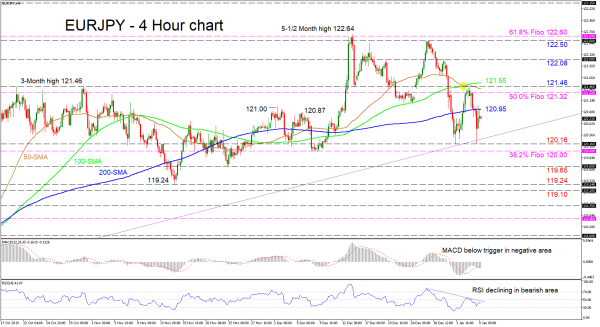

EURJPY appears to be curbed by the 200-period simple moving average (SMA) currently at 120.95, succeeding a second push off the 120.16 support, which resulted in buyers keeping the pair above a supportive trendline drawn from 3 September 2019.

The short-term oscillators suggest a slight strengthening in negative momentum. The MACD has slipped back below its red trigger line in the negative zone, while the RSI, has turned back down in the bearish region. Furthermore, boosting a retest of the supportive trendline or a gradual sideways move towards it, is the recent bearish crossover of the 100-period SMA by the downward sloping 50-period SMA.

To the downside, sellers would need to initially conquer a tough support region consisting of the supportive trendline around 120.30, the fresh lows of 120.16 and the 120.00 handle, which happens to be the 38.2% Fibonacci retracement of the down leg from 126.80 to 115.85. Moving down, the swing low of 119.65 from 22 November 2019 could apply some upside pressure ahead of the key support area of 119.24 to 119.10.

If buyers resurface driving the price above the 200-period SMA at 120.95, next to obstruct the climb is a fortified area made up of the 50.0% Fibo of 121.32 and the 100-period SMA at 121.55, which also encapsulates the fresh high and the 50-period SMA. Overcoming this, the 122.08 resistance could be next to prevent the price from reaching the peaks of 122.50 and 122.64.

Overall, the short-term bias seems neutral-to-bearish and a break below 120.00 could reinforce this outlook, while a break below 119.10 would cement a bearish bias.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals