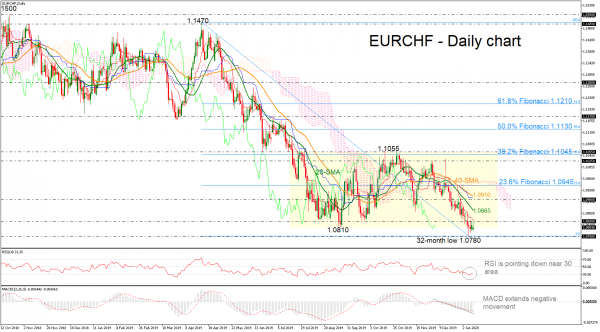

EURCHF found some footing around the 32-month low of 1.0780 last week and returned inside the trading range from 1.0810 to 1.1055.

The MACD seems to be losing momentum below its red trigger line, the RSI is still hovering around its 30 oversold mark and the red Tenkan-sen is sloping down as well, while the blue Kijun-sen is still flattening, all signaling a more cautious trading in the short-term.

Should weakness extend below the 32-month low of 1.0780 mark, support to downside movements could be initially detected within the 1.0620 – 1.0650 area, identified by the bottom on February 2017 and April 2017.

Alternatively, the pair needs to overcome the 1.0830 barrier taken from last week’s highs and the low on September 25 to meet a key barrier near the 20-day simple moving average (SMA) currently at 1.0865. The 1.9000 – 1.0910 strong resistance area, which encapsulates the 40-day SMA could act as resistance too before a more important battle starts near the 23.6% Fibonacci of the downward wave from 1.1470 to 1.0780 around 1.0945.

In brief, EURCHF maintains a neutral profile over the last six months in the medium-term. However, in the short-term the pair remains negative.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals