U.S. Highlights

- Economic news was relatively light in a holiday-shortened week. The move down in Treasury yields garnered headlines, as bond markets ratchet down inflation expectations.

- The FOMC Minutes were released this week and confirmed increased confidence among members that the economy is on the road to recovery.

- The Job Openings and Labor Turnover Survey also made news, showing demand for workers remains strong. Job openings were at an historic high in May. Challenges clearly remain in matching workers with opportunities. Hiring did not follow job openings up and the ratio of hires to openings fell to an historic low in the month.

Canadian Highlights

- Data from metropolitan real estate boards provided an early indication that Canada’s home sales likely continued to come back down to earth in June, as home sales edged lower in Toronto, Vancouver and Calgary.

- Employment bounced back strongly in June, with the economy adding 231k new jobs, and leaving the level of employment just 340k below its pre-pandemic level. Details were on the soft-side, with all gains and then some in part-time jobs.

- The Bank of Canada Business Outlook Survey and Survey of Consumer Expectations were positive, showing that businesses and consumers were feeling optimistic ahead of reopening.

U.S. – Bond Market Inflation Fears Ease

Economic news was relatively light in a holiday-shortened week. The move down in Treasury yields garnered headlines. U.S. yields have dropped notably and are now about 40 basis points below their March highs.

Nominal Treasury yields had surged earlier this year in the wake of the Democrats winning control of the Senate, as markets priced in more expansive fiscal policy and higher inflation. As is often the case with market swings, these expectations were likely a little over-done, and expectations for both inflation over the long-term, and fiscal stimulus appear to be recalibrating.

These moves seem a bit in contrast with the minutes from the mid-June Fed meeting, which confirm increased confidence among FOMC members that the economy is on the road to recovery. The minutes provided more color on why the “dots” – Fed members’ expectations for rate hikes – shifted earlier at that meeting. We expect the Fed to move from talking about talking about tapering to action in the coming meetings.

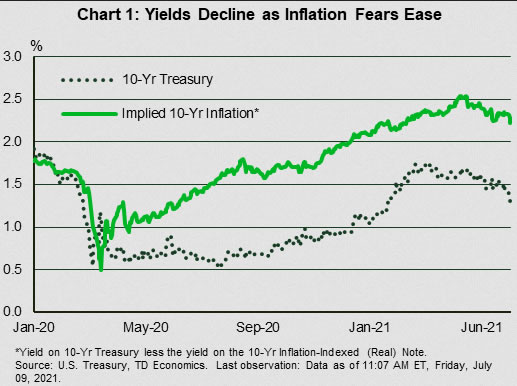

However, the recent decline in bond yields is less about shifts in market rate hike expectations. Rather, it is largely due to declining inflation expectations, as shown in a narrowing spread between nominal and inflation-indexed bond yields (Chart 1).

One economic release that has gained prominence recently – the Job Openings and Labor Turnover Survey – continued to paint a picture of a high degree of labor disruption and churn due to the pandemic. The level of job openings remained historically high in May, confirming demand for labor is strong in many sectors. However, the rate of hiring is only modestly above historical rates, suggesting either that businesses are finding it harder to find workers to fill openings, or that they are constrained in how quickly they can on-board new hires.

Quit rates are also high relative to history, although they fell from April to May. This points to increased churn in the labor market as workers move to jobs with higher wages or better working conditions. The pandemic has been a massive disruption to most sectors, leading to big swings in employment flows. Demand for workers has increased in many sectors (Chart 2), but the biggest increases are in those that were hardest hit by pandemic-related closures. At the same time there remains a high number of people on the sidelines. In May, there were 9.2 million job openings, compared to 9.5 million officially unemployed in June. That number doesn’t include the 1.6 million people who weren’t able to look for work due to Covid.

The bottom line is that demand for workers in many sectors is much stronger than prior to the pandemic, but 42% of people who are unemployed have been so for more than six months, and many will find it difficult to return to work until pandemic-related constraints have fully eased. Even with strong demand, the process of matching workers with jobs will take time..

Canada – June Brings Jobs (and Jabs)

It was a volatile week in financial markets. Equities sold off earlier in the week as investors turned less optimistic about the global economic recovery amid uneven access to vaccines and surging cases of the delta variant in many parts of the world. However, optimism rebounded Friday morning and, as of writing, the TSX is roughly flat relative to its level a week ago.

Meanwhile, worries about inflation have receded somewhat, reigniting demand for bonds and leading bond yields lower. Crude prices swung wildly due to an impasse within OPEC+, which left the outlook for near-term oil production uncertain.

Despite turbulence in financial markets, this week’s economic data was broadly encouraging. Data from metropolitan real estate boards provided early indication that Canada’s home sales likely continued to come back down to earth in June after rising to stratospheric levels in the spring. Home sales edged lower in Toronto, Vancouver and Calgary, and price pressures appear to have moderated.

However, today’s jobs report was this week’s marquee release. As COVID-19 cases subsided and restrictions eased, employment bounced back strongly in June, adding 231k new jobs, and leaving the level of employment just 340k below its pre-pandemic level. The unemployment rate also fell to 7.8% from 8.2% even as more people rejoined the labour force. Details of the report dimmed the excitement somewhat. All of June’s gains and then some were in part-time positions (Chart 1). Gains were also not broad-based across industries: accommodation & food and wholesale & retail trade accounted for three quarter of new jobs as shops and restaurants re-opened.

Still, ongoing progress in the job market, together with this week’s survey data will provide reassurance to the Bank of Canada on the state of the economic recovery ahead of next week’s interest rate decision. The Bank’s Business Outlook Survey showed that businesses sentiment and hiring intentions both reached record-breaking levels in May, as sales expectations improved. Separately, the Survey of Consumer Expectations showed that consumer spending intentions remained resilient as Canada emerged from the third wave of the virus. Households expected to boost their spending by 4.1% over the next 12 months – near the survey high and nearly double expected income growth of 2.1% (Chart 2). Lastly, both surveys indicated that businesses and consumers viewed recent inflationary pressures as transitory.

This positive tone is likely to be reflected in the Bank of Canada’s statement and Monetary Policy Report next week, however the Bank is also likely to acknowledge that the recovery is still not complete. With Q2 GDP growth tracking close to the Bank’s April projection, we expect it will not drastically change its forward guidance, maintaining the time horizon with respect to interest rate normalization (pegged to the second half of 2022). Still, progress to date will likely be sufficient for the Bank to announce a further reduction in asset purchases as a successful vaccination campaign clears the way for stronger economic growth.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals