Reasons to be fearful: bank second-quarter results

With the second quarter of 2020 drawing to a close and all the new alternative data footfall trackers showing economic activity picking up in the US and Europe, investors are starting to look forward to the undoubted highlight of their...

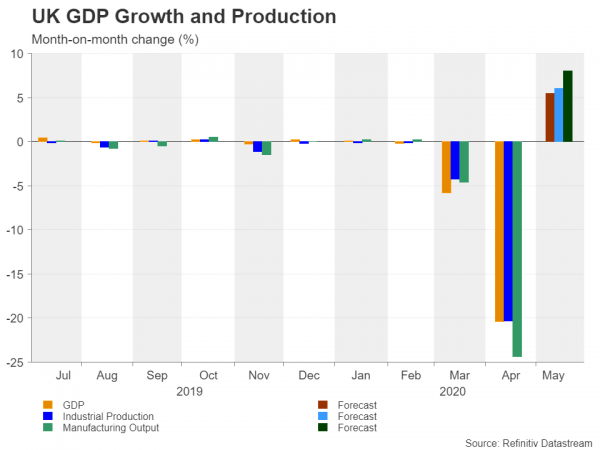

Pound Eyes UK GDP Rebound But Data to Stress Steep Mountain to Climb

Economic data out of the United Kingdom will be flooding the markets over the next few days with Tuesday’s monthly GDP print being the main highlight. The scheduled releases on growth, production, inflation and employment should reveal how the economy...

Dollar Index Outlook: Dollar Remains at Back Foot on Optimism Over Economic Recovery

The dollar remains in red on Monday and probes again through cracked 200WMA (96.30), pressuring supports at 96.18/16 (Fibo 76.4% of 95.68/97.78 / last Thursday’s low). Larger downtrend remains intact, with past three weeks action in red and today’s fresh...

Yen Down Further on Risk Appetite, Sterling Also Weak

Risk appetite is generally firm today with European indices trading in black while US stocks also open higher. Rebound in oil prices help push Canadian Dollar to be the strongest one today, followed by Australian. On the other hand, Yen...

AUDUSD Still Consolidating; Unable to Break above Upper Channel

AUDUSD has been consolidating since June 16 and has been stuck in a channel tilted slightly to the upside. The neutral to bullish picture in the short term looks to last for a while longer after prices failed to break...

Much Higher German Wholesale Prices

Earlier this morning, June German Wholesale price index was released at +0.6% on month. It was expected at -0.6%. On a yearly basis, it was published at -3.3%, vs -4.3% expected. Tomorrow, June inflation rate will be expected at +0.9%...

BOC to Turn More Upbeat about Economic Recovery, While Caution about Uncertainty and Keep Monetary Policy Unchanged.

At the BOC meeting this week, we expect new Governor Tiff Macklem to continue Stephen Poloz’s legacy and leave the policy rate unchanged at 0.25%, the effective lower bound. The asset purchases programs (QE) will also be maintained. Canada’s reopening...

Risk-On in Asia, Dollar and Yen Weaken Again

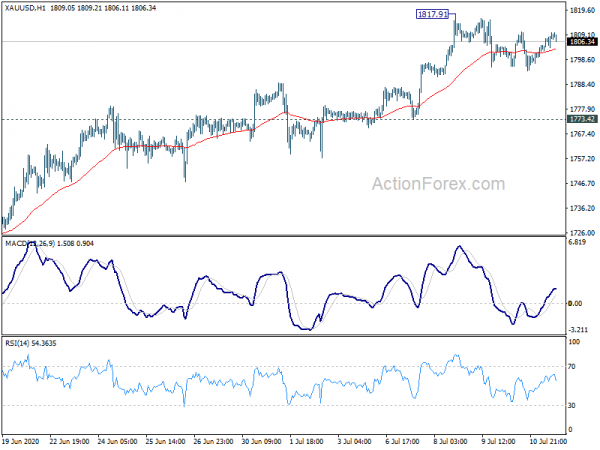

Asian markets open the week with risk-on sentiments, carrying forward the optimism over coronavirus treatment. Dollar and Yen are back under pressure again while Australian Dollar, Euro and Sterling are trading generally higher. Gold also firms up above 1800 handle,...

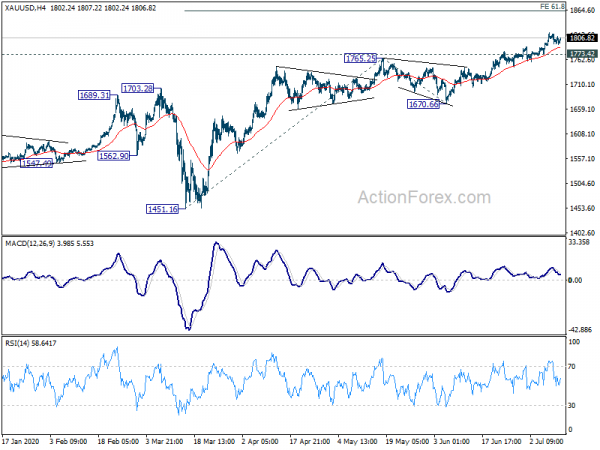

Gold Intraday: Steady Up Trend

On Friday, spot gold marked a day-high near $1,811 before closing 0.3% lower at $1,799. Investors were caught between the latest development in coronavirus treatment and uncertainty over U.S.-China relationship. U.S. biopharmaceutical giant Gilead Sciences released additional data on remdesivir,...

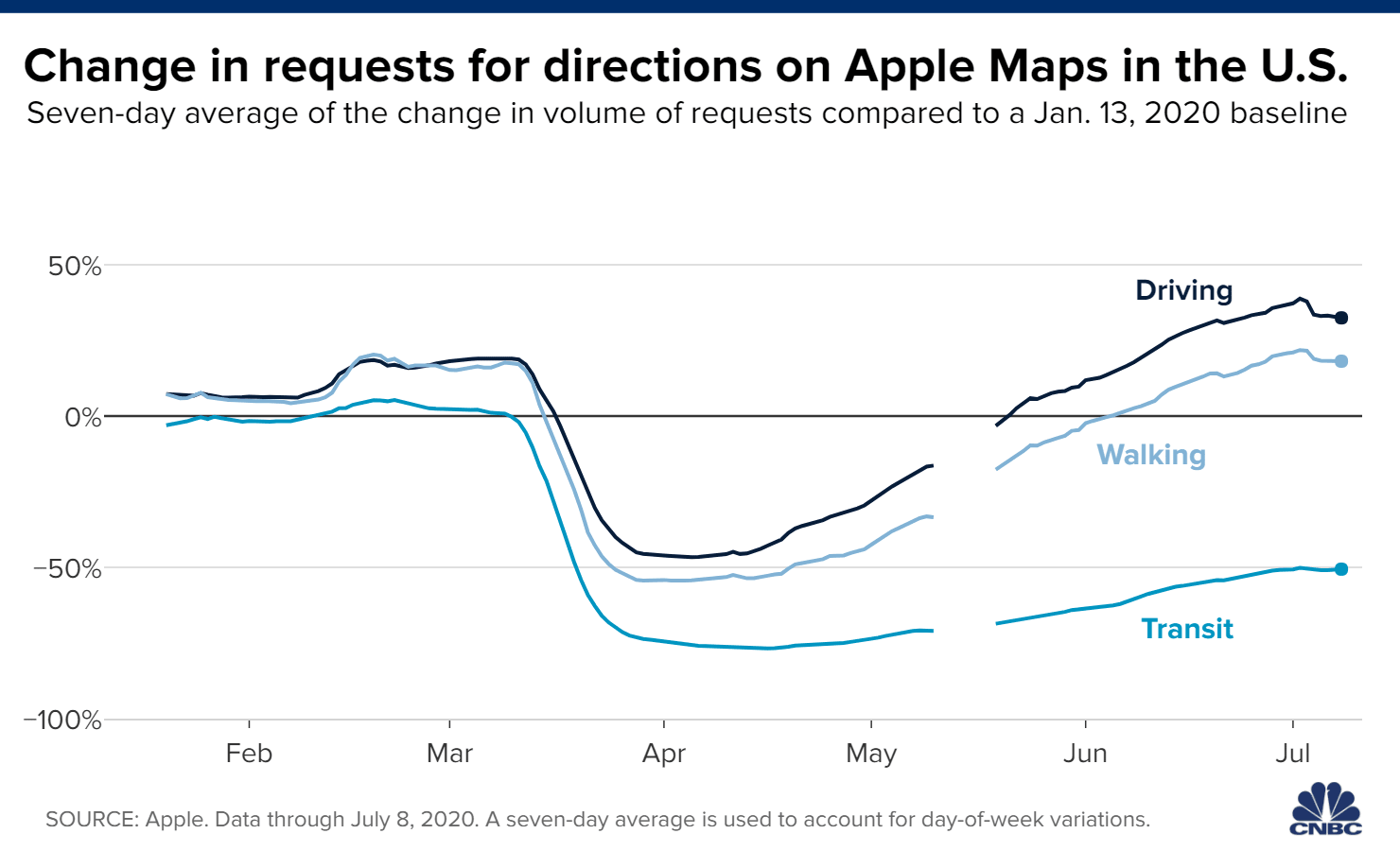

Here are five charts illustrating U.S. economic trends amid the coronavirus pandemic

As states take differing approaches to re-opening and closing, some parts of the economy continue to see improvement from the start of the pandemic while others continue to struggle. Some states have instituted mask mandates and other measures, such as...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals