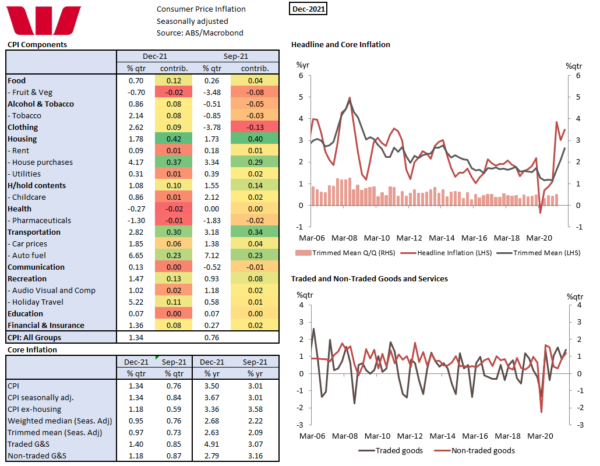

Headline CPI 1.3%qtr/3.5%yr; trimmed mean 0.97%qtr/2.6%yr, weighted median 0.95%qtr/2.7%yr. Core inflation is now above the mid-point of the RBA’s inflation target, not something the RBA was expecting in its forecast profile this early nor of this magnitude.

Headline inflation came in stronger than expected at 1.3% exceeding the top of the range forecast at 1.2%. Westpac and the market were forecasting 1.1%. At two decimal places it was 1.34% % so a solid 1.3%. The annual pace lifted from 3.0% to 3.5% not too far off the June 2021 12yr high of 3.8%.

As we noted in the June CPI update, the acceleration to almost 4%yr was due to base effects of the negative prints in 2020 due to government grants and subsidies. As such, this was expected to be a transitory blip in inflation. This time the ending of the HomeBuilder grants are part, but not all, of the inflation story.

The big surprise was the 1.0% rise in the trimmed mean, well exceeding the market expectation of 0.7%, highlighting the broad spread of this inflation surprise. The 1.0% was the largest quarterly rise in the trimmed mean since 1.2% in September 2008 taking the annual pace to 2.6%yr, the fastest pace of core inflation since June 2014. At two decimal places the trimmed mean rose 0.97%; for note the weighted median gained 0.9% for 2.7%yr.

The ABS reports that most significant price rises were for new dwelling purchase by owner-occupiers (4.2% vs 4.8% forecast) and automotive fuel (6.6% vs 6.7% forecast) and domestic holidays (4.8% vs 5.1% forecast).

The ABS noted that high levels of building construction activity combined with shortages of materials and labour contributed to two consecutive quarters of the largest rise in new dwelling prices since the introduction of the GST in September 2020. As we noted in our preview, fewer payments of HomeBuilder grants compared to the previous quarter also contributed to the rise. These grants have the effect of reducing out of pocket expenses for new dwellings being purchased.

The strong rise in auto fuel was due to post lockdown surge in global demand and constrained supplies while domestic holiday travel & accommodation prices lifted as border closures eased leading to increased demand for domestic air travel and accommodation.

In our preview we argued there was a high degree of uncertainty about how the Black Friday and Boxing Day sales would unfold this year. Black Friday Sales are growing in their significance for Australian retailers but the December quarter was when the economy reopened in NSW and Victoria and retail sales surged as a result. As such there were solid gains in clothing & footwear (2.6% vs 0.1% forecast), household contents & services (1.1% vs flat forecast) and audio visual & computing (1.0% vs 0.3% forecast).

The ABS is also now publishing a wider series of analytical indexes to help understand the drivers of inflation. The ABS noted that the rise in automotive fuel and new dwelling prices were the main contributors to goods inflation. As noted earlier there were also increased across a broad range of other goods with strong demand and supply disruptions leading to price rises for goods such as furniture and motor vehicles. Goods inflation is running at a 4.3%yr pace, services at a 2.3%yr pace. There is the exact reverse of the trend we have seen for the past few decades.

The ABS also noted that non-discretionary inflation (4.5%yr) is higher than the CPI (3.5%) and more than twice the rate of discretionary inflation (1.9%yr). Non-discretionary inflation includes goods and services that households are less likely to reduce their consumption of, such as food, automotive fuel, housing and health costs.

We will process all this data and review of near-term CPI forecasts based on this new information. While we don’t know what the overall impact will be it is clear that at 3.5%yr the current pace of inflation is running ahead of where we thought it would be at the end of 2021 (3.2%yr for headline, 2.4%yr for the trimmed mean) pointing to upside risk to our June 2022 forecasts of 3.3%yr of the CPI, 2.9%yr for the trimmed mean.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals