Data released next week will show that the economy entered the autumn on strong footing. Monday and Tuesday’s reports are expected to reinforce that the exceptionally quick and robust rebound in Canadian housing markets continued. Earlier reports flagged that activity remained near record levels despite signs that some downtown condo markets softened. We expect Tuesday’s housing starts data, to reveal a very strong 240k annualized pace in October given a surge in new building permits the prior month (271k).

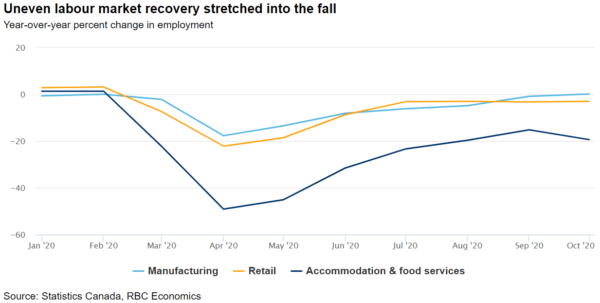

Preliminary estimates for Canadian manufacturing and retail sales in September have already been released, with the former expected to post a 1.5% rise, and the latter to hold at around August levels after a sharp rebound in May through July. Our monitoring suggests that COVID 19 restrictions reinstated in early October had a limited impact on both sectors given a robust manufacturing PMI reading (55.5 in October) and resilient tracking from our debit/credit card purchase data. Those measures have largely focused on the hospitality sector, recreation and leisure resulting in employment in accommodation & food services falling almost 50k in October. Subsequently, spending on services, which is not covered in the monthly retail sales report, is likely to have slipped again as well.

And while news of a vaccine suggests there is light at the end of the tunnel, the resurgence in COVID cases and the possibility of more stringent restrictions remains the biggest threat to the economic recovery in the near-term. We expect growth in the economy to essentially stall in Q4 of this year, with growth in sectors less likely to be impacted by containment measures, like retail and manufacturing, offset by setbacks in some of the already hard-hit service-sector industries like restaurants and hotels.

Week ahead data watch:

We continue to expect ongoing weakness in price growth from subdued services and tourism related spending to leave the Canadian headline inflation rate at 0.5% in October, matching September’s reading. BoC’s core measures likely held up better again, though still expected to tick lower in the longer run.

We expect to see steady gains with US retail sales in October, with the headline to rise 0.4% month over month. In the meantime the all-important retail control measure (which strips out autos, gas, and building materials) should look a bit better, with a gain of +0.5% expected.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals