EUR/USD Trades Below 1.2200

On Tuesday, the EUR/USD currency pair reversed north from the support level—the weekly S1 at 1.2159. It is likely that some downside potential could prevail in the market as the exchange rate is pressured by the 55– and 100-hour SMAs,...

GBP/USD Pair Started A Fresh Increase From The 1.3200 Zone

The British Pound found support near the 1.3200 zone and started a fresh increase against the US Dollar. The GBP/USD pair broke the 1.3260 and 1.3300 resistance levels to move into a positive zone. The pair even broke a connecting...

LTCUSD $120.00 Rejection

Litecoin has suffered another big upside rejection from the $120.00 region, further increasing the chances of a swift downside correction for the LTCUSD pair. Traders that are bearish towards Litecoin may be targeting a coming decline towards the $85.00 area....

EURUSD Sell Signal

The euro currency continues to weaken against the US dollar, with bulls failing to maintain the pair back above the 1.2200 resistance level. Technical analysis shows that a bearish breakout from a large rising wedge pattern has taken place on...

USDJPY’s Gradual Nose-Dive Continues Below Falling SMAs

USDJPY is in the process of plummeting further testing key troughs and is currently attached beneath the 103.65 level, which happens to be the 76.4% Fibonacci retracement of the up leg from 101.17 to 111.71. Furthermore, the pair maintains a...

Gold Weakens Despite The Bullish Picture In Short-Term

Gold has had a bullish tendency in the short-term, climbing to a new six-week high of 1,906 before it slipped below the simple moving averages (SMAs) and the 23.6% Fibonacci retracement level of the up leg from 1,764 to 1,906...

Silver Spot: Key Resistance At 25.7500

Pivot (invalidation): 25.7500 Our preference Short positions below 25.7500 with targets at 24.9200 & 24.6700 in extension. Alternative scenario Above 25.7500 look for further upside with 26.0800 & 26.5000 as targets. Comment The RSI is mixed with a bearish bias.

US Equities Mixed On Tuesday, Consumer Confidence Surprisingly Declines

US stocks were mixed on Tuesday, but bears dominated as concerns over the new COVID strain and downbeat economic data offset the optimism surrounding the second stimulus package. The S&P 500 fell 0.21%, the Dow lost 0.67%, while the tech-oriented...

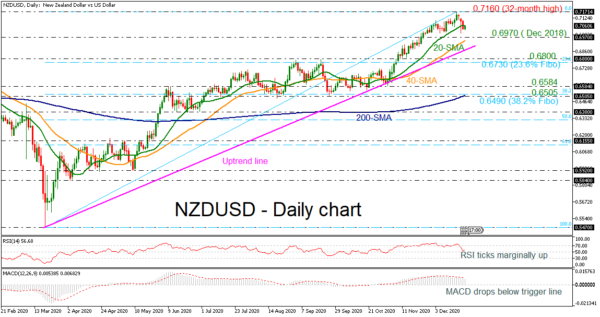

NZDUSD Plummets From 32-Month High, Bullish Outlook Intacts

NZDUSD has come under renewed selling pressure, falling below the 20-day simple moving average (SMA) and remaining well below the 32-month high of 0.7160. Despite the latest pullback though, the pair has been in a long-term ascending tendency since March...

Trading Remains Subdued as Some US Data Awaited

Trading remains rather subdued with markets already in holiday mode. Sterling has the potential to explode with wild moves, but we’re so far disappointed by the lack of progress in Brexit trade negotiations. The surge in cases of the coronavirus,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals