U.S. Highlights

- October retail sales rose a better-than-expected 1.7% on the month. Sales in volatile categories were up robustly, but sales in the control group also rose a strong 1.6%. Leading the charge on this front was a 4% gain in non-store sales.

- Housing starts fell 0.7% in October as starts in the larger single-family segment declined for the fourth straight month. Improved homebuilder sentiment in recent months indicates that this sector too may soon turn a positive corner.

- President Biden signing the Infrastructure Investment and Jobs Act (IIJA) into law. The legislation will channel $550 billion in new spending on transportation and other critical infrastructure over the next several years. In addition, the larger Build Back Better (BBB) social spending and climate bill cleared the House and is headed for the Senate.

Canadian Highlights

- CPI inflation took another leg up in October (to 4.7% year/year). Energy continued to act as a major tailwind, but the release showed broad-based price pressures across different spending categories. Meanwhile, retail sales fell 0.6% in September. However, Statistics Canada’s advance estimate pointed to a 1% rebound in October.

- This week’s packed calendar was complemented with communication from Bank of Canada officials. For instance, in a written article, Governor Macklem highlighted the central bank’s continued flexible approach and willingness to adjust policy to changing economic data.

U.S. – Infections Trend Up as Holidays Approach

Last week’s hot inflation report raised plenty of eyebrows, but this third week of November was more balanced on the data front. Retail sales rose a better-than-expected 1.7% month-to-month (m/m) in October. Sales in volatile categories – gas stations (+3.9%), building materials (2.8%), and autos (1.8%) – were up robustly. Receipts at bars at restaurants, meanwhile, were flat on the month. Sales in the remaining subsectors, known as the ‘control group’, did not disappoint, rising a healthy 1.6%. While most categories recorded an improvement, non-store retailers (a good proxy for online sales) led the charge, up 4%.

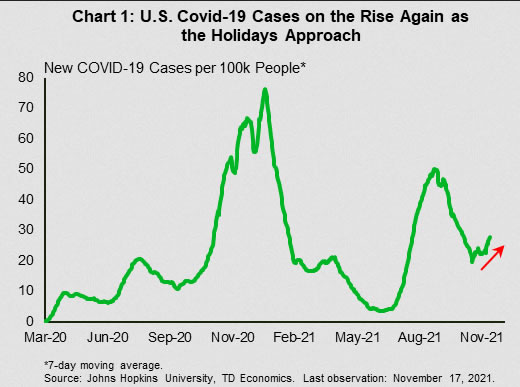

The healthy gain in the control group together with the October increase in auto sales points to a healthy start to goods spending in the fourth quarter. Scratching beneath the surface, however, reveals a more nuanced backdrop. The sales gain appears to reflect some pull-forward in activity from the busy holiday season. Consumers have been consistently warned about supply chain issues and possible shortages and many appear to have got an early start to their holiday shopping as a result. A recent survey showed that roughly half of holiday shoppers planned to start shopping before November. The strength in non-store retail sales, a very popular holiday shopping channel, adds credence to this view. While overall spending should remain healthy, it may slow closer to end of the year, reflecting this pull forward. The rise in new COVID-19 infections is an added risk to consumption growth, given that it could further delay the expected rotation in spending toward services (Chart 1).

Tilting to the housing market, homebuilding activity continued to lose steam in October, with starts down 0.7% on the month. Given the myriad of hurdles faced by builders, such as supply-chain disruptions, higher material costs and a shortage of workers and serviceable lots, it should be no surprise that homebuilding has eased a bit in recent months. Starts in the larger single-family segment have been the main contributor to recent downward trend. A steady recent improvement in homebuilder confidence indicates that this sector should turn a positive corner in the near-term (Chart 2). While the upcoming removal of monetary stimulus will pose a hurdle to housing demand in the quarters ahead as it weighs on already-stretched affordability, homebuilding activity is likely to remain well-supported given exceptionally low housing inventory.

The other big developments this week were on the political front, as President Biden signing the Infrastructure Investment and Jobs Act (IIJA) into law. The legislation will channel $550 billion in new spending on transportation and other critical infrastructure. This type of spending tends to carry high economic multipliers, resulting in a larger economic impact than the initial dollar amount spent. And, by raising the stock of productive capital, it may even raise the potential growth rate of the American economy. Still, given that the investments are spread out over several years and that such projects take time to be rolled out, the boost to the economy is likely to be modest and will take time to trickle in. In contrast, the larger $2 trillion social spending and climate bill, which passed the House late in the week, would provide a more noticeable near-term boost to growth in 2022. This package, however, faces a divided Senate and is still far from a done deal.

Canada – Bank of Canada Reiterates Flexible Approach

Canada’s economic recovery has been choppy in recent months, but as we peer ahead to 2022, above-trend growth is still in the cards. In large part, this expectation is predicated on a continued strong bounce-back in consumer spending, buoyed further by an improving labour market backdrop and a sizeable buildup of excess savings. But this view is not without its downside risks, and key amongst these is the acceleration in consumer price inflation since the early summer.

October inflation was the highlight data release (Chart 1) this week. Price growth took another leg up, rising 4.7% year-over-year. Unsurprisingly, energy continued to provide a key tailwind, up a notable 25.5% on the year. But price pressures were seen elsewhere, including a pick-up in spending categories that had previously been witnessing subdued price growth (i.e. clothing). At the same time, inflation in shelter (4.8%) and food (3.9%), the two categories with the largest basket weights, remained elevated and were little changed from the prior month. Monthly momentum, while declining from the prior month, was still high (+0.5% m/m). By all measures, inflation in Canada continues to run hot.

Turning to consumer spending, Friday’s retail sales release revealed a 0.6% decline in September, made worse by a larger volumes drop (-1.1%). Motor vehicles (-1.6%) were a major contributor to the overall weakness. Activity in this category has been dragged down by lingering supply chain disruptions. Still, the report was unambiguously subdued, with declines extending to seven of the 11 industries. The silver lining, however, is that Statistics Canada’s flash estimate called for a healthy rebound in October (+1%, Chart 2).

The potential interplay between inflation and consumer spending will be among the key themes to watch for in 2022. If price pressures continue to accelerate, economic growth could suffer due to an erosion of real wages and consumer purchasing power. Uncertainty remains elevated, especially on the supply side of the economy, suggesting that these risks should not be downplayed. In our base case, we expect inflation to gradually cool through 2022. But, continuing labour market gains and a gradual drawdown on households’ extra savings support strong consumption growth for the year. The Bank of Canada outlined a similar narrative in its October Monetary Policy Report. However, recognizing the risks posed by inflation, the central bank was among the first to bring forward its interest rate hike guidance and end its quantitative easing program. Still, the Bank understands the elevated uncertainty that surrounds the outlook. The Bank of Canada’s Governor Tiff Macklem, in an article this week, highlighted the uncertainty presented by the unusual shock to the economy, and in turn, the central bank’s readiness to change its position should data evolve contrary to expectations.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals