Jobs report blows past expectations as payrolls boom by 916,000 in March

Job growth boomed in March at the fastest pace since last summer, as stronger economic growth and an aggressive vaccination effort contributed to a surge in hospitality and construction jobs, the Labor Department reported Friday. Nonfarm payrolls increased by 916,000...

Week Ahead: Coronavirus Worsens, and the Bickering Begins Over Biden’s Infrastructure Plan

Monday is a holiday and many of the major markets will be closed. Now that month-end and quarter-end are behind us, as well as Non-farm payrolls and OPEC, the focus for the markets will turn back to the rising number...

US March Employment: Real Progress

Summary Hiring stepped up in a major way in March, with employers adding 916K new jobs. More workers returned to the job market and the unemployment rate edged down to 6.0%. While there is still a lot of ground to...

NFP React: Jobs Roaring Back, Stocks Pop, Dollar Strengthens, Yields Higher, Oil and Metals Markets Closed, Bitcoin Higher

The hiring spree has officially started in the US and Wall Street knows that it will take several months of monstrous job gains to trigger the taper tantrum. The equity market party is in the early stages as the US...

USDCHF Jittery ahead of Long-Term Restrictive Line

USDCHF’s attempts to navigate towards the looming long-term restrictive trend line may not be in vain, even though its positive spark seems to be fading. As mentioned, the bullish impetus appears to be withering from its fresh nine-month high of...

US 30 Index Resumes Bullish Bias; Upside Risks Improve

The US30 stock index (Cash) has currently crept over the all-time high of 33,253 and is headed for the 33,638 level, which happens to be the 261.8% Fibonacci extension of the down leg from 28,900 to 26,065. The sturdy advancing...

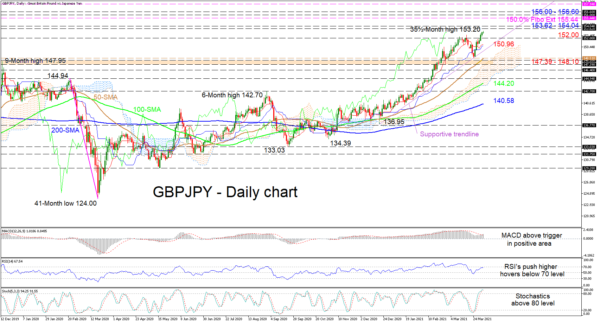

GBPJPY’s Opposing Forces Fail to Oust Bullish Tone

GBPJPY is sustaining its upward trajectory reaching a 35½-month high of 153.20, and bearish powers seem to be incapable of overthrowing the uptrend. The soaring simple moving averages (SMA) are safeguarding the positive structure, while the rising Ichimoku lines are...

XAU/USD Outlook: Gold Extends Recovery But Break Above $1755 Required to Sideline Bears and Signal a Double-Bottom

Spot gold extends strong rebound into second consecutive day after another short-lived probe below psychological $1700 level. The yellow metal advanced over 2.5% in two days, lifted by lower dollar and US and US bond yields, while weak US jobless...

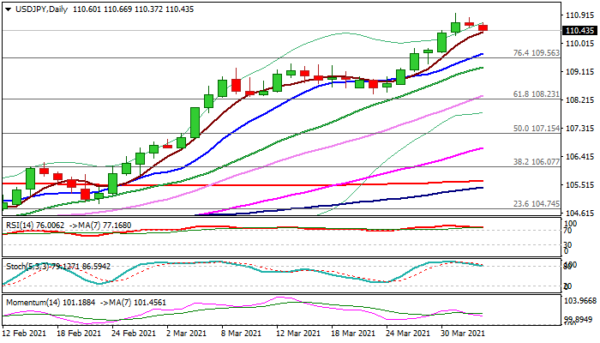

USD/JPY Outlook: Deeper Pullback Expected on Break of 110 Pivot

The pair eases further on Friday following Wednesday’s upside rejection and Thursday’s close in red (the first in seven days) as Japanese traders collected some profits ahead of the weekend. The dollar came under pressure on fresh risk appetite, driven...

WTI Oil Outlook: Oil Prices Jump as OPEC+ Decides to Extend Production Curb for Another Month

WTI oil rose over $2 on Friday and returned above $61 per barrel, lifted by the decision of OPEC+ group to extend production cuts, implemented after oil prices collapsed during the pandemic in 2020, for another month. The world’s top...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals