Risk aversion continues in Asian session as China’s coronavirus outbreak continues to worsen. The Shanghai SSE is currently down -8.13%, catching up with others as it’s back from holiday. Nikkei is down -1.10%. Singapore Strait Times is down -1.07%. Though, Hong Kong HSI is up 0.09%.

The currency markets, are relatively quiet, however, as major pairs are crosses are staying inside Friday’s range. Australian and New Zealand Dollars are mildly firmer while Sterling and Yen are softer. But the picture could drastically chance as the day goes on.

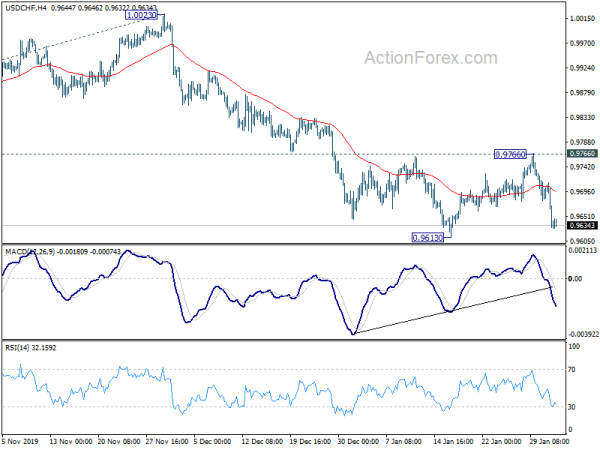

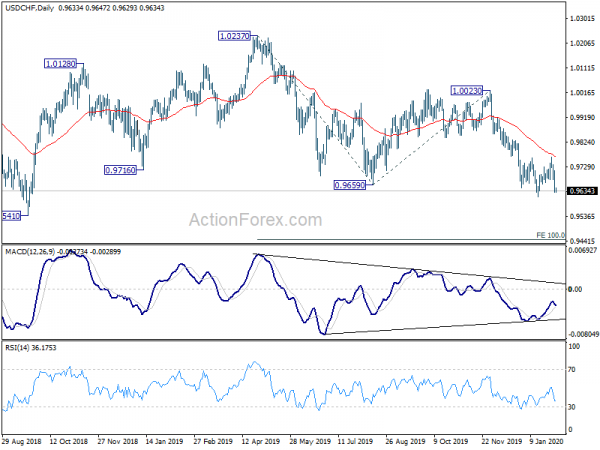

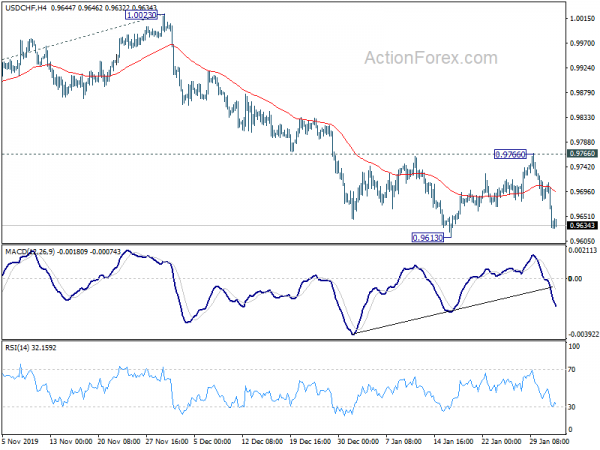

Technically, USD/CHF is heading to 0.9613 support and break will resume whole down trend from 1.0237. EUR/CHF might follow through 1.0665 temporary low. However, for now, we’d expect strong support from 1.0629 key support level to contain downside. EUR/CHF’s reaction to 1.0629 would decide whether EUR/USD’s rebound 1.0992 could sustain.

China coronavirus cases surge to 17205, PBoC cuts interest rates

According to China’s National Health Commission, as of end of February 2, total number of confirmed coronavirus case rose to 17205, with 2296 serious cases. Death tolls rose to 361. Suspected cases rose to 21558. Number of tracked people rose to 189583.

Globally, at least 171 cases were reported in Australia, Britain, France, Germany, Hong Kong, Japan, Russia, Spain, Thailand, Taiwan the United States and 13 other countries. Person-to-person transmission was reported in the US, Germany, Japan, Thailand, Vietnam and South Korea. The Philippines reported the first death outside of China on Sunday.

PBoC unexpectedly lowered interest rates today in response to the crisis in the country. Seven-day reverse repo rate was cut from 2.50% to 2.40%. 14 day tenor was cut from 2.65% to 2.55%. The central bank also injected CNY 1.2T case into the money markets through reverse bond repurchase agreements.

China Caixin PMI manufacturing dropped to 51.1, economy needs proper countercyclical policies

China Caixin PMI Manufacturing dropped to 51.1 in January, down form 51.5, missed expectation of 51.3. Production and new work both expanded at softer rates. Employment fell for the first time in three months. Though, business confidence improved as trade tensions eased.

Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said: “”China’s manufacturing economy recovered at a slower pace at the start of the year. Although corporate confidence was boosted by the trade deal, some manufacturers did not replenish stocks despite the pickup in production, due to limited improvement in domestic and foreign demand. Pressure from rising raw material costs is worth attention. In the near term, China’s economy will also be impacted by the new pneumonia epidemic, and therefore need to gain support from proper countercyclical policies.”

Japan PMI manufacturing finalized at 48.8, still portraying a struggling industry

Japan PMI Manufacturing was finalized at 48.8 in January, a slight increase from December’s 48.4. But contracted has continued since last May. Output and new orders recorded further declines. Export demand dipped, but downturn shows signs of easing. On the positive side, business confidence hits highest level since August 2018.

Joe Hayes, Economist at IHS Markit, said: “Manufacturing PMI data for Japan are still portraying a struggling industry, causing firms to cut back production for another month due to subdued demand and global uncertainties. “Scratching beneath the surface and we find that the capital goods sector was a particular straggler, with data here showing sharp and accelerated reductions in production and new orders. Falling demand for capital goods does not bode well for the global economic outlook, nor for Japanese exports.”

Australia AiG manufacturing dropped to 45.4, lowest since 2015

Australia AiG Performance of Manufacturing Index dropped to 45.4 in January, down from 48.3. That’s the lowest reading since 2015 and suggested faster contraction in the sector. AiG said, “January is traditionally the slowest month for Australian manufacturing, but the start to 2020 was even slower than usual. All manufacturing sectors reported weaker conditions in January compared to December and only the food & beverage sector reported expanding conditions.”

Also from Australia, building permits dropped -0.2% mom in December, better than expectation of -3.0% mom. TD securities inflation gauge rose 0.3% mom in January.

Big week for Aussie as RBA set the stage for rate cuts, US ISM and NFP watched too

It’s a big week for Australian Dollar while AUD/USD is also pressing key support level at 0.6670. RBA is widely expected to keep interest rate unchanged at 0.75%. After some improvement in economic data released recently, markets have pushed the expectations of rate cut to April. Westpac is forecasting a 25bps cut in April and then another in August, with cash rate settling at 0.25% afterwards. RBA’s new economic forecast might have downward revisions in growth projections, that pave the way to the cuts. Also, there will be retails ales and trade balance from Australia too.

Elsewhere, economic data from the US will be equally important. Market pricing of a Fed cut by June surged with the coronavirus outbreak. But focuses will first turn to ISM indices as well as non-farm payrolls. From Europe, main focus will be on EU’s economic forecasts and ECB bulletin. Other data to be watched include Canada employment, New Zealand employment and China trade balance.

Here are some highlights for the week:

- Monday: Australia AiG manufacturing index, building approvals; China Caixin PMI manufacturing, Japan PMI manufacturing final; Eurozone PMI manufacturing final; UK PMI manufacturing final; US ISM manufacturing, construction spending.

- Tuesday: New Zealand building approvals; RBA rate decision; UK PMI construction; Eurozone PPI; US factory orders.

- Wednesday: New Zealand employment, labor cost index; China Caixin PMI services; Swiss SECO consumer climate; Eurozone PMI services final, retail sales; UK PMI services final; US ADP employment, trade balance, ISM non-manufacturing; Canada trade balance.

- Thursday: Australia retail sales, trade balance; Germany factory orders, ECB monthly bulletin; EU economic forecasts; US non-farm productivity, jobless claims.

- Friday: RBA monetary policy statement; New Zealand inflation expectations; China trade balance; Japan leading indicators; Germany industrial production, trade balance; France industrial production; Swiss foreign currency reserves; Canada employment, Ivey PMI; US non-farm payrolls.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9604; (P) 0.9659; (R1) 0.9688; More…

Intraday bias in USD/CHF remains on the downside for 0.9613 support. Decisive break there will resume whole down trend from 1.0237. Next target is 100% projection of 1.0237 to 0.9659 from 1.0023 at 0.9445. Near term outlook will now remain bearish as long as 0.9766 resistance holds, in case of recovery.

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Jan | 45.4 | 48.3 | ||

| 00:00 | AUD | TD Securities Inflation M/M Jan | 0.30% | 0.30% | ||

| 00:30 | AUD | Building Permits M/M Dec | -0.20% | -3.00% | 11.80% | 10.90% |

| 00:30 | JPY | Manufacturing PMI Jan F | 48.8 | 49.3 | 49.3 | |

| 01:45 | CNY | Caixin Manufacturing PMI Jan | 51.1 | 51.3 | 51.5 | |

| 08:30 | CHF | SVME PMI Jan | 50.3 | 50.2 | ||

| 08:45 | EUR | Italy Manufacturing PMI Jan | 47.7 | 46.2 | ||

| 08:50 | EUR | France Manufacturing PMI Jan F | 51 | 51 | ||

| 08:55 | EUR | Germany Manufacturing PMI Jan F | 45.2 | 45.2 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Jan F | 47.8 | 47.8 | ||

| 09:30 | GBP | Manufacturing PMI Jan F | 49.8 | 49.8 | ||

| 14:30 | CAD | Manufacturing PMI Jan | 50.4 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 51.7 | 51.7 | ||

| 15:00 | USD | ISM Manufacturing PMI Jan | 48.5 | 47.2 | ||

| 15:00 | USD | ISM Prices Paid Jan | 49.3 | 51.7 | ||

| 15:00 | USD | Construction Spending M/M Dec | 0.40% | 0.60% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals