Asia relocation: In the Vanguard

Shanghai skyline At one level, it can be argued – no, not really. The Pennsylvania-based group has long struggled to break into Hong Kong’s retail market. In a statement, Vanguard said it would, after an “extensive review”, wind down its...

Dollar Dived on New Fed Strategy, Aussie Shone ahead of a Key Week

Dollar tumbled sharply, and broadly last week as markets perceive Fed’s adoption of average inflation targeting as a dovish move. Nevertheless, selloff were mainly against commodity currencies and, to a lesser extent, Sterling. The greenback ended in range against Euro,...

RBA Preview – Keeping Expansionary Policy Stance with Focus on 3-Year Yield

We expect RBA would leave the monetary policy unchanged in September. Since March, RBA has been adopting a number of measures to lower the borrowing costs and provide liquidity to the market. These include keeping the cash rate at record...

Orchestration platforms to ease payments complexity

Kristian Gjerding, chief executive of CellPoint Digital, a company founded in Copenhagen in 2007 to help travel merchants handle payments in a mobile-first world, tells Euromoney: “Think about airlines, for example, that may have different online storefronts in different countries. They...

Weekly Economic and Financial Commentary: Q3 PCE Rebound in the Cards, Outlook More Uncertain

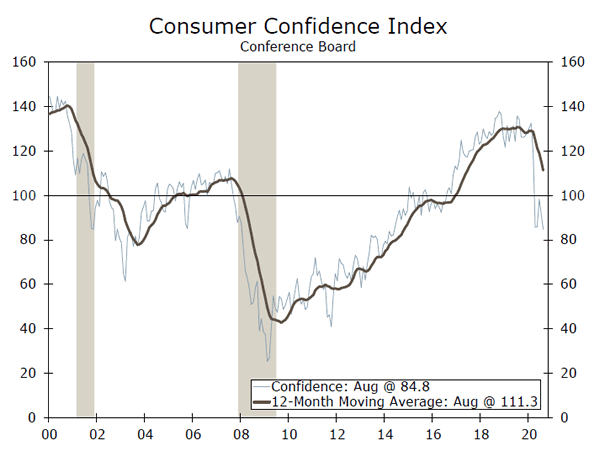

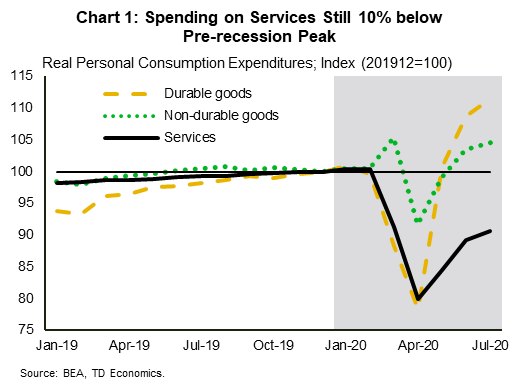

U.S. Review Q3 PCE Rebound in the Cards, Outlook More Uncertain After a revised look at GDP this week suggested the second quarter may not have been quite as bad as first estimated, attention shifts to the current quarter. Fresh...

Covid’s long Latin tail

If quantitative easing is seen to be ‘cost free’ by policymakers, then what has started out as a one-time emergency policy response could be used next time the economy is sluggish and the fiscal accounts are tightened. After all, low...

The Weekly Bottom Line: Federal Reserve Flips the Script, Targets Average Inflation

U.S. Highlights Federal Reserve Chair Powell unveiled a change in the Fed’s monetary policy strategy, announcing that it will target an inflation rate “that averages 2% over time” (instead of a strict 2% goal), and that it will be concerned...

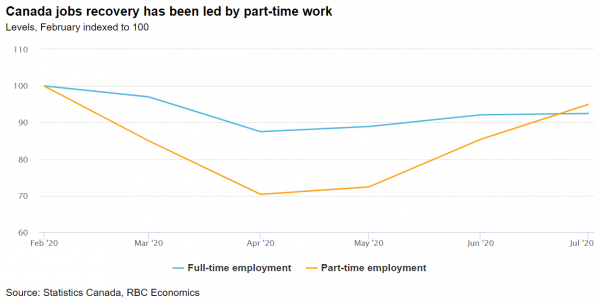

Forward Guidance: Early Sprint in Job Gains Likely to Fade as Recovery Wears On

The jobs recovery probably extended into August alongside further improvement in the broader economic backdrop. About 1.7 million of the 3 million Canadian jobs lost in March and April came back through July, alongside an initial rebound in GDP as...

Week Ahead: NFP, Polls Gain Traction and European Covid Cases In Focus

The focus across the week was Jerome Powell and the shift in the Fed’s policy framework that he announced at the first virtual Jackson Hole symposium. The US central bank will adopt a softer approach to inflation, favouring full employment...

Fed’s Bullard says the recession is over but rates will ‘stay low for a long time’

St. Louis Fed President James Bullard said Friday that he believes the recession caused by the coronavirus pandemic is over but that the central bank will continue its accommodative stance toward the U.S. economy. Bullard said on CNBC’s “Closing Bell”...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals