US stocks are set for a mixed start with the Nasdaq underperforming following Fed Chair Powell’s re-nomination yesterday. PMIs are due next.

US futures

- Dow futures +0.06% at 35648

- S&P futures -0.04% at 4681

- Nasdaq futures -0.21% at 16348

In Europe

- FTSE -0.06% at 7260

- Dax -0.73% at 16017

- Euro Stoxx -0.5% at 4315

Rotation out of high growth tech after Powell re-nomination

US stocks are set for a mixed open on Tuesday with the Nasdaq underperforming its major peers following the re-nomination of Fed Chair Powell for another 4 years at the head of the US central bank.

News of the announcement yesterday sent bond yields higher on expectations that Powell and the Fed could adopt a more aggressive approach to tightening monetary policy, with possibly 2 interest rate hikes next year.

Whilst such a move is supportive of cyclical stocks, high growth stocks which are particularly sensitive to higher interest rates plummeted lower. The Nasdaq closed yesterday -1.2% lower whilst the Dow Jones, which is more closely associated to cyclicals closed on higher ground.

The rotation out of high growth and into cyclicals is seeing some follow through today.

Attention is now turning towards US PMI data which is due shortly. Expectations are for business activity in November to tick higher to 59 for both the manufacturing and services sector. If European data is anything to go by then expect some upbeat numbers. A strong reading could add to speculation of a more hawkish Fed, lifting the USD whilst hurting the high growth Nasdaq.

Stocks in focus

In corporate Zoom is under the microscope whilst falling over 9% pre-market. The video-conference platform provider added fewer large clients and saw revenue growth slow to 35% in Q3, down from 360% this time last year as people returned to work in offices.

Where next for the Nasdaq?

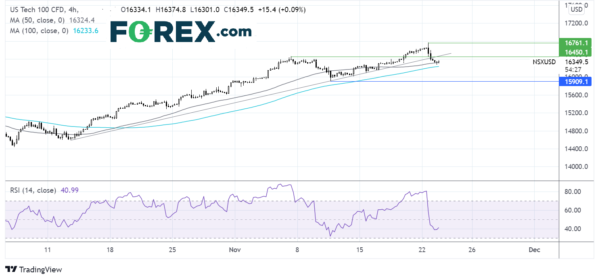

After reaching an all time high of 16768 yesterday the Nasdaq was then slammed lower. The price broke below support at 16450 negating the near-term uptrend and broke below the month old rising trendline. The price is currently testing the 50 sma on the 4 hour chart at 16325. The RSI is bearish territory supportive of further downside. A move below the 50 sma is needed to expose the 100 sma at 16220. A move below 15900 would see the bias change to bearish. Should the 50 sma hold buyers will look to regain 16450 for a chance to target the all-time high.

FX – USD extends gains, EUR rises from 20-month low

The USD is edging higher, building on yesterday’s gains following the re-nomination of Fed Chair Powell and a potentially more hawkish Powell as the recovery gathers speed.

EUR/USD is rebounding off a 20-month low after better-than-expected PMI data. The Eurozone composite PMI unexpectedly rose in November to 55.8, up from 54.2 and ahead of the 35.1 forecast. The data suggests that the Eurozone still saw decent growth in November despite rising headwinds. Price pressures have continued to mount in the survey which is prompting bets that the ECB could move to start tapering bond purchases soon.

- GBP/USD -0.37% at 1.3350

- EUR/USD -0.02% at 1.1236

Oil extends declines on supply & demand concerns

Oil prices are heading lower after the US announced that it will release 50 million barrels of oil from its emergency reserves over the coming months in a bid to cool market prices. The move comes after OPEC shrugged off repeated requests by global leaders to increase output amid surging demand. President Biden had seen his popularity slip as petrol prices increased.

The question now is how will OPEC respond? The oil cartel has said that they are concerned of an oil glut next year and have already downgraded their demand outlook for Q4. Could OPEC consider reining in supply in light of Biden’s actions? For that we will need to wait until the next OPEC meeting at the start of December.

For now, API inventory data will be in focus.

- WTI crude trades -0.3% at $76.40

- Brent trades -0.1% at $79.01

Looking ahead

- 14:45 Manufacturing & services sector PMIs

- 21:30 API crude oil inventories

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals