Dollar Tumbles Broadly as CPI Matched Expectations, Risk Cleared

Dollar tumbles broadly in early US session even though consumer inflation data hit multi-decade highs. The move could be seen as a result of clearing the risk of even worse inflation reading that could force Fed’s hand. For now, Canadian...

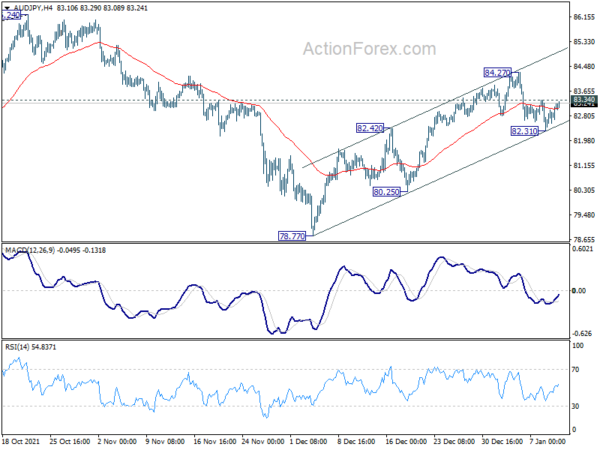

JPY Lower as Risk-On Sentiment Returns, CAD Follows Oil Up

Overall, Fed Chair Jerome Powell’s renomination hearings seemed to be well received by the markets. US stocks closed broadly higher overnight, followed by rallies in Asian indexes. Yen and Dollar are both under some selling pressure today. On the other...

Empty grocery shelves return as sick employees, supply chain delays collide

Bread aisle shelves at a Target are seen nearly empty as the U.S. continues to experience supply chain disruptions in Washington, U.S., January 9, 2022. Sarah Silbiger | Reuters Empty shelves have returned at supermarkets as grocery employees call out...

Fed Chair Powell says rate hikes, tighter policy will be needed to control inflation

U.S. Federal Reserve Board Chairman Jerome Powell speaks during his re-nominations hearing of the Senate Banking, Housing and Urban Affairs Committee on Capitol Hill, in Washington, U.S., January 11, 2022. Graeme Jennings | Reuters Federal Reserve Chairman Jerome Powell, with...

Watch Fed Chair Jerome Powell testify live at his Senate confirmation hearing

[The stream is slated to start at 10 a.m. ET. Please refresh the page if you do not see a player above at that time.] Federal Reserve Chairman Jerome Powell testifies Tuesday before the Senate Banking Committee as part of...

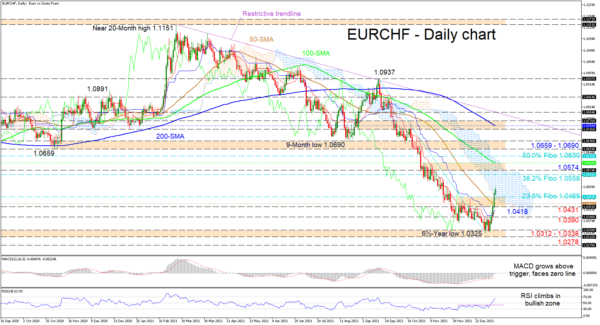

EURCHF Recoups Lost Ground as Bullish Tone Bolsters

EURCHF buyers have dominated ever since touching a 6½-year low of 1.0325, plotting four consecutive green candles, which has steered the price above the 50-day SMA of 1.0442 and the 1.0469 level, which is the 23.6% Fibonacci retracement of the...

Will Oil Drop to $60 or Rise to $100 in 2022?

Predicting oil prices is a difficult job at the best of times. Still, it is increasingly difficult as COVID-19 and its variants continue to suspend consumers’ plans and disrupt the balance between oil demand and supply. In addition, governments are...

Fed Vice Chair Clarida to step down early following scrutiny over his trades during pandemic

Federal Reserve Vice Chairman Richard Clarida said Monday he will be leaving his post with just a few weeks left on his term and amid revelations regarding his trading of stock funds. In an announcement released Monday afternoon, Clarida said...

Jamie Dimon sees the best economic growth in decades, more than 4 Fed rate hikes this year

Jamie Dimon said the U.S. is headed for the best economic growth in decades. “We’re going to have the best growth we’ve ever had this year, I think since maybe sometime after the Great Depression,” Dimon told CNBC’s Bertha Coombs...

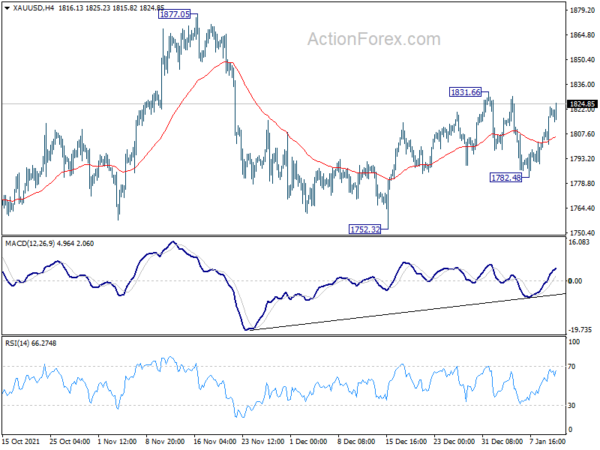

Gold Analysis: Recovers to Trade above 1,800.00

At mid-day on Monday, the price for gold broke the resistance of the 1,800.00 mark and shortly traded above this level. However, the surge was stopped and reversed by the 100-hour simple moving average at 1,802.65. If the price for...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals