The Weekly Bottom Line: Bank of Canada Not Spooked by Inflation

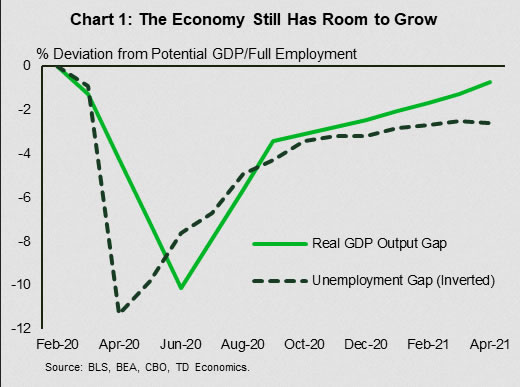

U.S. Highlights The U.S. Federal Reserve continues to upgrade its outlook. And while Chairman Powell reiterated that the recent rise in inflation was transitory, he acknowledged that there was a risk that inflation could be higher than expected. Most U.S....

Week Ahead: FOMC aftermath, BOE and PMIs

Although the FOMC statement was close to that of the last meeting, the hawkish forecasts and “dot plots” surprised markets. Some Fed members are now looking for an increase in rates by the end of 2022! Fed Chairman Powell will...

Week Ahead – Dollar Rally Accelerates on Hawkish Fed

The steepening trade is dead for now as Treasury flattening accelerates. The Fed’s super hawkish pivot is sending short-term Treasury yields and the US dollar higher. The Fed is no longer in an ultra-accommodative stance, they are now just pretty...

Stocks making the biggest moves midday: Nvidia, Lennar, Adobe and more

A sign is posted in front of the NVIDIA headquarters on May 10, 2018 in Santa Clara, California. Justin Sullivan/Getty Images Check out the companies making headlines in midday trading. Nvidia — Shares of Nvidia gained 2.3% midday, then closed...

Hawkish Bullard Sends US Dollar Higher

Just when you thought the Fed was not as hawkish as first thought, enter James Bullard. He is President of the Federal Reserve Bank of St Louis, as well as a member of the FOMC committee. Yesterday, the back end...

Goldman Sachs ramps up bitcoin trading in new partnership with Mike Novogratz’s Galaxy Digital

Goldman Sachs’ efforts to help hedge funds and other big institutional clients wager on bitcoin have taken a step forward. The bank has begun trading bitcoin futures with Galaxy Digital, the crypto merchant bank founded by Mike Novogratz, CNBC has...

Fed’s Jim Bullard sees first interest rate hike coming as soon as 2022

St. Louis Federal Reserve President James Bullard told CNBC on Friday that he sees an initial interest rate increase happening in late-2022 as inflation picks up faster than previous forecasts had anticipated. That estimate is even quicker than the outlook...

Weekly Focus – The Fed and Norges Bank turn more hawkish

This week’s most important event was the Fed meeting. The Fed was more hawkish than anticipated and the meeting most likely marked the first step of the Fed taking the foot off the gas. The Fed is now signalling two...

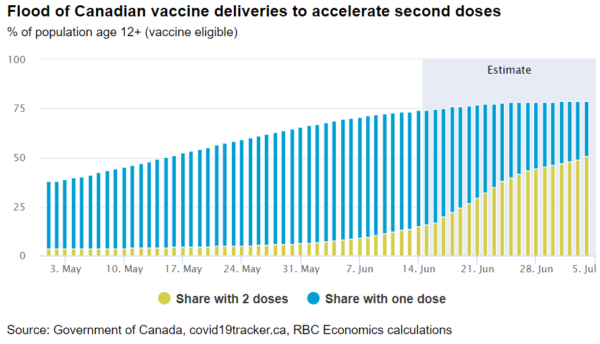

Forward Guidance: Canadian Retail Spending to Stage Summer Comeback from Third Wave Lows

Retail sales fell a sizable 5.1% in April, Statistics Canada’s preliminary estimate showed. The steep drop—which followed big gains in both February and March—came amid renewed pandemic restrictions that forced many shops to close their doors to in-person shoppers. According...

EURUSD at Two-Month Low on Central Bank Divergence

EUR/USD trades at its lowest level in two months on a post Fed hangover and on news that the Fed also started taper talk – highlighting the growing gap between the Fed and the ECB. EUR/USD is extending losses for...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals