U.S. Review

A Solid Week To Be Sure, But Keep an Eye on the Details

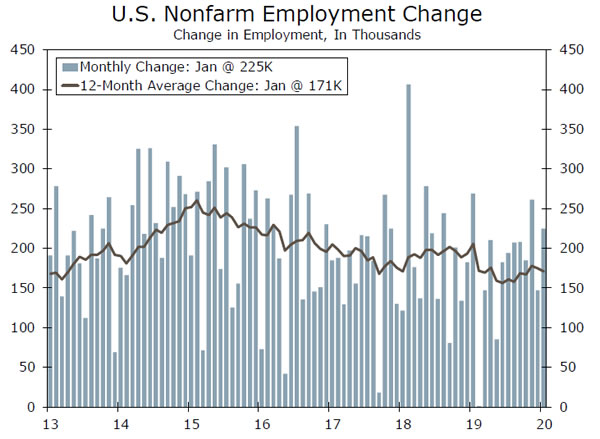

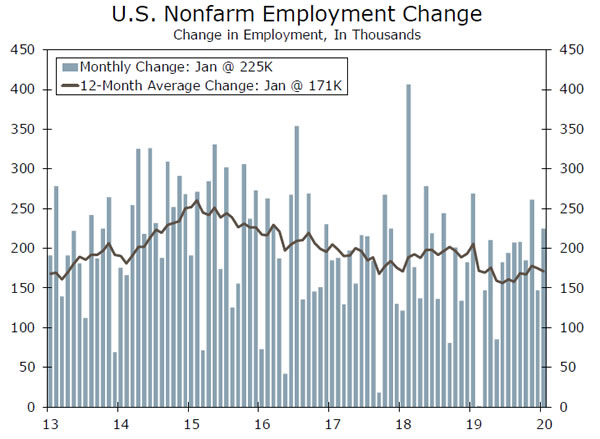

- U.S. employers added 225K new workers to their payrolls in January, which handily beat expectations. But the factory sector shed jobs for the third time in four months, and net layoffs were reported for finance and retail as well.

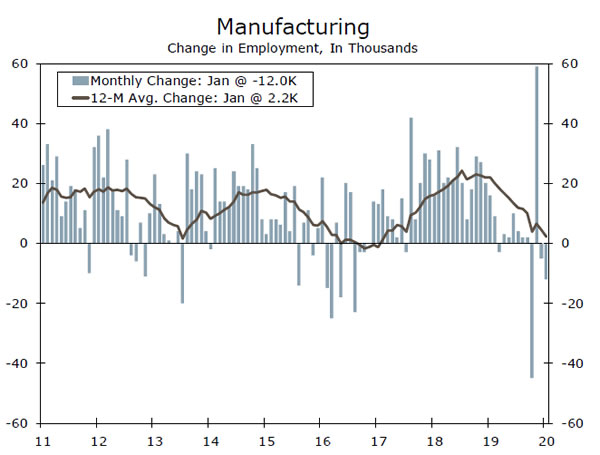

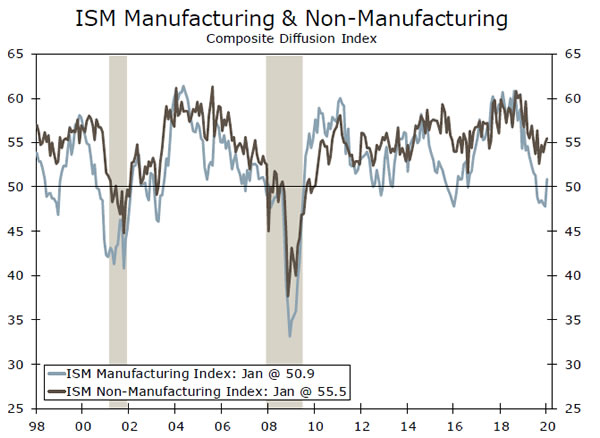

- For the first time in six months, the ISM was not in contraction territory in January. A first step toward de-escalation in the trade war helped, but coronavirus worries are not yet showing up in these numbers.

- The economy is still growing, but we’re not out of the woods yet with the trade war, and the coronavirus is still a developing threat that we are only beginning to understand.

Strong Jobs Numbers Tempered by Sign

U.S. employers added another 225K workers to their payrolls in January, an outcome that exceeded expectations. Owing partly to the fact that more people are entering the in the labor force, the unemployment rate edged higher to a still-low 3.6%.

Another drop in initial claims for unemployment insurance attests to the fact that the labor market remains tight, but there were a few chinks in the armor of this otherwise solid jobs report.

The manufacturing sector lost jobs for third time in four months, and there were no auto strikes to blame this time. Layoffs were not limited to the factory sector either as financial services went from slowing job growth to a slight decline in January. Retailers also posted net layoffs for the second time in three months.

Elsewhere, the gains were broadly based and the strong demand for labor helped lift wage growth to 3.1%. We expect wage growth to strengthen this year, but only modestly. Compensation plans have improved somewhat, but fewer job openings and pockets of layoffs, even if only temporary, suggest demand for labor has cooled since the middle of last year.

A hallmark of the current cycle has been that despite a low unemployment rate, there has not been sustained periods of the sort of strong wage growth it takes to meaningfully push inflation higher. On that basis, we see little to change in the Fed’s intentions from today’s solid jobs report.

Manufacturing ISM Edges Up, More Strength in Services The ISM manufacturing index came in at 50.9 in January after touching the lowest level since the recession in December. This key yardstick for the manufacturing sector had been in contraction territory for five straight months. So the move to expansion from contraction is certainly welcome, but we are not completely out of the woods with the trade war, and we are only beginning to understand the potential effects of the coronavirus outbreak and what it means for supply chains. The non-manufacturing ISM has been less vulnerable to some of the factors that have buffeted the factory sector like the trade war and the slowing in global growth, which perhaps explains why the service sector ISM has remained in expansion territory throughout 2019. We learned this week that in January the non-manufacturing ISM edged higher to 55.5 with most subcomponents also in expansion territory.

Some Improvement on Trade

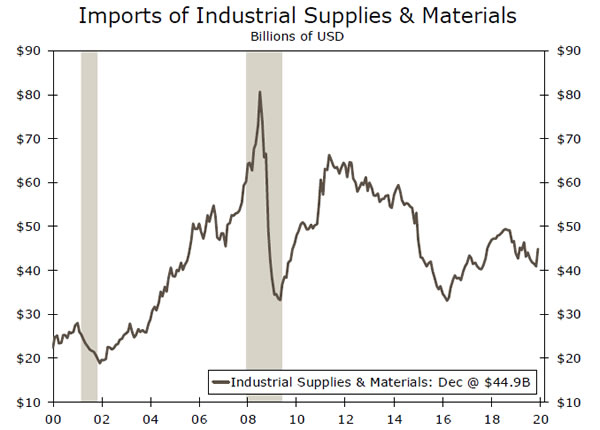

The trade deficit widened for the first time in three months in December. In recent months there has been a slowing in both imports and exports, but trade picked up on both sides of the ledger in December. Exports increased a little over $1.5 billion, but imports shot up $6.8 billion. There were some signs of life for capital spending in the details; imports of industrial supplies shot up $4.0 billion, accounting for almost all of the surge in imports and partially reversing four straight monthly declines. The Phase I trade deal may boost trade activity this year, though we suspect it is too early to get excited about a resumption in normal trade. The improved sentiment seen in the ISM jump is the place where we can see some affirmation that the manufacturing sector is encouraged by the de-escalation.

U.S. Outlook

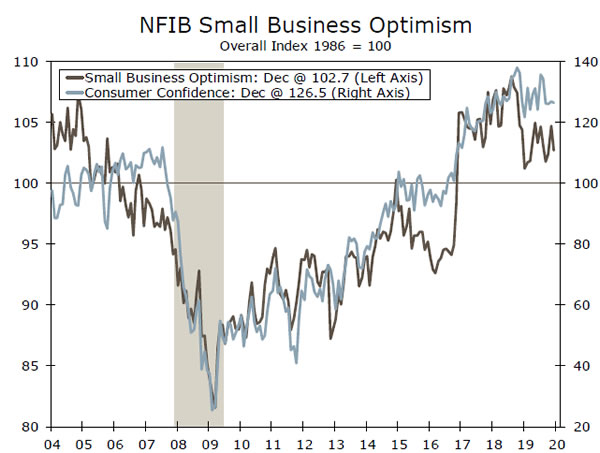

NFIB Small Business • Tuesday

Small business owners had a lot to digest in January. First, impeachment proceeded in Washington, D.C., but removal from office was never a serious prospect as it quickly became clear that Republicans senators would not break ranks. With President Trump now acquitted, the Democratic primaries will take over as the largest political question mark for small business owners, who lean disproportionately Republican. Second, the Phase I deal with China, signed on January 15, should moderately reduce trade policy uncertainty. However, just a few days later the Wuhan coronavirus became a global concern. Small businesses are certainly less exposed to the global economy than large corporations, but even the smallest firms have ties to Chinese suppliers, and are exposed to financial conditions, which tightened in response to the outbreak.

Last month the index fell two points as the uncertainty sub-index soared eight points. The latter index likely remains elevated.

Previous: 102.7 Consensus: 103.5

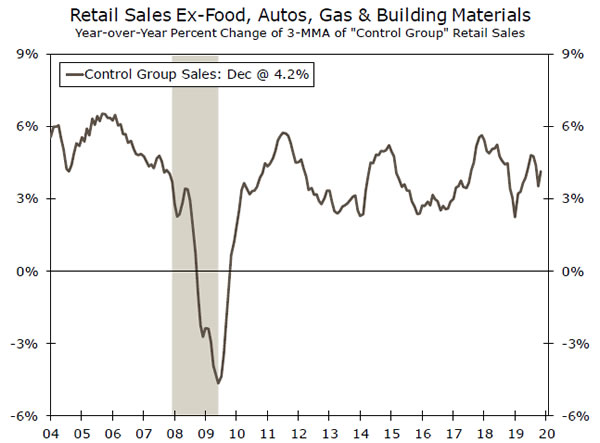

Retail Sales • Friday

We expect retail sales rose 0.3% in January, in-line with consensus, but we will also be closely watching for revisions to data from the end of the holiday shopping season. Primary data show our measure of holiday sales (retail spending excluding auto, gas and restaurant sales) rose 4.1% in 2019 compared to 2018, slightly below what we expected. They also show non-store retailer sales rose an incredible 24%, matching bullish Q4 corporate earnings reports from Amazon and other retailers with major e-commerce platforms. Revisions and seasonal adjustments may be more significant than usual as the Department of Commerce adjusts to changing shopping patterns.

Looking ahead, job growth remains solid and consumer confidence is back near cycle highs. The trend-like gain in January should set up personal consumption for the 2.1% annualized increase we currently expect in Q1. The coronavirus is unlikely to impact the U.S. consumer in a material way.

Previous: 0.3% Wells Fargo: 0.3% Consensus: 0.3% (Month-over-Month)

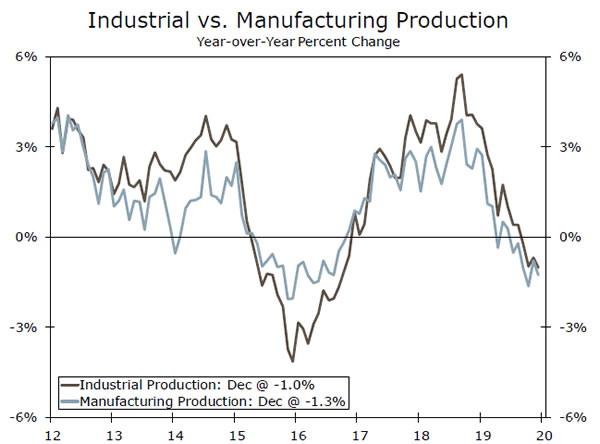

Industrial Production • Friday

Boeing 737 MAX production was fully suspended in January, meaning that the domestic factory sector’s performance will appear worse than the underlying trend. We estimate the months-long suspension will shave about 0.5 percentage points off GDP growth in Q1, and it should materialize in a sharp drop in aircraft production.

The coronavirus will not directly impact U.S. factories, but could certainly weigh on production in industries whose supply chains are heavily intertwined with China, where many factories have shut down. The computer & electronics industry is the most exposed, but any impact will likely not materialize until next month’s IP report. See our report on U.S. supply chains for more detail.

Outside the MAX and coronavirus disruptions, manufacturing continues to show signs of bottoming, with the ISM manufacturing index returning to growth territory after five straight sub-50s.

Previous: -0.2% Wells Fargo: -1.0% Consensus: -1.3% (Month-over-Month)

Global Review

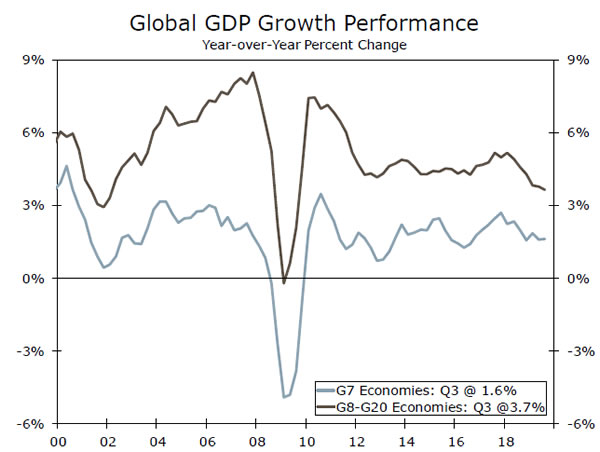

Growth Slowdown & Monetary Easing Nearing an End?

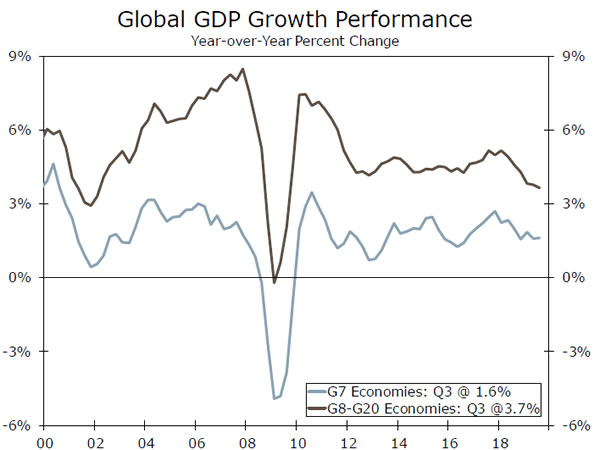

- There are signs the global growth slowdown and global easing cycle may be nearing an end, even as the coronavirus offers new downside economic risks. After U.S. and China’s GDP growth were broadly steady in Q4, Australia’s central bank governor this week suggested the growth slowdown is coming to an end.

- Australia’s central bank held rates steady, but its language was more hawkish in tone, while monetary policy in the U.S. and across Europe also appears to be on hold. Brazil’s central bank cut rates 25 bps but signaled an end to its easing cycle. Mexico is a notable exception that proves the rule, and is expected to cut interest rates 25 bps next week.

Australian Economy Subdued, RBA Mildly Hawkish

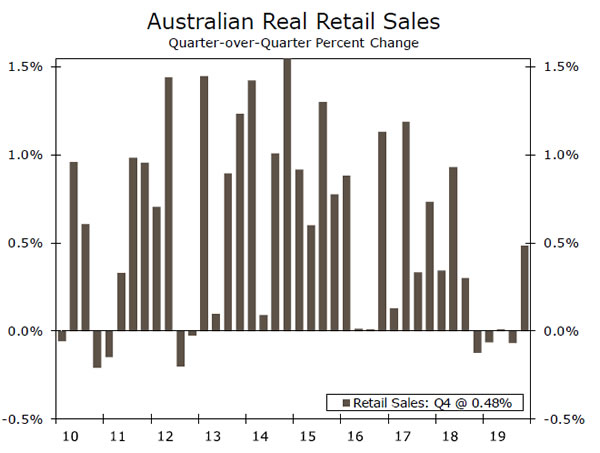

The Reserve Bank of Australia (RBA) held its latest monetary policy this week, keeping its Cash Rate steady at 0.75%. While the RBA said interest rates will remain low for an extended period and it is prepared to ease further if needed, some aspects of its announcement were more hawkish in tone. The RBA said there were signs the global growth slowdown is coming to an end, though in a follow up speech RBA Governor Lowe noted there would be a stronger case to cut interest rates if unemployment rises. Meanwhile the central bank made only minor downward revisions to its GDP growth and CPI inflation forecasts in its Monetary Policy Statement. A policy shift in either direction doesn’t look likely for the time being, though if there was to be a move the risks probably still lean more towards a rate cut than a rate hike. This week’s economic releases saw a 0.5% quarter-over-quarter increase in Q4 real retail sales, a reasonable result after a run of modest outcomes for the retail sector (top chart). In addition the January manufacturing and services PMIs remained near or below the breakeven 50 level, suggesting subdued growth. As of now market pricing still implies a rate cut during the next 12 months, while we expect the RBA to remain on hold during that period.

Canadian Growth Swings Lower Again

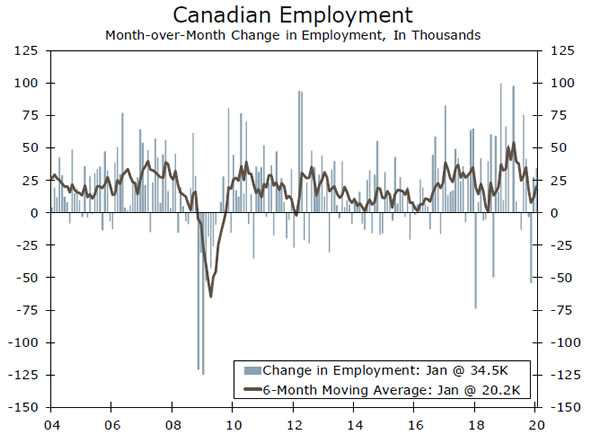

The Canadian economy has been in focus in recent months as both activity trends and the Bank of Canada’s (BoC) monetary policy outlook have shown some variability. In late January central bank policy once again took a dovish swing, as the BoC held rates steady but cut its Q4 GDP forecast to just 0.3% quarter-over-quarter annualized, while Governor Poloz said the door was open to a rate cut. Recent data have kept that door ajar. Canada’s November GDP actually beat expectations with a modest 0.1% month-over-month gain, though on a three-month annualized basis growth slowed to just 0.3%. Canada’s jobs data for January were a bit more encouraging and employment rose by 34,500, a second straight gain, and the unemployment rate dipped to 5.5%. However, the trend in employment growth has slowed noticeably in the past six months, to an average monthly gain of 20,200. We don’t believe those employment figures are soft enough for the BoC to move just yet. That said, markets have priced in 20 bps of rate cuts over the next six months and, should the soft Canadian data trend continue, that may be enough for the BoC to deliver on those expectations.

Rate Cuts Still Coming From Latin America

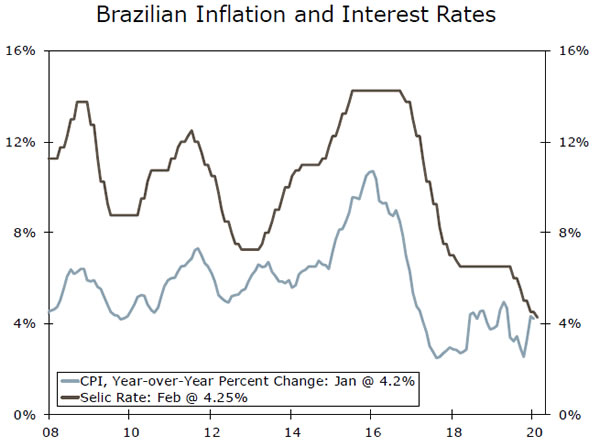

The trend of lower interest rates continued in Latin America this week, with Brazil’s central bank lowering its Selic rate 25 bps to a record low 4.25%. However, the central bank also signaled that it has reached the end of its easing cycle. While Brazil’s December industrial output fell 1.2% year-over-year, the broader economy is on a gradual recovery path, while the January CPI eased to 4.2% year-over-year.

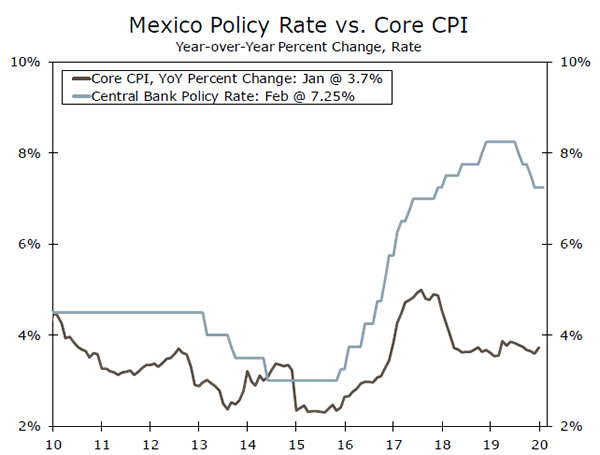

In Mexico, however, the monetary easing cycle appears likely to continue. The January manufacturing and services PMI were near the breakeven 50 level, consistent with a stagnant economy. The January CPI rose to 4.2% year-over-year, but remains well within its target range. We expect the Bank of Mexico to cut rates further at its next meeting 0n February 13.

Global Outlook

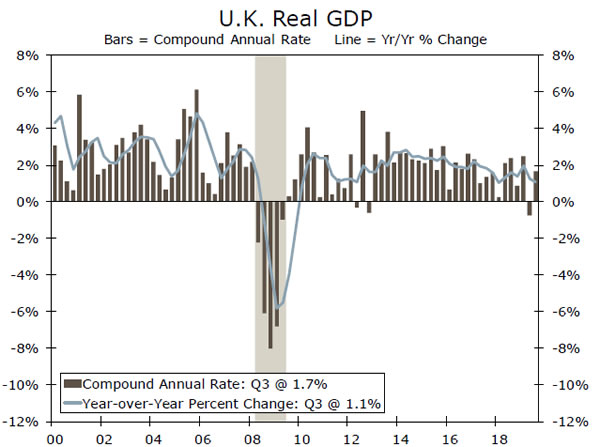

U.K. GDP • Tuesday

The U.K. economy likely finished 2019 on a soft note, in part due to Brexit uncertainty and ahead of the U.K. December general election. Monthly activity indicators and a variety of confidence surveys suggest soft Q4 growth after a gain of 0.4% quarter-over-quarter in Q3. For Q4 we expect that GDP was flat on a sequential basis. That would see Q4 GDP slow to 0.9% year-over-year, which would be the slowest pace of growth since early 2010.

The release will also include details on the U.K. economy both by expenditure breakdown and by industry sector. Consumer spending is expected to rise 0.1% quarter-over-quarter and investment spending is seen falling 0.2%. We also anticipate that industrial activity fell during Q4, while we see services activity as having been broadly flat. While the Bank of England has become more dovish recently, we think it will take more soft data before the central bank more seriously considers lowering interest rates.

Previous: 0.4% Wells Fargo: 0.0% Consensus: 0.0% (Quarter-over-Quarter)

Riksbank Policy Meeting • Wednesday

The Riksbank exited negative interest rate territory at its December policy meeting, raising its repo rate 25 bps to 0.00%. Recent commentary from policymakers suggests that zero is not the new lower bound for interest rates and a rate cut is just as likely as a rate hike. However, a steady repo path remains the most likely scenario. Looking ahead to next week, we expect the Riksbank to remain on hold at its meeting, and will closely watch the accompanying report for any indication of a material change to its projected repo path.

In neighboring Norway, the January inflation release is on next week’s schedule. Underlying CPI inflation slowed more than expected in December, edging down to 1.8%, likely in part due to holiday-related discounts. With the Norges Bank likely to remain on hold for an extended period of time and underlying inflation holding near the central bank’s 2% target, next week’s CPI report should have little impact on the projected policy rate path.

Previous: 0.00% Wells Fargo: 0.00% Consensus: 0.00%

Banxico Policy Decision • Thursday

The Bank of Mexico is scheduled to make a monetary policy announcement next week, and is widely expected to lower its overnight rate another 25 bps to 7.00%. Mexico’s economy has come to a standstill in recent quarters and, indeed, GDP fell by 0.3% yearover- year in Q4. Next week’s data also include December industrial output, which we anticipate will show a 14th straight year-over-year decline. With inflation comfortably within the central bank’s 2% to 4% target range, we are with the consensus in expecting another rate cut next week.

While the consensus forecast is for a 25 bp reduction the Mexican peso has been quite sturdy recently, meaning, if anything, the risks are tilted to a larger 50 bp cut. Moreover, a rate cut next week is unlikely to be the end of the monetary easing cycle, with market pricing currently pointing to around a further 109 bps of easing over the next 12 months.

Previous: 7.25% Wells Fargo: 7.00% Consensus: 7.00%

Point of View

Interest Rate Watch

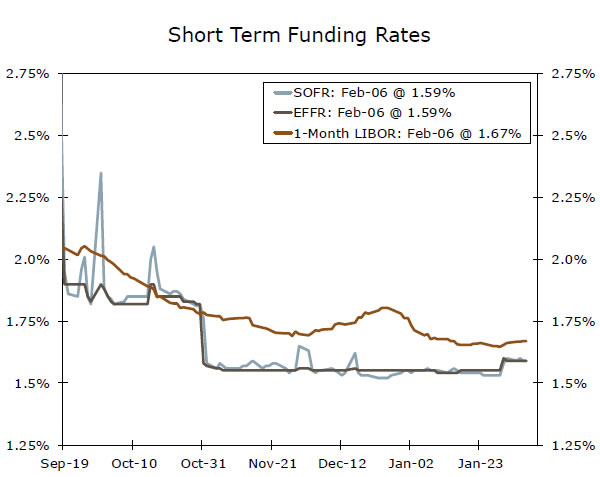

When Will the Fed Stop Buying Treasury Bills?

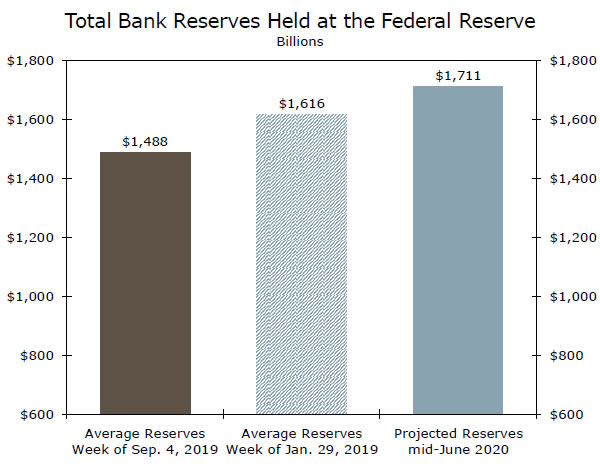

At the January 29 FOMC meeting, the committee reaffirmed its plan to “continue purchasing Treasury bills at least into the second quarter of 2020 to maintain over time ample reserve balances at or above the level that prevailed in early September 2019.” The Fed also committed to conducting term and overnight repo operations until at least April. This raises an interesting question: why would the Fed continue to buy T-bills? Money markets have been tame over the past few months, and Treasury repo rates continue to exhibit little volatility (top chart).

First, the Fed likely wants to create enough of a reserve buffer above $1.5 trillion to ensure that there are ample reserves in the banking system, even during periods of reserve volatility (middle chart). Second, the Fed will need to buy T-bills to offset the decline in reserves that will occur as the Fed gradually pulls back from the repo market. As the Fed pulls back from lending in the repo market, a decline in repurchase agreements (an asset on the balance sheet) will correspond with a decline in bank reserves (a liability on the balance sheet).

Our forecast assumes the Fed will continue to buy T-bills at a pace of $60 billion per month through mid-April. We then project the Fed will taper to $45 billion from mid- April to mid-May, then buy $30 billion from mid-May to mid-June. In addition, we project that the total amount of repo agreements on the Fed’s balance sheet will decline from about $200 billion at present to $100 billion by mid-June.

By mid-June, we expect the Fed will stop buying a predetermined amount of securities and instead allow the balance sheet to grow organically, as is normal. Our projection of organic balance sheet growth is roughly $12.5 billion per month, with the purchases spread across the entire Treasury curve. Were this scenario to unfold, it would put the total size of the Fed’s balance sheet at roughly $4.3 trillion by mid-June, with total bank reserves around $1.7 trillion. The Fed would own nearly 20% of the T-bill market, up from zero as recently as last September (bottom chart).

Credit Market Insights

Lenders Look Out into 2020

In the Fed’s latest Senior Loan Officer Opinion Survey, covering Q4-2019, banks reported continued weakness in demand for commercial and industrial (C&I) loans. This caps off a year-long deceleration in C&I lending, which ended with a sequential decline in fourth quarter loan volumes. While banks have not eased credit standards to help improve demand, a number of them have offered better spreads on loans due to greater competition from other banks or capital markets.

On the consumer side, demand for residential mortgage loans remained strong. The MBA’s mortgage application index ended the year up roughly 60%, propelled by lower mortgage rates. While the strength in housing demand looks set to continue into 2020, the outlook for other forms of consumer credit is less clear. Banks reported weaker demand for auto loans, and though demand for credit card loans was unchanged, revolving credit growth has been decelerating on a year-ago basis since April. These trends are not terribly concerning for consumer spending, given the strong labor market, but some banks are beginning to tighten standards on consumer loans. For those which expected to tighten lending standards in 2020, a majority cited a lower risk appetite and deteriorating credit quality. This is not too surprising, given the recent drift up in delinquency rates, but it may not be cause for alarm. Most banks still expect their standards to remain unchanged, reflecting the general strength in households’ financial position.

Topic of the Week

Wuhan Coronavirus Update Cases of the new coronavirus continue to climb with the total currently at roughly 30,000. The virus is now estimated to be responsible for more than 600 deaths and is reported to span 5 continents and at least 25 countries.

The macro impact remains uncertain but will likely be greater than during the 2003 SARS outbreak as China is a bigger player in the global economy today than it was 17 years ago.

Below is a short synopsis of our recent work on the topic.

Downward Revision to China’s GDP Outlook

The virus will likely weigh on China’s services sector as it coincided with the Lunar New Year, the most significant holiday on the Chinese calendar. Factory closures will also weigh on industrial output.

We expect a significant hit to China’s Q1 GDP, with the lost output mostly recovered in subsequent quarters. We now forecast Chinese GDP growth of 5.5% in 2020 compared to 5.9% before the outbreak.

Economies Most Exposed to a China’s Slowdown

The impact is unlikely to be contained to China. Most of the economies with the greatest economic exposure to China—measured by total value added derived from final demand in China—lie in Asia. Indirect effects are also likely. Countries with the greatest share of foreign final demand in their total value added are also at risk, such as Luxembourg, Ireland, Singapore, Malta and Hungry.

Smaller, externally oriented economies should feel the biggest economic brunt of the current outbreak.

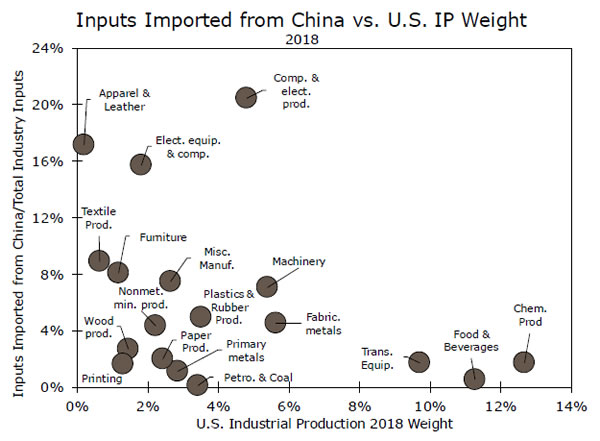

Supply Disruption & U.S. Factories

U.S. output could also be hit. The toll on manufacturing production is likely to be concentrated in the computer & electronics industry given its reliance on Chinese-made inputs as well as its relatively high share of U.S. industrial production. Few other industries, however, bear both high input exposure to China and command a large fraction of U.S. production. High levels of manufacturing inventories also suggest spillovers to U.S. production could be limited at least for a time.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals