Refinance demand jumps 105% annually, as mortgage rates set 15th record low of 2020

In this Friday, Sept. 21, 2012, photo,a home is for sale in Oklahoma City. Average U.S. rates on fixed mortgages fell again to new record lows. The decline suggests the Federal Reserve’s stimulus efforts may be having an impact on...

XAU/USD Trades Above 1,850.00

During today’s morning, the XAU/USD exchange rate raised to the 1,865.00 level. It is likely that yellow metal could gain support from the Fibo 23.60% at 1,860.59 and trade upwards against the US Dollar in the nearest future. The rate...

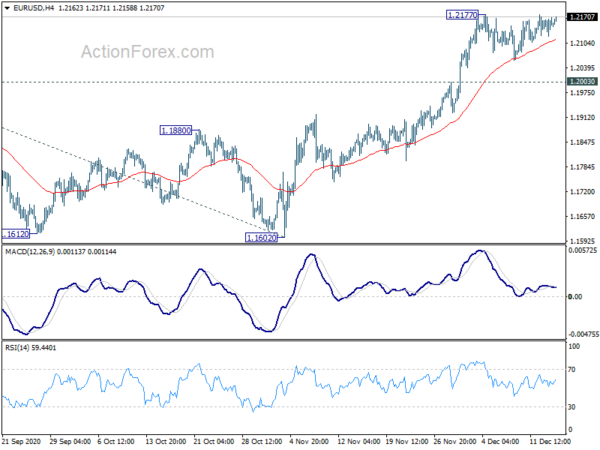

US Dollar Losses Continue

US dollar sell-off resumes overnight The US dollar extended its losses for the week, the dollar index falling by 0.26% through support at 90.50. Assuming it navigates the FOMC without incident, the dollar index remains poised for further losses, with...

WTI Crude Oil Advances To A Nine-Month High

Oil prices are trading bullish once again following the previous few sessions where price action was rather subdued. As the bullish momentum slowly grips, oil prices are seen advancing to the previously formed nine-month high. A continuation to the upside...

Dollar Selloff Returning ahead of FOMC, No Clear Direction Elsewhere

Dollar trade with a generally soft tone today, with strong risk-on markets in the background. But overall, most major pairs and crosses are bounded inside last week’s range. The economic calendar is extremely busy for the rest for the week....

BOE Preview – Staying Cautious about Brexit Outlook

For QE expansion at the last meeting, we expect the BOE will keep its powder dry this month. BOE should leave the Bank rate unchanged at 0.1%, and the size of asset purchases (QE) at 875 pound. There have been...

Robert Shiller calls stocks ‘highly priced,’ but wouldn’t cash out

Nobel Prize-winning economist Robert Shiller believes the fear of missing out is fading. According to Shiller, the market phenomenon was the major narrative driving the historic rally off the March 23 low — as the world entered the throes of...

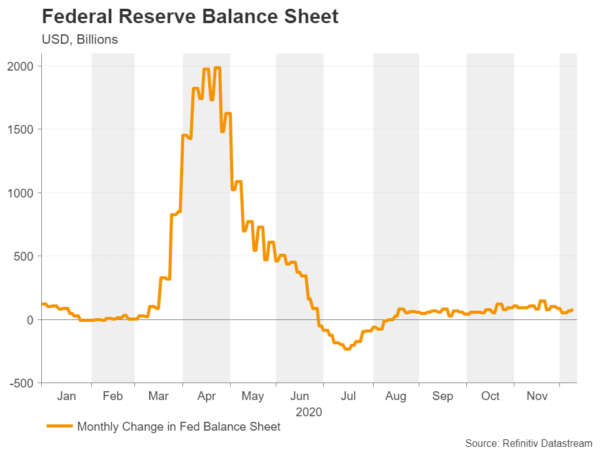

The Fed could disappoint markets Wednesday, even if it keeps a super dovish tone

The Fed may see a brighter long-term outlook when it releases its economic forecasts Wednesday due to vaccine developments, but it also has the opportunity to disappoint at least some investors who are expecting immediate changes in its bond buying...

WTI Futures Take a Breather; Upside Risks Remain Solid

WTI oil futures improved mildly off the Ichimoku lines but are struggling to restart the upwards trajectory with a breakout of the small sideways move. The fairly horizontal Ichimoku lines reflect the stall in positive momentum, while the rising simple...

Fed Likely to Skip QE Boost, May Adjust Composition and Forward Guidance

The Federal Open Market Committee (FOMC) begins its two-day policy meeting on Tuesday, with a decision expected on Wednesday at 19:00 GMT. Federal Reserve Chair Jerome Powell will give his last post-meeting press briefing of the year 30 minutes later....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals