Summary

United States: Output Continues to Ramp Up as COVID Surges Higher

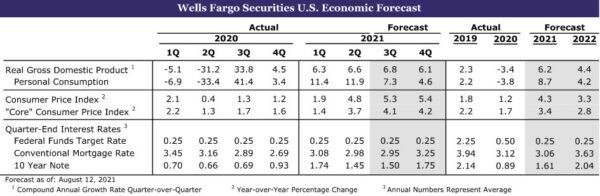

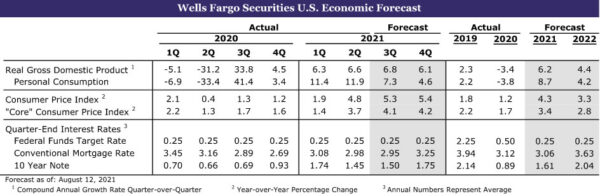

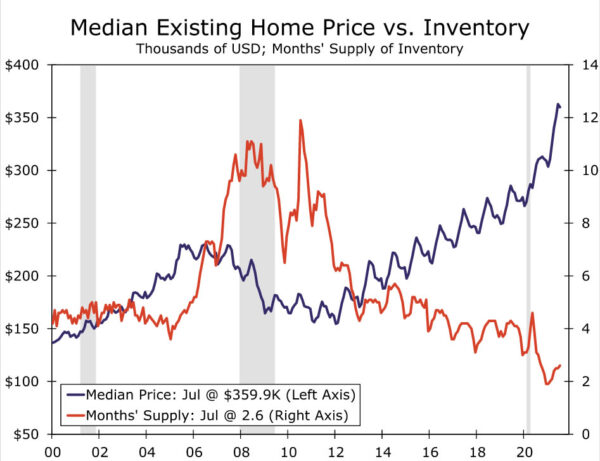

- Output continues to ramp up across the U.S., even as the resurgence in COVID cases is leading to some pullback in consumer engagement. The need to rebuild inventories should keep production rising, even if consumer spending moderates a bit further. Housing is already beginning to move into better balance, with rising inventories of existing homes beginning to moderate soaring home prices. Inventories of new homes have also increased, although most of the gain is in developed lots and homes under construction.

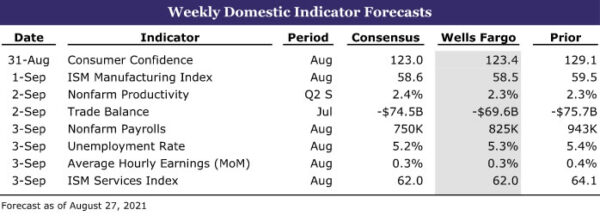

- Next week: Construction Spending (Wed), ISM Manufacturing (Wed), Employment (Fri)

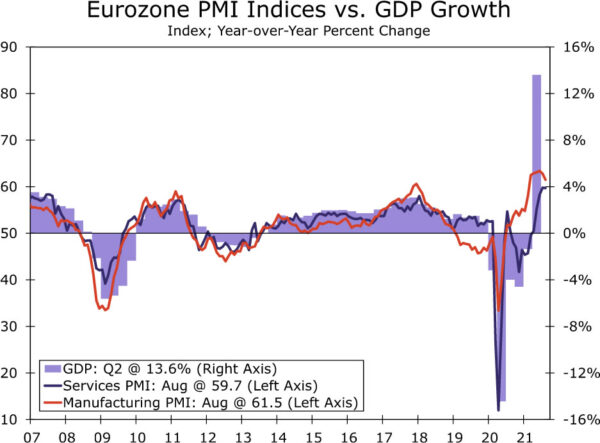

International: Eurozone Economy Still Showing Solid Momentum

- After the Eurozone economy enjoyed solid growth in Q2, August PMI data indicate that momentum has carried into Q3. The services PMI was virtually unchanged at 59.7, still a historically elevated level, while the manufacturing PMI fell to 61.5. We expect Eurozone Q3 GDP to rise 2.5% quarter-over-quarter, even stronger than the Q2 gain.

- Next week: China PMIs (Tues), Eurozone CPI (Tues), Canada GDP (Tues)

Interest Rate Watch: Powell Keeps an Open Mind to Tapering

- It does not seem that the Fed chair has made up his mind yet about when to taper, and he will continue to watch incoming data. The labor market report for August, which is slated for release on Friday, September 3, will be an important marker for the beginning of tapering.

Credit Market Insights: Red-Hot CLO Market

- This past year has been a banner year for fundraising and deal activity, with demand booming for collateralized loan obligations (CLOs). The low interest rate environment has supported record-breaking deal flow as firms have been able to borrow cheaply coming out of the pandemic.

Topic of the Week: The Economics of College Football: Season III

- We are again publishing our series on college football this year. Each week of the season, we will be highlighting a key matchup, covering the history behind each university’s football program, local economy and school community, and of course, giving predictions about the upcoming game.

U.S. Review

Moving Back into Balance

Shortages, supply-chain bottlenecks and higher prices have been a hallmark of this economic recovery, with some of the most notable shortages and price hikes occurring in housing and motor vehicles. This week’s economic data provide some hints that the economy is moving toward some sense of better balance, with the rise in COVID infections causing consumers to tap the brakes and allow production to catch up with consumption. Many forecasters have slashed their estimates for third quarter economic growth due to the recent slide in consumer sentiment and some moderation in the high-frequency data that focus on consumer spending and economic engagement. Real GDP measures the production of goods and services, however, which appears to be less affected by the resurgence in COVID infections. The revised Q2 GDP data also show that inventories fell even more than previously reported, which likely sets up an even larger swing back in Q3.

Consumers took a breather in July, with today’s personal income and spending data showing a 0.1% drop in real personal consumption outlays for the month. Real outlays for durable goods fell 2.6%. Spending on motor vehicles and parts fell 3.7%, largely due to the lack of cars and SUVs available for sale. Dealer lots are nearly empty, with several dealerships down to just a handful of cars on their lots. New cars are also selling at a premium. Consumers certainly have the ability to continue spending. Personal income rose 1.1% in July, with wages and salaries climbing 1.0%. With income rising faster than outlays, the saving rate rose 0.8 percentage point to 9.6%. Consumers are also still sitting on a mountain of savings built up during the pandemic, estimated around $2.3 trillion above where it would have been under its pre-pandemic trend. Consumer sentiment for the month of August affirmed the 11-point plunge reported in the preliminary report earlier in the month. The final Consumer Sentiment index for August rose 0.1 from its preliminary level and shows essentially the same large, nearly 14-point drop in consumer expectations, likely reflecting concerns about the rising number of COVID infections tied to the particularly contagious Delta variant.

The moderation in consumer spending on goods should allow for production to begin to catch up with consumption. While headline advance orders for capital goods fell 0.1%, the core nondefense capital goods orders, excluding aircraft, were flat, while orders for motor vehicles and parts surged 5.8%. Core shipments of capital goods, which is a good proxy for business fixed investment, rose a solid 1.0% in July and are up at a solid 13% annual rate. Inventories also increased, climbing 0.6% in July.

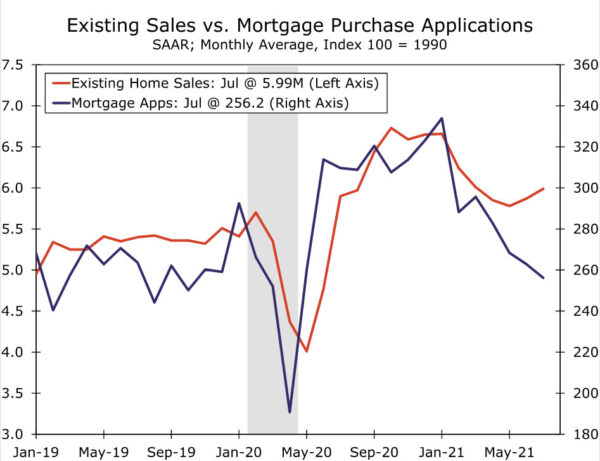

This past month’s housing data suggest the market is beginning to move back into balance. To be certain, inventories of existing homes are still exceptionally low and homes are selling quickly and often above asking price. The earlier surge in home prices has brought out more sellers, however. The inventory of existing homes has been gradually trending higher since February and now sits at a 2.6-month supply. A 5.5-month supply has typically been considered the norm, although innovations in mortgage finance and the rise of cash buyers have probably reduced that by a month or two. Sales of existing homes slightly topped consensus expectations this past month, rising 2% to a 5.99-million unit pace. Sales of single-family homes rose 2.7% and accounted for all the overall gain. The median price of an existing home declined slightly from the prior month, on a non-seasonally adjusted basis, to $359,900. That still leaves the median price 17.8% above its year ago level. The pace of price appreciation appears to have peaked in May at 23.6%.

Sales of new homes rose 1.0% to a 708,000-unit pace, ending a three-month string of declines. Home buying activity has cooled off in recent months alongside soaring prices and shrinking inventories. Sales in June were also revised slightly higher and now show a 2.6% drop, compared to a 6.6% drop reported earlier. Low inventories and the rapid run-up in prices have led prospective buyers to put their home-buying plans on hold, which explains a softer pace of sales in recent months. The pullback also makes sense considering the extremely low inventories of completed homes available for sale and continuing supply chain disruptions that have led to project delays. Sales of homes where construction has not started rose 19% during July, while sales of homes under construction fell 13% to the lowest level since May 2020.

The inventory picture appears to be improving slightly. The number of new homes for sale rose 5.5% to 367,000 in July. At the current sales pace, all the current inventory on the market would be sold in 6.2 months, up from six months in June and 3.6 months in July 2020. While the number of homes for sale rose at every stage of construction, most of the recent improvement in inventories has been for homes that have not yet started construction.

U.S. Outlook

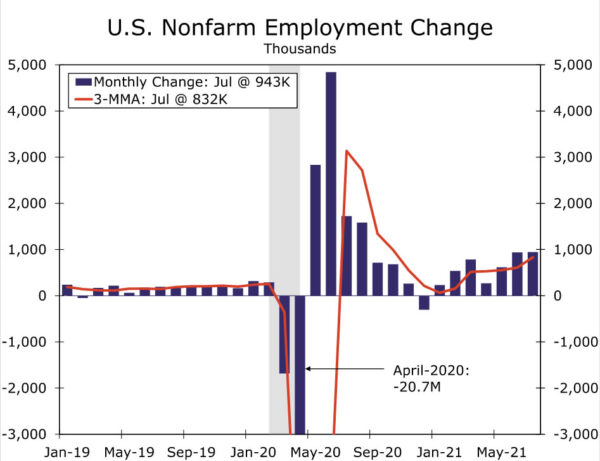

Construction Spending • Wednesday

During June, total construction spending edged up 0.1%. Again, nearly all of the gain occurred in the residential sector, which rose 1.1% during the month. More time spent at home throughout the pandemic has induced a need for more space, which has bolstered single family and home improvement spending. By contrast, nonresidential outlays declined 0.9% during June, which reflects the seismic impact COVID continues to have on office, hotel and education construction projects.

Residential’s momentum has been slowing over the past few months alongside sky-rocketing home prices and building material scarcities. Housing starts declined sharply during July, which adds to the evidence that home building has hit a near-term ceiling, in part due to supply constraints. Retail sales at building material stores also have pulled back recently, suggesting fast-rising input prices are also a headwind for home improvement spending. In terms of nonresidential spending, both the Architectural Billings Index and Dodge Momentum Index fell back during July as the Delta wave of COVID reintroduced uncertainty surrounding prospective tenant demand. We look for another modest gain for overall construction spending during July.

ISM Manufacturing • Wednesday

Pervasive supply chain bottlenecks continue to hamper otherwise strong activity in the factory sector. The ISM manufacturing index came in below expectations and slipped to 59.5 during July, the first reading below 60 since the start of the year. Most sub-components of the headline index deteriorated during the month, notably new orders, production and inventories. There were a few signs that procuring parts and labor was becoming less of an issue. The employment index crossed back into expansion territory, while the prices paid index fell back from the highly elevated levels seen recently. The supplier delivery index also fell to a five-month low of 72.5. These improvements no doubt come as welcome news to the manufacturing industry, which has been the epicenter of the supply chain dislocations affecting the entire economy. However, smooth functioning value chains still appear to be some ways off, as many indicators of global supply bottlenecks (as encapsulated by our “Pressure Gauge”)remain heightened. Bearing this in mind, as well as the softer-than-expected results from most of the Fed’s regional survey’s of manufacturing activity, we expect another modest decline in the manufacturing ISM during August.

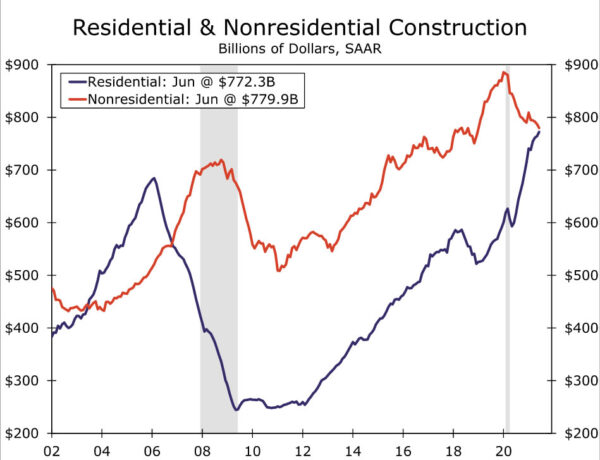

Employment • Friday

The labor market recovery appears to be gaining speed. Employers added 943K jobs during July, bringing the three-month moving average to 832K, the fastest pace since October of last year. Meanwhile, the unemployment rate fell sharply to 5.4% from 5.9%. Employers still appear to be having trouble staffing open positions, which is keeping pressure on wage growth. Average hourly earnings rose 0.4% during July, bringing the three-month annualized pace to 5.0%.

We expect another robust gain in payrolls for August. That said, the increase may fall slightly short of July’s enormous addition. For one, payrolls in July were flattered by a 221K gain in local government education jobs, a result that was likely overstated by the seasonal adjustment process, which has been flummoxed by the unusual hiring patterns in public education following the onset of the pandemic. On the other hand, the leisure & hospitality sector posted a solid gain in July, which demonstrates that labor supply constraints are beginning to ease. Many states have now exited the federal pandemic unemployment benefit program, which could help add to the labor supply in the months ahead. That said, the surge in COVID cases driven by the highly transmissible Delta variant presents some downside risk, as fear of catching the virus is one factor keeping workers on the sidelines. Related to that, the FOMC is likely to again consider deteriorating public health conditions as a detriment to “substantial further progress,” which removes some heft from the August employment report when it comes to determining the timing of potential tapering.

International Review

Eurozone Economy Still Showing Solid Momentum

After the Eurozone economy enjoyed a sizable 2.0% quarter-over-quarter gain in Q2, the August PMI figures indicated that sturdy momentum has carried into the third quarter. Of particular note, the services PMI was virtually unchanged at 59.7, still a historically elevated level, while the manufacturing PMI eased a bit, to 61.5. The details of the report showed only a mild softening of new orders and incoming new business. Overall, we expect Eurozone Q3 GDP growth of 2.5% quarter-over-quarter, even stronger than the gain in Q2. Meanwhile, the input and output price components of the PMI survey also remained at relatively high levels, indicative of inflation pressures, although these pressures have yet to show through in the Eurozone CPI to any meaningful extent.

Separately, Germany’s August IFO business confidence also shows reasonable momentum for the Eurozone’s largest economy, though possibly hinting at some slowing by late this year. The headline business climate index fell to 99.4. The current assessment component actually increased to 101.4, but the expectations component showed a perceptible decline, to 97.5.

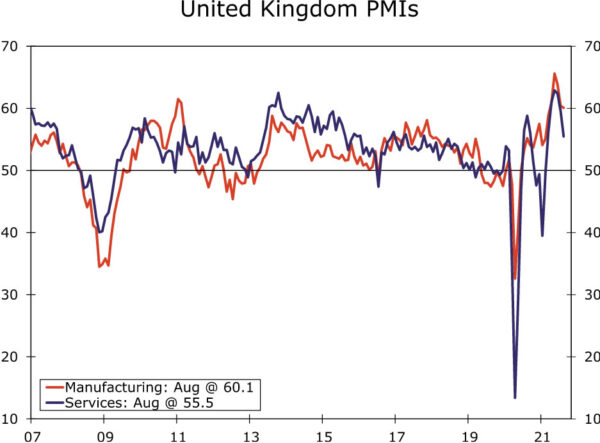

In contrast to the Eurozone, the August PMI surveys for the United Kingdom showed a more notable slowdown, although that was perhaps always to be expected after the U.K. economy enjoyed supercharged growth of 4.8% quarter-over-quarter in Q2. The August services PMI dropped to 55.5, the lowest level since February, while the manufacturing PMI eased to 60.1. The survey comes after a reported decline in July retail sales and suggests that while the service sector will likely continue to grow in Q3, it will probably be at a much slower pace than in Q2. As a result, we also expect slower growth in U.K. Q3 GDP, with our forecast 2.5% quarter-over-quarter gain only around half of the increase seen in Q2.

Finally, the Bank of Korea delivered a somewhat “dovish rate hike” at its monetary policy announcement this week. The Bank of Korea raised its policy rate 25 bps to 0.75%, surprising the (slight) majority of analysts who had expected the central bank to hold rates steady. The decision to raise interest rates was not unanimous, with one policymaker voting to hold interest rates steady. The Bank of Korea also will “gradually adjust” the degree of support for the economy, taking into account COVID developments and financial imbalances, among other factors. Meanwhile, the Bank of Korea kept its GDP forecasts unchanged, while raising its CPI inflation forecasts. Still, Central Bank Governor Lee described interest rates as still accommodative after the move, and the majority of economists expect one more rate hike before he steps down as central bank governor in March.

International Outlook

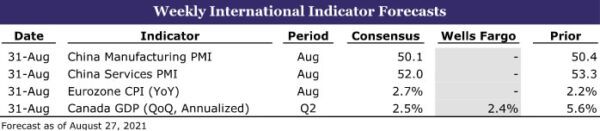

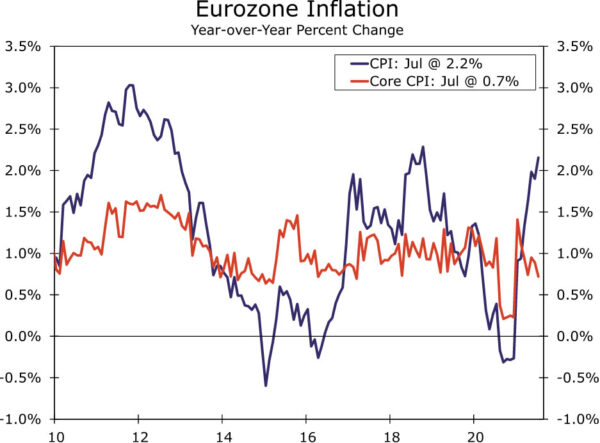

China PMIs • Tuesday

China’s economy has slowed recent months, in part due to COVID-related restrictions and regulatory changes. Localized outbreaks of COVID cases have seen some restrictions on tourist events and sites, and have affected air travel. Meanwhile, regulatory changes, including measures to curb pollution, are potentially affecting industrial activity.

Against this backdrop, the consensus forecast is for a further decline in China’s official PMIs for August. The manufacturing PMI is expected to ease to 50.2 while, more notably, the services PMI is expected to fall to 52.0. The Caixin PMIs, also due next week, are expected to show a dip in the manufacturing PMI to 50.1 and a decline in the services PMI to 52.0. While we have downgraded our 2021 GDP growth forecast for China over the course of this year, the risks around that forecast are likely still tilted to the downside.

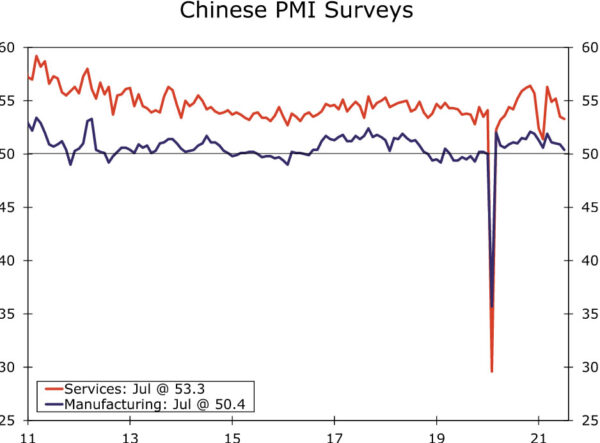

Eurozone CPI • Tuesday

Next week’s August CPI figures for the Eurozone are expected to show some acceleration of inflation. While some of that might reflect some firming in underlying price pressures, base effects are also expected to contribute to faster inflation.

There are some nascent inflation pressures, most clearly reflected in the Eurozone PMI surveys, where the input and output price components are at historically elevated levels. That said, the pass-through to the CPI has been limited so far. For August, the headline CPI is expected to quicken to 2.7% year-over-year, from 2.2% in July. Core CPI inflation is expected to double to 1.4% in August, from 0.7% in July.

However, much of that pickup of inflation stems from price declines, and temporary VAT tax reductions, that took place in Germany in the middle of last year. For example, focusing on the core CPI and adjusting the series for seasonal influences, the consensus forecast of 1.4% for August would equate to an annualized pace of core CPI inflation over the past six months of around just 0.4%. That is, we would not view a spike in August inflation as a harbinger of inflationary pressures to come, and we doubt the European Central Bank would either.

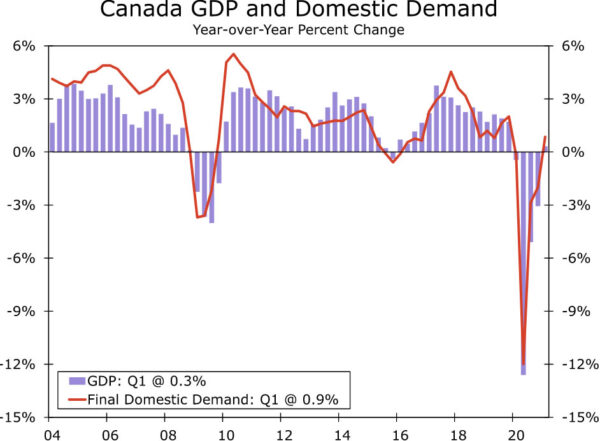

Canada GDP • Tuesday

Canada’s GDP data are released next week and should show slower, but still respectable, growth for the economy in Q2. We forecast Q2 GDP growth of 2.4% quarter-over-quarter annualized, very close to the consensus forecast of 2.5%, but well below the 5.6% growth seen in Q1.

Still, given the renewed spread of COVID cases and associated restrictions, that would still represent a decent pace of growth for the Q2. For example, the early part of the quarter saw significant declines in employment and retail sales, before some recovery in June. As a result, we suspect growth in final domestic demand for Q2 might not be quite as strong as the headline GDP. That said, with the economy proving resilient in the face of COVID restrictions, we expect the Bank of Canada to view the growth slowdown as temporary, and we believe the central bank will continue along the path of less accommodative monetary policy in the months and quarters ahead.

Interest Rate Watch

Powell Keeps an Open Mind to Tapering

The topic of “tapering” by the Federal Reserve has been very much front and center in financial markets in recent weeks. In an effort to provide monetary accommodation to the economy, the Fed has been making monthly purchases that total $80 billion of Treasury securities and $40 billion of mortgage-backed securities (MBS) for more than a year. The minutes of the past two FOMC meetings show that the committee has been discussing the conditions under which the Federal Reserve would pare back (i.e., “taper”) its extraordinary pace of asset purchases, and a number of FOMC members have been saying publicly that the Fed should start to taper soon. So all eyes were on Fed Chairman Powell when he addressed the Jackson Hole Economic Policy Symposium today.

In our view, Chair Powell did not signal that tapering is imminent. He did acknowledge that he was of the view at the July 28 FOMC meeting, as were most of the other committee members, that “if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.” However, the intervening month has brought mixed news. The good news is that employment growth was strong in July. On the other hand, risks to the economic outlook have risen due to the spread of the Delta variant. Powell stressed the benefits of strong levels of employment, and he continued to articulate his view that the sharp increase in inflation this year will be transitory. In short, it does not seem that the Fed Chair has made up his mind yet about when to taper, and he will continue to watch incoming data. The labor market report for August, which is slated for release on Friday, September 3, will be an important marker for the beginning of tapering.

Even when tapering commences, financial conditions will remain accommodative. The Fed will continue to buy Treasury securities and MBS, just at a slower pace. So a sharp backup in long-term interest rates does not seem likely in the foreseeable future, unless economic growth turns out to be stronger and/or inflation comes in higher than most market participants currently expect. Once the Federal Reserve completes its tapering process, focus will then turn to the first rate hikes. In our view, the FOMC will maintain the federal funds rate in its current target range of 0.00% to 0.25% through at least the end of 2022.

Credit Market Insights

Red-Hot CLO Market

This past year has been a banner year for fundraising and deal activity. The low interest rate environment has supported record-breaking deal flow as firms have been able to borrow cheaply to reposition themselves coming out of the pandemic. Booming demand for collateralized loan obligations (CLOs) in particular has been a standout. CLO sales have fully recovered from last year’s trough and are rising at a record clip in the United States, according to S&P Global Market Intelligence. Globally, the market for CLOs recently surpassed $1 trillion.

CLOs are securities typically backed by pools of low-rated corporate loans. With a CLO, the investor gets scheduled debt payments from the underlying loans, assuming most of the risk in the event that borrowers default. In exchange for taking on the default risk, investors are offered the potential for higher-than-average returns. The CLO market is often used as a conduit for large institutional investors to lend to non-investment grade borrowers. Greater CLO issuance typically means more dry powder to support debt financing for private equity buyouts and M&A deals.

CLOs have historically offered a yield premium over other corporate credit instruments of an equivalent rating. That said, the market’s structure and volatility tamed investor interest following the financial crisis. After the crash, many investors steered clear of credit derivative products after having to repay loans on securities for which value had fallen. Over the past few years, however, investors have become more comfortable with CLOs, and issuance has improved. New interest from insurance companies and pension funds have also helped to deepen the market’s institutional buyer base. With many buyouts currently under way, the record pace of CLO formation should support financing in the months ahead.

Topic of the Week

The Economics of College Football: Season III

With the summer winding down and schools reopening to in-person instruction, college football games are rapidly approaching. Each week of the season, we will release one or two reports highlighting a key matchup, covering some of the history behind each university’s football program, local economy and/or school community, and of course, some predictions about the upcoming game.

The biggest changes in college football this year deal with financial issues. After a series of moves by state legislatures and a major Supreme Court decision, the NCAA has changed its rules to allow college athletes to earn money by selling the rights to their name, image and likeness (NIL). The impact is likely to be greatest for athletes at major schools who play in nationally televised games. Schools that are close to major media markets would also appear to have a greater competitive advantage, which may make schools like UCLA and USC more popular destinations for top talent. Major media centers like Atlanta, Miami, Dallas and Nashville would also like to further cement the competitive position for the SEC, while the Big Ten should have plenty of access to the media in Chicago.

Securing a steady stream of big games and TV deals is believed to be the driving force behind the other major off-season changes, including the move by the University of Texas and the University of Oklahoma out of the Big 12 and into the SEC. Texas and Oklahoma are not scheduled to move until after the 2024 season, which is when the Big 12’s current television contact runs out. The prospect of even more must-see SEC college football games has raised concerns about the SEC’s growing clout. An alliance between the Big Ten, Pac-12 and ACC was announced this past week. Few details are available so far, but the agreement appears to be an attempt to gain some leverage in negotiating television deals and might also result in some marquee inter-conference matchups.

While one of the purposes behind the recent alliance between the ACC, Big Ten and Pac-12 is to eliminate any poaching of each other’s teams, we doubt we have seen the end of conference realignment. The growing importance of media rights, which account for 30% of Division 1 football program revenues, will likely drive more up-and-coming programs to seek membership in one of the Power Five conferences. Schools from rapidly growing markets will be of particular interest and conferences will likely be interested in broadening their geographic reach to include large new media markets where it makes sense. This would make more conference games attractive to the major networks.

We have an aggressive schedule of games that we plan to feature in our weekly college football economic outlook series. The reports are a fun way to discuss state and local economies and provide some perspective of college football. The start of this year’s college football season is being met with a bit more trepidation than most. College football is unique, because most teams can only afford one slip up, at most, if they hope to compete for the national title. This makes almost every game a big game for most teams. COVID also continues to hang over the sport. Will fans return to stadiums in full force? We will find out soon, as the season begins this Saturday and a full slate of games is scheduled for the extended Labor Day weekend, beginning on Thursday, September 2.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals