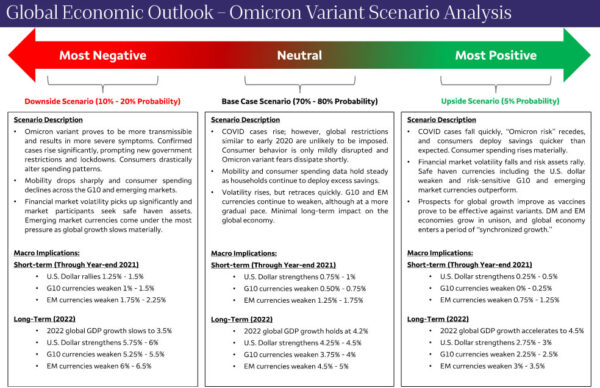

Omicron Introduces New Risks For Global Economy

Summary The recently detected Omicron COVID variant has injected new risks into the global economy. In this report, we lay out our base case scenario for the global economy and currency markets amid the early onset of Omicron cases. We...

Canadian Economy Rebounds in the Third Quarter

Real GDP rose by 5.4% (annualized) in the third quarter, above the consensus call for 3.3%. This left economic output 1.4% below its pre-pandemic (2019-Q4) level. In nominal terms, GDP increased by 8.9% in the third quarter. Statistics Canada also...

Here’s why unemployment claims hit their lowest level since 1969

Recruiters speak with potential applicants during a job fair in Leesburg, Virginia, on Oct. 21, 2021. ANDREW CABALLERO-REYNOLDS | AFP | Getty Images Claims for unemployment benefits dipped to their lowest point in more than 50 years the week before...

Risk Selloff Resumes on Omicron, Dollar Vulnerable Against Euro and Yen

Selloff in stock markets resume today, after Moderna Chief Executive Stéphane Bancel foresaw “material drop” in effectiveness of current vaccines on Omicron. Benchmark treasury yields also tumble sharply on safe haven flows. In the currency markets, Canadian Dollar lead commodity...

Ray Dalio says cash is not a safe place right now despite heightened market volatility

Bridgewater Associates’ Ray Dalio stood by his belief that cash is not the place to be despite the volatility in the markets triggered by the new omicron Covid variant. “Cash is not a safe investment, is not a safe place...

US 500 Extends Decline From All-Time High As Bullish Forces Wane

The US 500 stock index (cash) keeps trending upwards in the long term picture, creating a profound structure of higher highs and higher lows. However, in the four-hour chart, the index has been giving up ground since its rally halted...

US Dollar Index: Weekly Shooting Star And Bull-Trap Generate Initial Reversal Signal

The dollar index is holding in red for the third straight day and extending pullback from new multi-month high at 96.92. Bears gained control after the news that new variant of coronavirus was detected last Friday, with narrower range on...

Rolling back U.S.-China tariffs would ease inflation in the U.S., former Treasury secretary says

Eliminating tariffs imposed on goods during the worst of the trade war would help ease inflation in the U.S., former Treasury Secretary Jacob Lew told CNBC on Tuesday. But there’s currently “no political space” to do so, he said on...

Elliott Wave View: Five Swing Sequence In NZD/USD Favors Downside

NZDUSD broke below August 20, 2021 low (0.6805) and now shows a 5 swing sequence from February 25, 2021 high favoring more downside. A 5 swing sequence is an incomplete sequence and needs another leg lower to end 7 swing....

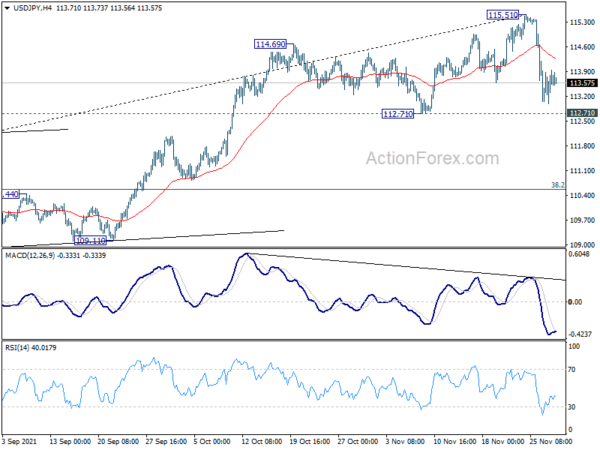

Dollar and Yen Stay in Consolidation, Awaiting Next Move

Overall market sentiment is stable, with major Asian indexes mixed, following the recovery in US stocks overnight. Yen and Dollar soften slightly after turning into consolidations, but Swiss Franc is still strong. Commodity currencies are mixed with no follow through...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals