Week Ahead: US Debt Ceiling, Evergrande, and An Impending Energy Shortage

There was a barrage of central bank meetings last week, with the FOMC and the BOE having the most market impact. Watch for the volatility to continue this week. In addition, there will be plenty of storylines to follow, including...

Week Ahead – Risks Haven’t Gone Away

Are investors getting complacent? The next few months are going to be extremely interesting in the markets, with central banks becoming less comfortable with the level of stimulus they’re providing, economic recoveries slowing and market risks mounting. Evergrande has come...

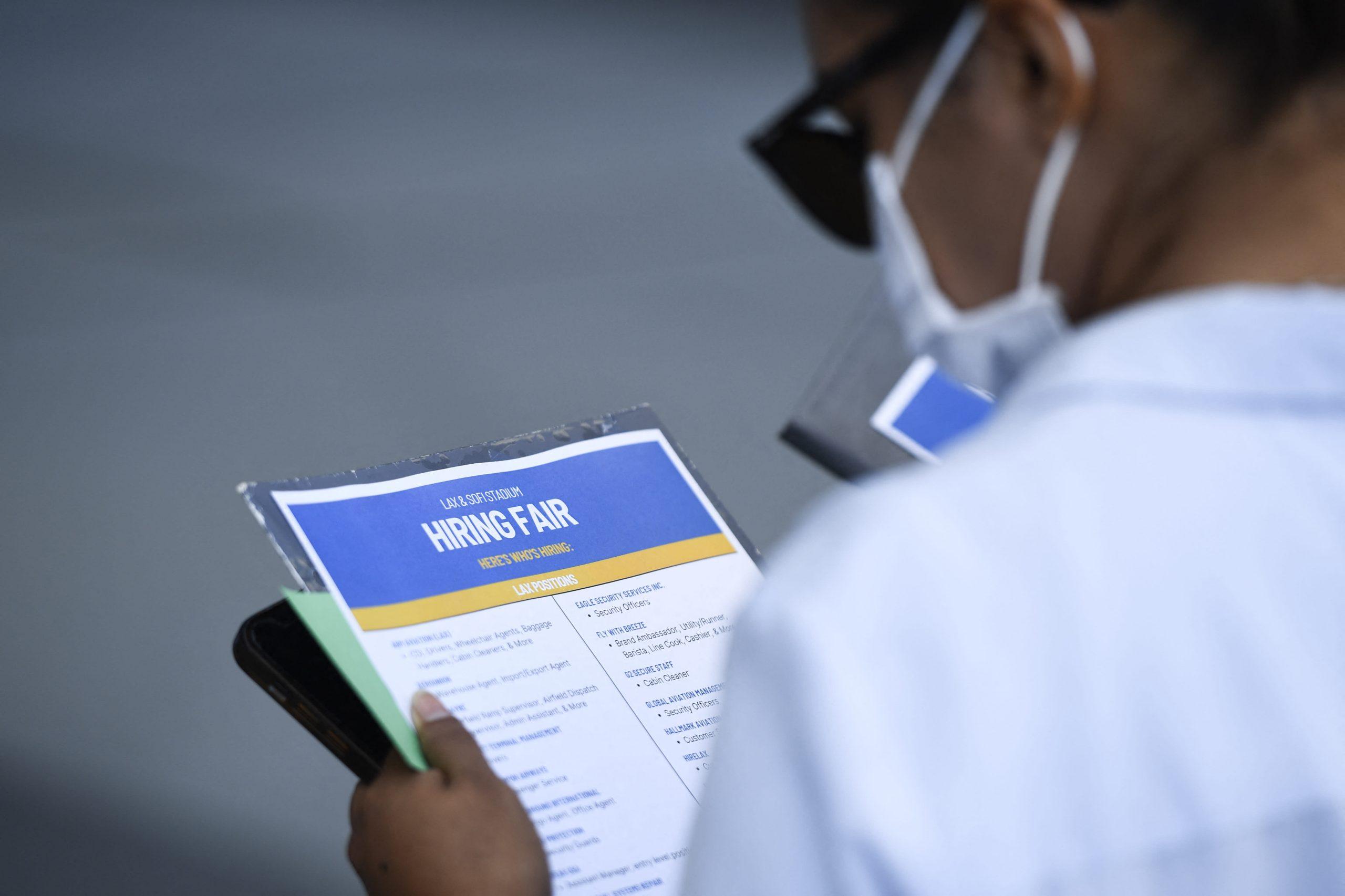

Evidence still missing that end of extra unemployment pushed people back to work

A person reads a list of employers as they attend a job fair at SoFi Stadium on Sept. 9, 2021, in Inglewood, California. PATRICK T. FALLON | AFP | Getty Images There remains little evidence that states successfully nudged people...

Costco, Nike and FedEx are warning there’s more inflation set to hit consumers as holidays approach

A worker wearing a protective mask removes rotisserie chicken from skewers inside a Costco store in San Francisco, California, on Wednesday, March 3, 2021. David Paul Morris | Bloomberg | Getty Images Shipping bottlenecks that have led to rising freight...

Energy Crisis: Oil Surge Causes Petrol Panic at Pump

Oil’s continued increase has combined with supply issues caused by the HGV driver shortage to fuel petrol spikes and stoke winter energy crisis fears. Here’s the latest, as well as a technical look at Brent. Energy crisis concerns are escalating...

Forward Guidance: Spending on Services to Support Growth Despite Supply Chain Challenges

All eyes will be on Canada’s GDP report next week—and more specifically, its ‘official’ July estimate. A preliminary report in August called for a surprising 0.4% decline in GDP in July, despite an easing of COVID restrictions in provincial economies....

NZDUSD Positive Impetus Fades as 100-MA Deters Gains

NZDUSD has dipped back down to the 200-period simple moving average (SMA) after the pair’s recent bounce around the 0.6986 level was capped by the 100-period SMA. The horizontal 100- and 200-period SMAs are promoting an overall trendless bias, while...

Oil Price Outlook: A Major Bullish Trend Line Forming with Support Mear $72.50

Crude oil price started a fresh increase above the $70.00 resistance against the US Dollar. The price remained well bid and it even surpassed the $71.50 level. There was a close above the $73.00 level and the 50 hourly simple...

Gold Bulls Need To Hold 1750

Gold bulls need to hold the 1750 level. If the price breaks higher, we should see a momentum up. It’s a very hard time for bulls. Gold went strongly down and the price is congesting around 1755. We should see a move...

NZD/JPY Bounces Off Support

The NZD/JPY currency pair bounced off the lower boundary of an ascending channel pattern at 76.35 on September 21. As a result, the New Zealand Dollar has surged by 173 pips or 2.26% against the Japanese Yen since this week’s...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals