Unemployment is falling. Long-term unemployment is ballooning

Volunteers hand out potatoes in Auburn, Washington on May 7, 2020. JASON REDMOND | AFP | Getty Images That’s a big jump from the prior month, when 19% of the unemployed were out of work for at least six months....

Jobs report shows labor market stronger than expected, as economy faces new surge in Covid cases

The labor market was stronger than expected in October, showing good momentum ahead of the latest wave of coronavirus cases. The economy added 638,000 nonfarm payrolls and the unemployment rate fell by a full percentage point to 6.9%. The government...

Week Ahead – The Calm after the US Election Storm

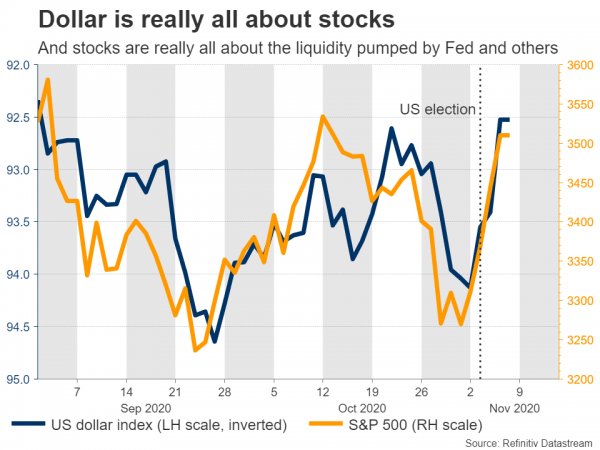

It’s a relatively quiet week coming up for global markets as the election dust settles. The main event will be the RBNZ policy meeting, though frankly, the real driver for most currencies and stocks may be the ‘aftershock’ effects of...

Job growth stronger than expected in October, unemployment rate slides to 6.9%

Employment growth was better than expected in October and the unemployment rate fell sharply even as the U.S. faces the challenge of surging coronavirus cases and the impact they could have on the nascent economic recovery. The Labor Department reported...

Dollar Selling Continues Despite Solid NFP, Euro Surges

Dollar’s selloff continues today despite stronger than expected employment data. Though, selling focus has turned to against Euro and Swiss Franc. Australian Dollar is taking a breather, together with global stock markets. There is no doubt that Dollar will end...

GBPUSD’s Hike Ceases Around Upper Bollinger Band

GBPUSD is consolidating beneath the 1.3175-1.3183 limiting border after surging off the 200-period simple moving average (SMA) and above the 50- and 100-period averages. The fairly horizontal bearing of the SMAs are promoting the neutral picture. That said, the price...

XAU/USD Skyrocketed To 1,950.00

Yesterday, the XAU/USD exchange rate skyrocketed to the 1,950.00 level. From the one hand, it is likely that some upside potential could continue to prevail in the market within the following trading session. From the other hand, the exchnage rate...

USD/JPY Trades Below 103.50

Yesterday, the USD/JPY currency pair declined below the weekly S2 located at the 103.56 mark. It is likely that some downside potential could prevail in the market in the short term. In this case the exchange rate could target the...

Non-bank trade finance providers look to boost market share

Emerging market (EM) manufacturers were facing difficulties even before the coronavirus pandemic decimated international demand for many of their products. The Asian Development Bank estimated that $1.5 trillion of requested trade finance was rejected last year – a figure that...

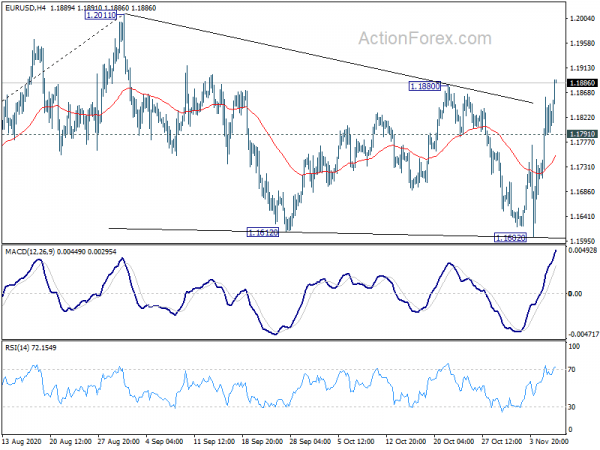

EUR/USD Reached 1.1850 Level

On Thursday, the EUR/USD currency pair raised to the psychological level at 1.1850. From the one hand, it is likely that the exchange rate could continue to trade upwards in the short term. In this case the rate could face...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals