U.S. Highlights

- It was another volatile week across global financial markets as the recent surge in commodity prices stoked fears of an inflationary spiral. Sentiment improved through the latter half of the week, allowing global equities to pare losses.

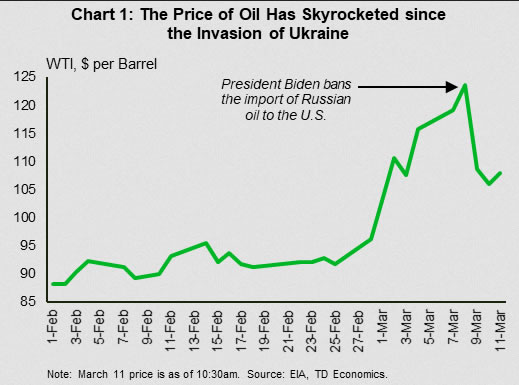

- Oil remained a focal point, with WTI briefly touching $128 per-barrel on Tuesday following President Biden’s announcement to ban the import of Russian oil. Gains were later reversed on the hopes of increased OPEC production.

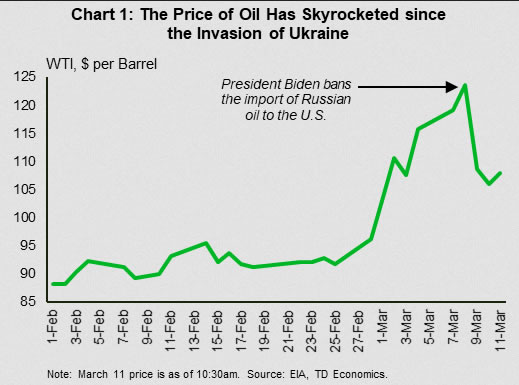

- February CPI data showed a further acceleration in consumer prices, with both headline (+7.9% y/y/) and core (+6.4% y/y) inflation rising to new 40-year highs. With price pressures likely to continue to mount over the coming months, the FOMC is certain to raise rates next week.

Canadian Highlights

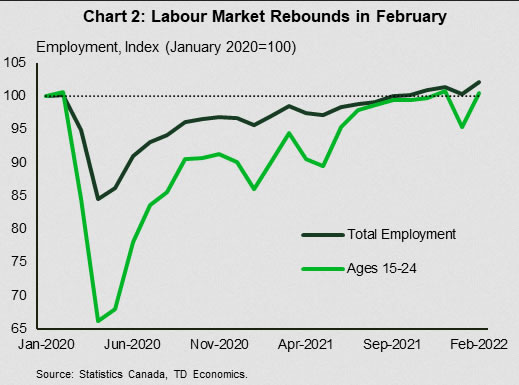

- Easing public health restrictions led to a strong rebound in hiring in February. The labour market added 336k jobs, pushing the employment rate down 1 percentage point to 5.5%.

- The Russia-Ukraine war continued to reverberate through financial markets this week. The economic fallout from the conflict is being felt far outside its borders via surging prices of oil and other commodities.

- Next week’s CPI report is expected to show another leg up in consumer prices in February.

U.S. – Looking Through the Turmoil, Ready for Lift-off

Despite Fed officials entering a ‘quiet week’ ahead of next Thursday’s FOMC meeting, it was anything but across global financial markets. New economic sanctions and fears of a prolonged Ukraine-Russia conflict have pushed commodity prices significantly higher in recent weeks, stoking fears of an inflationary spiral that could trigger a recession across Europe. The risk-off sentiment abated through the latter half of this week, allowing global equites to pare losses. At the time of writing, the S&P 500 was still lower by about 1.5%. Yields rose through much of the week, as intensifying price pressures pushed the US 10-year higher by 25 basis points to just over 2%.

Across the commodity space, oil remained a focal point. On Tuesday, both WTI and Brent briefly touched levels not seen since 2008, hitting $128 and $133 per-barrel, respectively. The sharp gains followed President Biden’s announcement that the U.S. will immediately ban imports of Russian oil. The UK made a similar commitment, agreeing to phase-out imports of Russian oil by year-end. Gains, however, were reversed from their intraweek highs on hopes that OPEC members would boost production to help make up for some of the shortfall. At the time of writing, WTI is currently down 7% on the week, trading at $108 per-barrel (Chart 1).

Inflation also remained a key theme for the week, as Thursday’s release of February CPI data showed a further acceleration in consumer prices. Headline CPI rose 0.8% month-on-month (m/m), which drove the year-on-year measure to 7.9% (Chart 2). Core inflation was up a softer 0.5% m/m – a slight deceleration from January – though still enough to push the annual reading to a new 40-year high of 6.4%. Higher fuel prices (6.4% m/m), food (1.0% m/m) and shelter costs (0.5% m/m) were the biggest contributors to February’s price gain. Also noteworthy was the modest cooling in used vehicle prices (-0.2% m/m), which came after four consecutive months of strong gains. New vehicle prices were still higher in February, though even here we have seen a meaningful deceleration in price growth in recent months, suggesting consumer’s may be nearing a ceiling of what they’re willing to spend for a new vehicle.

Unfortunately, inflationary pressures are likely to continue to move higher over the coming months, as the recent surge in commodity prices will continue to filter through to higher prices both at the pump and grocery stores. Even if gasoline prices hung at today’s level of $4.32 per-gallon for the rest of the month, that alone would lift headline CPI for March by an additional 0.9 percentage points.

The pinch on consumer’s wallets could lead to slightly weaker discretionary spending over the near-term, but this is unlikely to dissuade Fed officials from raising rates at next week’s meeting. Inflationary pressures are running too hot, and the labor market has become as tight as it has ever been. Failing to move on rates runs the risk of the Fed falling even further behind the curve, which would erode its credibility and jeopardize the economic recovery. Expect the FOMC to acknowledge the recent tightening in financial market conditions, but maintain its hawkish tone, setting the stage for what will be a series of rate hikes over the remainder of the year.

Canada – Labour Market Resilience Clears the Path for Further Rate Hikes

The impact of the war in Ukraine and the subsequent sanctions on Russia continued to reverberate through financial markets this week, with equities and commodities feeling the biggest impact. The already-high crude prices shot up even further this week, briefly hitting $128 per barrel on Tuesday following the announcement of the U.S. ban on Russian crude and oil products. While oil prices eased through the latter half of the week, it would appear that oil prices will remain above the $100 mark for a second week in a row. Equity markets remained volatile but the S&P/TSX ultimately ended the week slightly higher supported by energy stocks.

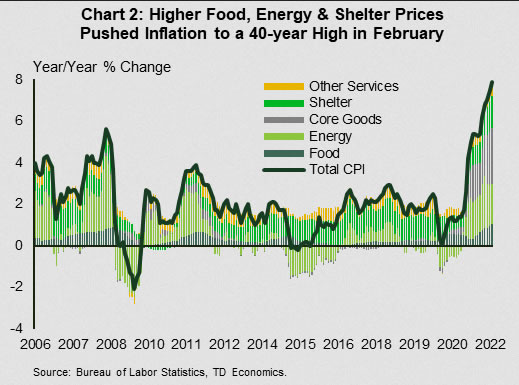

The economic fallout from the conflict will be felt far away from its borders, exacerbating current inflationary pressures and putting additional strain on supply chains. Consumers in Canada and around the world will feel the pinch of higher gas prices at the pump, which in Canada were already up 32% in January from the year prior. But the ball will not stop there, as businesses are expected to pass higher energy costs to consumers. It is also notable that the Canadian dollar has so far not benefitted that much from soaring oil prices (Chart 1). While this will be helpful for exports, it could lead to an even greater increase in prices via higher cost of imported goods.

High inflation is not the only headwind confronting households this year. With the Bank of Canada on a mission to bring inflation lower, interest rates will also rise and debt servicing costs will follow suit. The Bank set that process in motion last week, increasing the overnight rate by 25 basis points. It is not going to stop there despite the heightened geopolitical risks and is expected to deliver four additional quarter point hikes this year.

On the upside, households are facing those headwinds at the time when the labour market is tight and job vacancies are plentiful. This bodes well for job seekers as well as workers looking to boost their income. Rising employment and wages will partially mitigate the impact of higher prices and debt servicing costs. Indeed, the Canadian labour market rebounded with fervor in February, gaining 337k positions and more than offsetting January’s loss of 200k (Chart 2). The unemployment rate dropped by one percentage point to 5.5%, below the level from February 2020. Last but not least, wage growth also accelerated to 3.1% (year-over-year) up noticeably from 2.4% in January.

The incredible resiliency of the Canadian labour market sets up the Bank of Canada to continue raising rates at its upcoming meetings. Bond markets have moved in tandem to reflect this, with yields rising significantly over the last few trading sessions. With inflation as a main concern for the Bank, the path to higher rates has been cleared.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals