Summary

United States: Growth Concerns Rattle Markets During Relatively Quiet Week for Economic Data

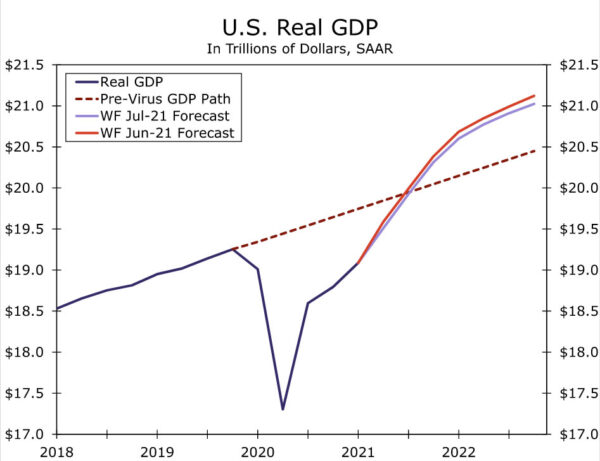

- Financial markets were jittery this week as uncertainty mounted around the new COVID variant hampering global activity and the growing idea that a lack of supply may prevent economic growth. We continue to believe that the drivers of economic recovery remain intact and project a robust above-consensus pace of growth into next year as supply problems ease.

- Next week: Consumer Price Index (Tuesday), Industrial Production (Thursday), Retail Sales (Friday)

International: U.K. Calms Down but Still Carries On

- U.K. May GDP figures pointed to an ongoing recovery, albeit at a slower pace, as the economy grew 0.8% month-over-month, with slower growth reported in both services and industrial activity. Meanwhile in Canada, after COVID restrictions crimped activity in recent months, June saw a rebound as employment jumped by 230,700.

- Next week: Bank of Canada policy announcement (Wednesday), China GDP (Thursday), Australian employment (Thursday)

Interest Rate Watch: June FOMC Minutes Raise as Many Questions as Answers

- Anyone looking for a higher degree of clarity on the path and timing for the Fed to remove its extraordinary policy accommodation was likely disappointed by this week’s release of the June FOMC meeting minutes.

Credit Market Insights: What Happens When Forbearance Ends?

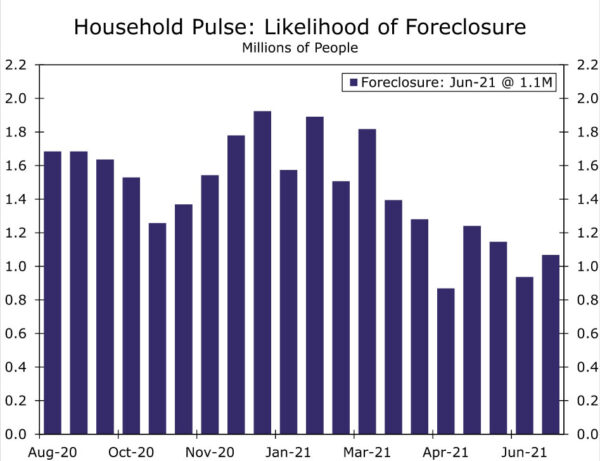

- Since the beginning of the year, an average of 1.3 million adults have reported being at risk of foreclosure; meanwhile, federal forbearance protections are set to expire at the end of September.

Topic of the Week: Oil Prices in the Spotlight Amid OPEC+ Impasse

- Talks last week among OPEC+ broke down as Saudi Arabia and the United Arab Emirates (UAE) failed to come to terms on how new production quotas should be calculated.

U.S. Review

Growth Concerns Rattle Markets During Relatively Quiet Week for Economic Data

There was little fresh economic data released during this holiday-shortened week, but financial markets were jittery. Equity markets slid by the most in three weeks on Thursday and Treasury yields sank, reflecting a risk-off move as uncertainty mounted around the new COVID variant hampering global activity and the growing idea that a lack of supply may prevent economic growth. While we’ve acknowledged parts of the U.S. economy could be growing even faster if it were not for severe bottlenecks, we continue to believe the drivers of economic recovery remain intact and project a robust above-consensus pace of growth into next year as supply problems ease.

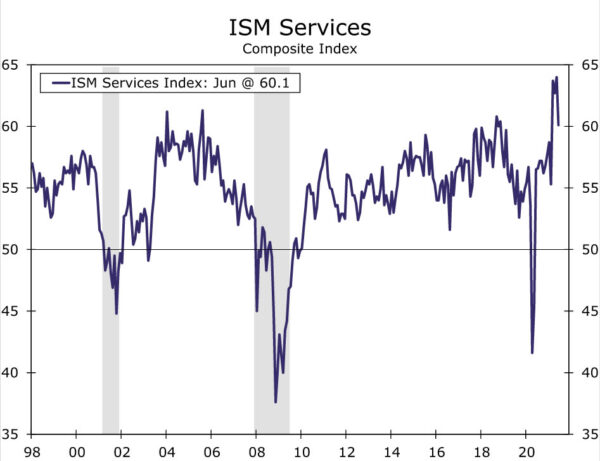

Households are flush with cash, which should continue to support service sector activity. Although the ISM services index pulled back to 60.1 in June from a record high the prior month, the index remains consistent with activity remaining hot this summer (see chart). A normalization of spending from goods back to services over the remainder of the year should help ease some ongoing issues with the supply of physical inputs.

In terms of labor, we expect frictions to remain for some months as employers struggle to find all the help they need. Job openings notched another record high of 9.2 million in May (see chart), but the monthly gain (+16,000) was the smallest since the start of the year. Encouragingly, the smaller gain in openings and the recent pickup in hiring over the past two months suggest reopening frictions are not meaningfully getting worse. Restaffing will take some time, and we expect a return to in-person schooling in the fall; the expiration of enhanced unemployment benefits as well as the easing of COVID concerns should bring more workers back into the labor force over the remainder of the year.

In the meantime, the strong pace of demand amid strapped supply is bidding up costs and pushing earnings and non-wage incentives higher as firms are having to pony up to attract workers. Earnings are rising fastest among lower-paying sectors hardest hit from the pandemic. For example, average hourly earnings in the transportation & warehousing sector were up 17.7% at an annualized rate over the past three months through June, the most of any sector. Anecdotal evidence suggests a more competitive wage environment will keep price pressures elevated, and a respondent from the transportation & warehousing industry in the latest ISM services report noted, “wages have risen at an unprecedented rate… We are expecting a long-term effect on pricing of services.” The prices paid component of the ISM came in north of 70 for the fifth consecutive month in June as all but one industry (agriculture) reported higher costs during the month. These developments further support our view that inflation pressures will remain elevated.

Considering the current labor situation, we suspect the modest pickup in initial jobless claims to 373,000 last week was more noise than a signal. The trend in initial claims is falling and with labor scarce and more expensive for those looking to hire, businesses are likely increasingly reluctant to lay off workers. The pickup in wages does, however, bode well for workers weighing their options and suggests continued churn in the labor market. The quit rate remains above pre-pandemic levels, and higher earnings amid consumer perceptions that jobs are “plentiful” may continue to encourage job switching. A silver lining is that a higher wage environment may also serve as an additional incentive to draw workers back into the labor force.

U.S. Outlook

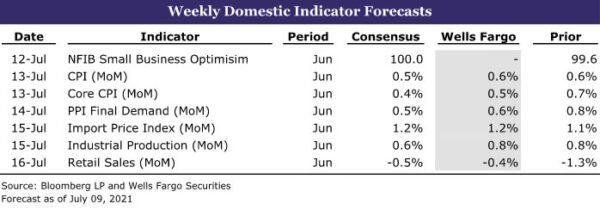

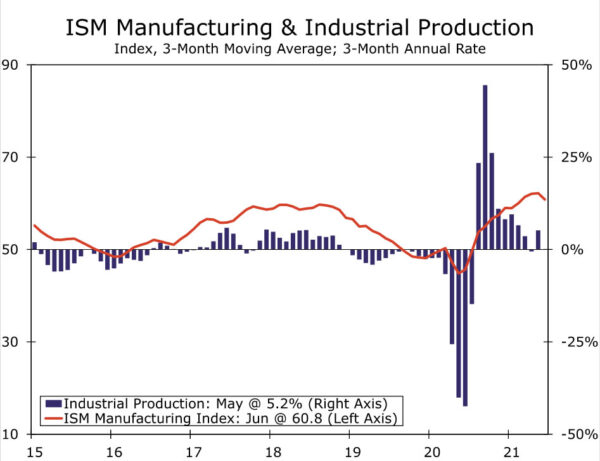

Consumer Price Index • Tuesday

The Consumer Price Index (CPI) report for May had a little bit for both sides of the inflation debate. Again, the major drivers behind May’s 0.6% month-over-month increase were categories related to temporary phenomena, such as the reopening of the service sector and supply-chain woes. Vehicles and other goods accounted for more than half of May’s increase, while travel services accounted for another 11%. That said, housing inflation, which had been relatively benign despite the rapid increase in home prices, started to pick up in May. Shelter inflation, which makes up roughly a third of the CPI basket, could provide a more durable boost to overall inflation as the run-up in home prices filters into the CPI and demand for apartments starts to normalize.

Looking to May, used car prices have showed some signs of topping out. The Manheim Used Car Index fell in June for the first time in 2021. While this may not show up in the June CPI report, given the lag between wholesale and retail car prices, it could signal a shift for one of the more inflationary categories. While core goods inflation could continue to moderate from its April high, the goods sector continues to face a host of rising input costs, which it may pass on to consumers. Companies in manufacturing as well as transportation & warehousing have had to bid up wages to attract workers, while transportation and material costs remain elevated. Altogether, we look for the headline CPI to increase 0.6% in June, bringing the year-over-year rate to 5.0%. Excluding food and energy, we expect core CPI to rise 0.5% in June to 4.0% above its year-ago level.

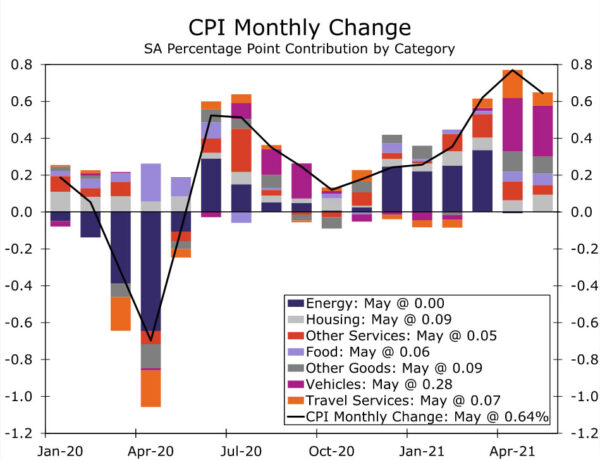

Industrial Production • Thursday

Industrial production increased 0.8% in May, beating expectations. While some of this was due to downward revisions to April data, the outrun was an impressive feat given the plethora of obstacles facing the industrial sector. Rising input costs, lagging supplier deliveries and a lack of skilled labor has been bedeviling producers for months and showed little sign of abating in June. In the June ISM survey, purchasing managers in the manufacturing sector highlighted their inability to keep up with new orders due to a lack of materials, and one added the “lack of labor is killing us.” Despite these headaches, which weighed on the headline index, the production sub-component rose 2.3 points to 60.8.

While the problems facing production are unlikely to abate soon, the demand outlook remains robust. Businesses have ramped up investment to ease current capacity constraints and will likely need to keep spending through the end of this year as they rebuild their depleted inventories. Outside the factory sector, utilities could see some boost in June, following the heat wave that blanketed parts of the West at the end of last month. Overall, we look for industrial production to rise 0.8% in June.

Retail Sales • Friday

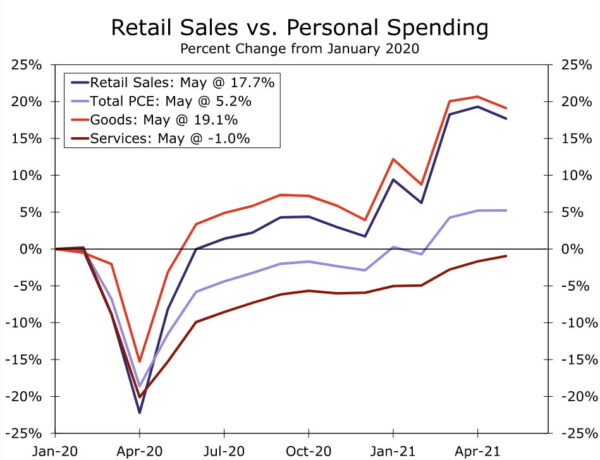

Retail sales fell 1.3% in May, driven by slower vehicle and parts sales as well as slower sales at general merchandise stores. While we had expected goods spending to slow as consumers shifted their spending toward the reopening services sector, low inventories and higher prices have brought sales down faster than we initially anticipated. That said, we remain optimistic that overall spending will be strong this summer. As can be seen in the chart, retail sales largely reflect good spending. Outside last year, however, the bulk of consumer spending is on services.

Looking to next week’s report, we suspect retail sales remained soft. Vehicle sales fell again in June and will likely weigh on the headline index. Excluding autos, we suspect retail sales increased 0.5% in June. We will also be closely watching spending at restaurants & bars for insights into the ongoing service recovery. Despite the deep hole the industry fell into last year, real spending at restaurants has been closing in on its pre-pandemic level and likely made further progress in June.

International Review

U.K. Calms Down but Still Carries On; Canada Moves from Soft Spring to Solid Summer

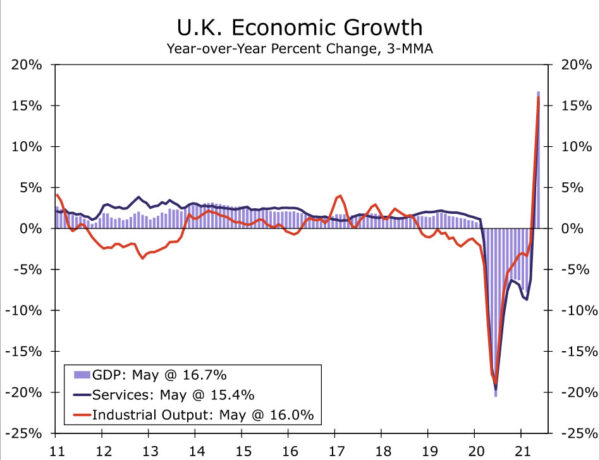

The latest U.K. GDP figures indicated the country’s economic expansion continued, albeit at a somewhat slower pace in May. U.K. GDP rose 0.8% month-over-month in May, less than expected, following sizable gains in both March and April. That said, with the May increase, the level of GDP for the first two months of Q2 is now 4.3% above its Q1 average. May services activity showed a steady gain of 0.9% month-over-month as the U.K. continued along the reopening path, while May industrial output rose a similar 0.8%. The release did show clear evidence of the reopening, as accommodation and food service activities rose 37.1%. Given overall encouraging economic signals, even with the brief delay in the final phase of the U.K. reopening, we remain constructive on the prospects for U.K. growth. Indeed, in our forecast update published earlier this week, we lifted our U.K. GDP growth outlook for 2021 to 7.5%, from 7.0% previously.

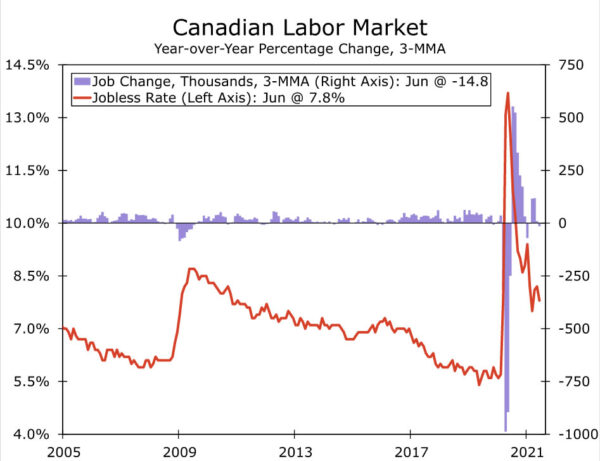

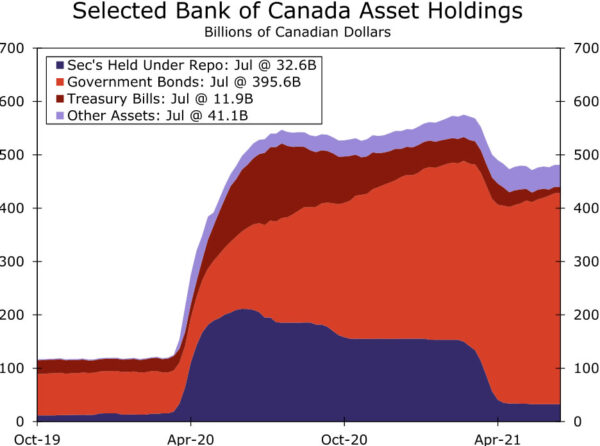

Also moving in a positive direction are activity data and confidence surveys from Canada. A renewed spread of COVID cases and associated restrictions earlier this year led Canadian employment to decline noticeably in both April and May. However, Canada’s June labor market report saw the start of a rebound as employment rose by 230,700. The composition of that job growth was less impressive, as a fall in full-time jobs of 33,200 was more than offset by a gain of 263,900 part-time jobs. Meanwhile, the unemployment rate declined to 7.8%. The labor market report wasn’t the only good news from Canada this week, as the June manufacturing PMI jumped to 71.9. With Canada’s economy showing solid overall trends, we expect the Bank of Canada to slow its bond purchases further at its July monetary policy announcement.

Speaking of tapering bond purchases, the Reserve Bank of Australia (RBA) announced an initial foray into slowing the pace of its bond purchases. At its monetary policy announcement this week, the RBA kept its policy interest rate at 0.10% and its target for three-year government bond yields also at 0.10%. With respect to its quantitative easing plans, the RBA said it would complete its A$200 billion of bond purchases, as previously indicated, while also noting the recent pace of purchases has typically been around A$5 billion per week. Beyond September, the RBA said it would continue its bond purchases, but at a modestly reduced pace of A$4 billion per week, until at least mid-November, at which time it said it would conduct a further review.

International Outlook

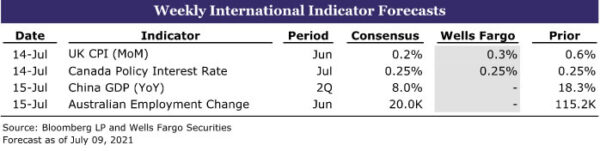

Bank of Canada Policy Announcement • Wednesday

The Bank of Canada announces its latest monetary policy decision next week, and despite some economic softness during the spring given a renewed spread of COVID cases and associated restrictions, we expect another step toward less accommodative monetary policy.

There are indications Canada’s economy is shaking off the latest COVID scare as new cases recede, and given elevated oil prices and a rebound in both June employment and the June manufacturing PMI. We do not expect those more hopeful signals to prompt any change in the central bank’s policy interest rate, which we expect to stay at 0.25%. We do, however, expect the Bank of Canada to slow its government bond purchases further, from the current pace of at least C$3 billion per week to a reduced pace of at least C$2 billion per week. Next week’s announcement will also be accompanied by a Monetary Policy Report, which will detail the central bank’s latest economic projections. A particularly strong upgrade to the central bank’s GDP growth or CPI inflation outlook could hasten the point at which market participants expect the Bank of Canada to begin raising interest rates.

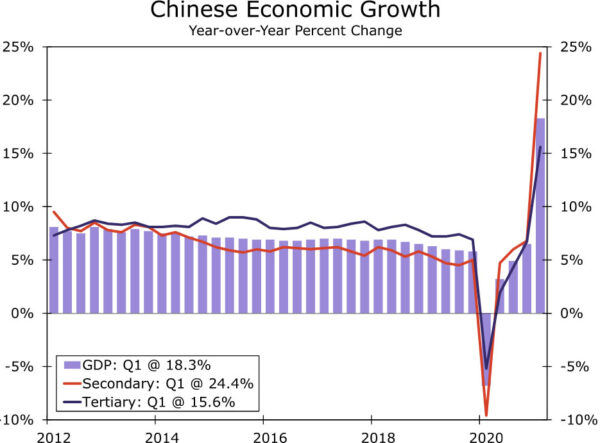

China GDP • Thursday

China’s Q2 GDP figures due next week should confirm an overall and ongoing slowdown in the economy. On a sequential basis, the consensus forecast is for Q2 GDP to rise 1.0% quarter-over-quarter. That would be better than the 0.6% increase seen in Q1, but still slower than the trend rate of growth typically seen prior to the COVID crisis. Meanwhile, on an annual basis GDP is forecast to slow markedly to 8.0% year-over-year, with both manufacturing and service sector growth expected to decelerate.

Indeed, recent monthly activity data confirm that there has been a broad-based slowdown, a trend that is expected to continue with the release of June figures. The consensus forecast is for June retail sales to slow to 10.9% year-over-year, while growth in June industrial output is forecast to slow to 8.0%.

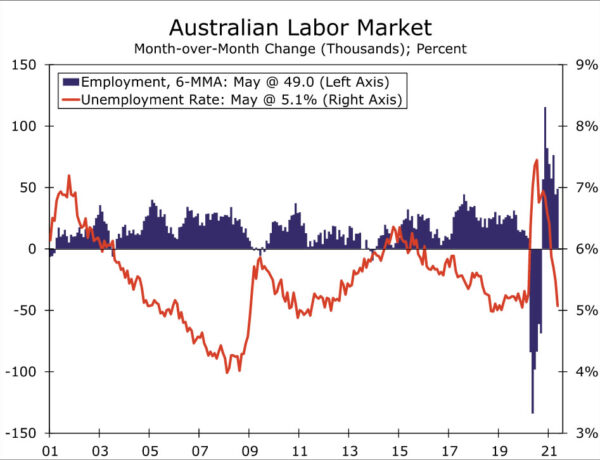

Australian Employment • Thursday

Next week, Australia’s June labor market report is expected to show another—albeit smaller—job gain for June. Except for a brief dip in April following the end of government income support measures, Australian employment has otherwise gained in the past eight months. For June, the consensus forecast is for an employment increase of 20,000 and for the unemployment rate to dip to 5.0%.

The Reserve Bank of Australia (RBA) recently said the country’s economic recovery has been stronger than expected so far, but also acknowledged the renewed outbreak of COVID cases and associated restrictions as a possible risk to activity in the near term. Moreover, despite the solid recovery, there have so far been few signs of wage or price inflation. Thus even in the event of another rise in jobs, we would not expect any further adjustment in policy settings or guidance, especially given the modest tweaks in policy approach already announced at the July RBA monetary policy meeting.

Interest Rate Watch

June FOMC Minutes Raise as Many Questions as Answers

Anyone looking for a higher degree of clarity on the path and timing for the Fed to remove its extraordinary policy accommodation was likely disappointed by this week’s release of the June FOMC meeting minutes. Given that the Fed raised its estimate for 2021 inflation, as measured by the PCE deflator, by a full percentage point to 3.4%, there was quite a bit of discussion about inflation. While a few members clearly appear to be more alarmed about the rapid and widespread acceleration in price increases, the majority of FOMC members still are clinging to the notion that the bulk of the acceleration in inflation will prove transitory. Supply-chain bottlenecks are clearly proving more pernicious and likely to persist longer than earlier thought, but the recent decline in lumber prices has bolstered confidence of those who still believe relief from higher inflation is just around the corner.

Views on the path for economic growth were also divided beyond the burst provided by the avalanche of fiscal stimulus early this spring. The FOMC cited the recent slowing in payroll growth (prior to the June report) as reason for patience in accelerating the winding down of QE. And the committee was also divided whether its purchases of mortgage-backed securities were contributing to the rapid run-up in home prices. In short, the minutes suggest the Fed has only slightly pulled forward its expectations for when it would be appropriate to begin winding down their bond purchases, with the most likely timing of an announcement coming late this fall with implementation beginning early next year. That puts the timing of the first interest rate hike sometime in early 2023, consistent with the movement in the Fed’s dot plot, which shows 11 of the 18 FOMC participants believe that at least two quarter-point hikes in the federal funds rate would be appropriate by the end 2023 and two others believe that one hike would be needed. Seven FOMC members feel the Fed should begin hiking rates in 2022, with five members believing one rate hike would be appropriate and two stating the appropriate federal rate at the end of 2022 would be half a percentage point higher than it is today.

Long-term bond yields declined sharply this week, with the yield on the 10-year Treasury note briefly falling to 1.25% on Thursday morning. Yields have recovered somewhat but remain well below where they were a week ago. The drop in yield follows growing concern about the pace of economic growth. Forecasts for second quarter GDP have been scaled, with our own estimate reduced from 10.9% a month ago to 9.2% currently. Moreover, many forecasters have pointed out that the second quarter will mark peak growth for this business cycle and that waning stimulus and growing calls for increased regulation and higher taxes will slow growth in coming quarters. News that China would make it more difficult for Chinese firms to list on U.S. stock exchanges and would clamp down on the growth of its tech giants in general also sent a chill throughout the financial markets.

Expectations for global economic growth were also dented by growing concerns about the Delta variant. Japan announced the Olympics, set to start in two weeks, would not allow spectators due to the rise in COVID infections. Several other countries have also reported a disturbing rise in new COVID cases and infections have risen sharply in parts of the U.S., particularly rural portions of Missouri and Arkansas. Despite these concerns, some sense of order appears to have returned to the markets at week’s end. Both the Pfizer and Moderna vaccines appear to provide a high degree of protection from the Delta variant. For those infections that do slip through to vaccinated individuals, the overwhelming majority have proved to be asymptomatic or resulted in cases with very mild symptoms. The variant is more contagious, however, and could potentially slow the reopening of schools this fall, which is a key cog in the reopening process that is widely expected to boost job growth this fall.

Credit Market Insights

What Happens When Forbearance Ends?

Since the beginning of the year, an average of 1.3 million adults have reported being at risk of foreclosure in the Census Bureau’s weekly Household Pulse Survey. That equates to roughly 1.6% of total owner-occupied homes across the country. To support struggling homeowners, the foreclosure moratorium for federally-guaranteed mortgages was extended for the final time to July 31. Federal forbearance protections were also extended to September 30, with borrowers given the ability to request or extend forbearance enrollment by up to three or six months. Black Knight, Inc.’s and the Mortgage Bankers Association’s (MBA) estimates show the number of homeowners currently in forbearance is around 2 million. Looking ahead, Black Knight projects that most of the active forbearance plans will expire in September and October. So, what will happen when forbearance ends?

In our view, we doubt that we will see a material surge in foreclosures once the forbearance programs end. When forbearance agreements expire, loan servicers typically work with borrowers to find a repayment option to avoid foreclosure. Over the course of the pandemic, forbearance plans have been remarkably successful. According to MBA, 28% of forbearance exits over the past year have resulted in a loan deferral, while another 24% of borrowers exited because they were able to continue making their monthly payments during the forbearance period. While the pace of forbearance exits has slowed in recent weeks, it is likely to improve in the coming months alongside stronger job growth. Furthermore, more fiscal support is on its way to homeowners. The American Rescue Plan, passed in March, appropriated $9.96 billion for homeowner assistance.

Topic of the Week

Oil Prices in the Spotlight Amid OPEC+ Impasse

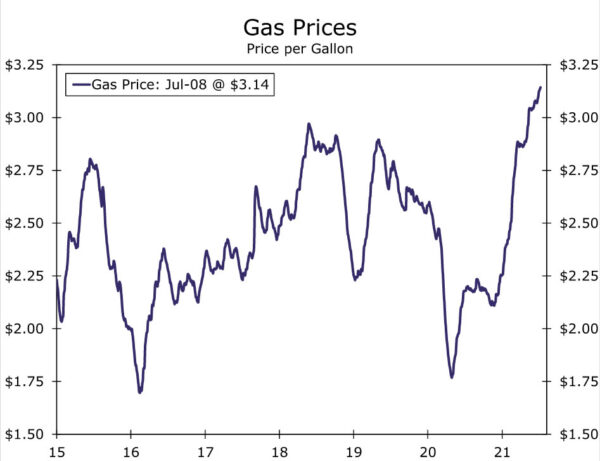

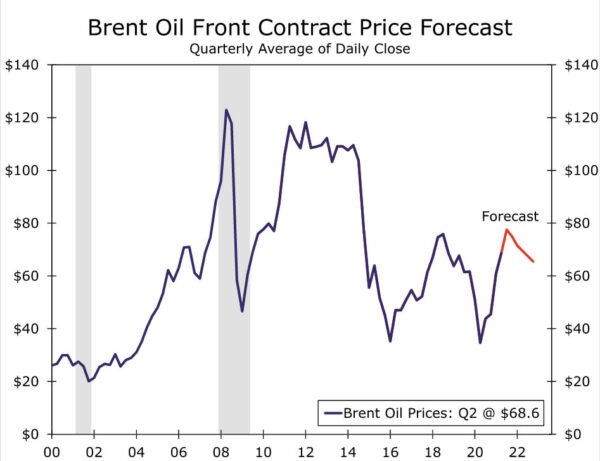

Oil prices are trending higher. As of this writing, Brent front month contract prices, which are a commonly used global benchmark for oil prices, were $73.90 per barrel, almost 75% higher than the $42.35 per barrel prices seen in early July of last year. The rise in oil prices has occurred alongside a resurgence in global energy demand. While COVID is still a threat, more progress is being made on vaccinations, and many economies are unwinding pandemic-related restrictions. This has been especially true in the United States, where over 67% of the population has received at least one vaccination and consumers are venturing back out in the economy, hitting the road and hopping on airplanes. According to the Energy Information Administration, fuel demand jumped to 10 million barrels a day during the week leading up to the July 4th holiday. This comes as no surprise, considering 2.19 million people passed through TSA checkpoints in airports on July 2 (a post-pandemic high) and an estimated 44 million people traveled by car over the Independence Day weekend. With more people out and about, gas prices have risen to $3.14 a gallon, the highest since the onset of the pandemic.

The ascension of oil prices also comes as energy supplies struggle to keep up with demand. The Organization of the Petroleum Exporting Countries and its partners (OPEC+) broached this issue at a meeting last week. Last year, as global energy demand collapsed alongside lockdowns and other pandemic-related restrictions, OPEC+ agreed to cut production by 10 million barrels a day, which was the largest production cut on record. Now, with COVID risks receding, many economies are reopening and oil demand is bouncing back. With the pendulum swinging the other way, OPEC+ has gradually lifted production and the early July meeting was meant to decide the next phase of its production policy. However, talks among the group of 23 crude oil producing nations, which controls over 50% of global oil supplies and 90% of proven reserves, broke down as Saudi Arabia and the United Arab Emirates (UAE) failed to come to terms on how new production quotas should be calculated. Expectations for the OPEC+ meeting were for a modest increase in production, but the stalemate has introduced a new source of uncertainty regarding the timing and magnitude of future production increases to oil markets. The OPEC+ impasse was followed by a rally in oil futures, which hit a six-year high of nearly $77 a barrel on July 6. Oil prices have since retreated a bit, as prospects for a complete recovery in global energy demand have been dimmed by ongoing COVID outbreaks in Southeast Asia and Japan.

Source: Bloomberg LP and Wells Fargo Securities

Source: IHS Markit and Wells Fargo Securities

Considering the ongoing supply and demand imbalance in energy markets and recent OPEC+ stalemate, we look for the Brent front contract price to end the year at $75 per barrel. That said, energy markets should begin to balance out as demand moderates over the next few years. If the outcome of the recent meeting is any indication, less OPEC+ cohesion is to be expected moving forward, with price concerns superseded by a focus on gaining market share. Thus, we expect a gradual decline in Brent prices over the course of next year and for prices to be at $65.50 per barrel by the end of 2022. Still, the OPEC+ impasse has raised concerns that oil prices might be higher than many are expecting in coming years, which could generate added inflationary pressures and slow down overall economic growth.

Those fears are not unfounded. We utilized Oxford Economics’ Global Economic Model to quantify the impact of a modest oil price shock in which Brent prices remain at $75 per barrel over the next seven quarters. Under this scenario, the Oxford model projects that the level of real GDP would be over 0.2% lower at the end of 2022 compared to its baseline forecast. Slightly slower GDP growth under these conditions is mostly explained by the more moderate pace of consumer spending that would theoretically occur as households budget for higher gas prices and heating bills. Not surprising, higher oil prices would also produce a faster rise in the headline Consumer Price Index (CPI), which directly measures increases in energy prices. The core CPI, which excludes energy and food prices, would also increase at a slightly faster rate than Oxford’s baseline forecast. Materials used in a long list of consumer products, such as plastics, tires, clothing and roofing shingles (to name just a few), are byproducts of oil refining, meaning that any increase in oil prices could potentially flow through to the core CPI.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals