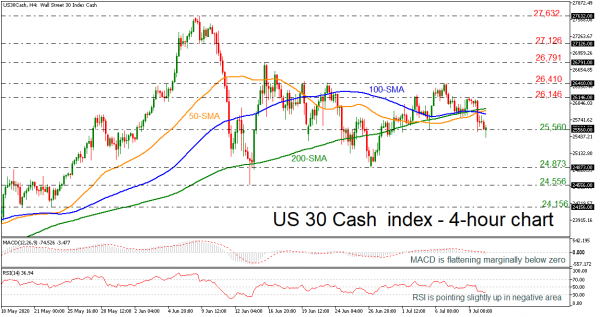

The US 30 cash index has been on the sidelines over the last month as the 26,410 resistance level seems to be a real struggle for the bulls. Technically, the price could lose some ground in the short-term as the MACD is changing direction to the downside below the zero line, while the RSI is holding beneath the neutral threshold of 50 but is pointing up.

A rebound on the 25,560 support and a rise above the simple moving averages (SMAs) could retest the 26,146 barrier. Should the price overcome this level, it could hit the 26,410 resistance and any increase above the 26,791 hurdle could shift the outlook from neutral to bullish.

Alternatively, a decline under 25,560, could meet a strong barrier at the 24,873 support ahead of the 24.556 low, registered on June 15. A step below this line could open the way for further decreases until the 24,156 trough.

In the medium-term picture, the index is gently pointing up over the past four months, framing a positive profile. A strong rally above 27,632 would extend the upward pattern, making the outlook even more bullish, while a decisive close below 24,873 would confirm the start of a downtrend.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals