USD/CAD Rises to 1.34, Federal Reserve on Deck

After starting the week with losses, the Canadian dollar has reversed directions on Tuesday. Currently, the pair is trading at 1.3399, up 0.32% on the day. Does Fed have more easing up its sleeve? The Fed has mobilized to steady...

The Fed is extending its lending programs until the end of the year

The Federal Reserve said Tuesday that it is extending its menu of lending programs to businesses, governments and individuals to the end of 2020. Originally set to expire Sept. 30, the myriad facilities, stretching from credit to small businesses up...

Why unemployment is a broken system: ‘It really is an experiment out of control’

Demonstrators rally near the Capitol Hill residence of Senate Majority Leader Mitch McConnell, R-Ky., to call for the extension of unemployment benefits on Wednesday, July 22, 2020. Tom Williams/CQ-Roll Call, Inc via Getty Images Wage replacement Unemployment benefits offer temporary...

U.S. consumer confidence for July misses expectations

© 2020 CNBC LLC. All Rights Reserved. A Division of NBCUniversal Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Market Data Terms of Use...

Home prices rose at a slower rate in May, according to S&P Case-Shiller

Real estate agents leave a home for sale during a broker open house in San Francisco, California. Justin Sullivan | Getty Images Home prices continued to rise in May, albeit at a slightly slower pace than they did in April...

Yen and Franc Rise, Euro and Gold Dip in Consolidative Markets

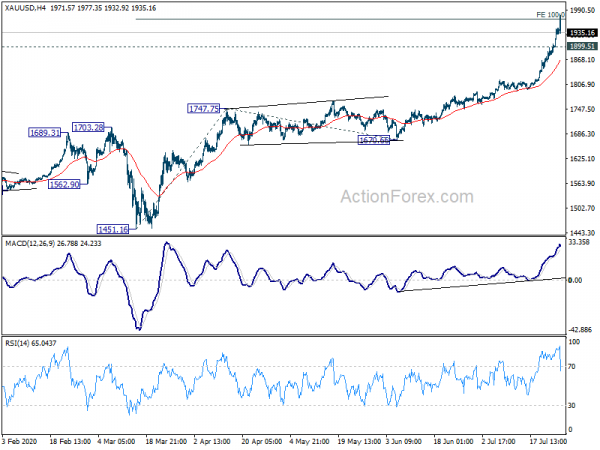

Yen rises generally today, together with Swiss Franc, in rather subdued consolidative markets. Stocks are trading mildly lower but there is hardly any following selloff for now. Much volatility is seen in Gold and Silver, while retreat notably after initial...

Gold And Silver Shake Up Markets

Oil remains in the vice of opposing forces Opposing forces continue to squash volatility in energy contracts, leaving both Brent crude and WTI marooned in no-man’s land. Fears over protracted stimulus negotiations and a Covid-19 derived double-dip is capping gains....

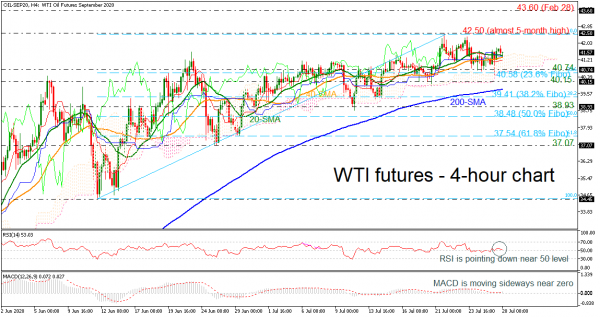

WTI Futures Lacks Direction After The Jump To Almost 5-Month High

WTI crude oil futures have been on a sideline move after they reached an almost five-month peak around 42.50 in the preceding week. The price is flirting with the upper surface of the Ichimoku cloud and the short-term simple moving averages (SMAs)...

Dollar in Recovery as Markets Digests Recent Losses, Weak Momentum Though

Dollar recovers mildly today as markets start to digest recent broad-based losses. Gold and silver are also in retreats after initial spikes. But the movements are so far rather limited. While some consolidations might be seen, there is no sign...

What European banks need before mergers can save them

European banks must revolutionise their business models – even the European Central Bank recognises this now. In new draft guidance, the ECB signals it won’t stand in the way of mergers, including cross-border deals in the EU. This is at...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals