Jackson Hole Clues to Direct Market Moves

Markets have clearly been anxious in the lead up to Jackson Hole, as investors and traders await the next policy clues out of Fed Chair Powell later this week. The declines in equities and bonds of late suggest that Powell...

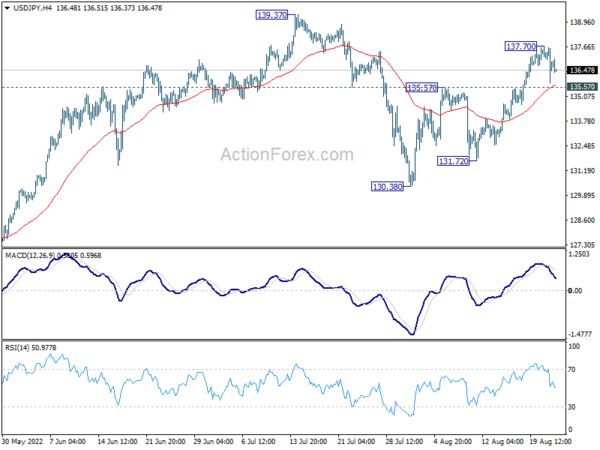

Dollar Rally Halted, Yen Picking Up Momentum

Dollar’s rally was choked off by terrible PMI data, in particular services, overnight. But the greenback is trying to regain some footing in Asian session. It’s too early to say that the bullish trend in Dollar has reversed. Traders are...

Stocks making the biggest moves midday: Twitter, Zoom, Palo Alto Networks, Macy’s and more

Source: Nasdaq Check out the companies making headlines in midday trading Tuesday. Zoom Video — Zoom sank 16.5% after missing on revenue estimates for the previous quarter due to a strong dollar. The videoconferencing company also cut its forecast for...

European and US PMIs weaker; EUR/USD remains near parity

With the Jackson Hole Symposium this Thursday and Friday and the Fed stating that it is “data dependent”, the US data matters more at this point. PMIs out of Europe and the US are causing EUR/USD to remain near parity...

GBP/USD: Bears May Pause at 2022 Low on Oversold Conditions

Cable is trading near new multi-month low (1.1717) posted today, keeping firm bearish stance, additionally boosted by terrible UK manufacturing PMI data for August that add to fears the economy is sliding into recession. Bears probed below 2022 low (1.1760)...

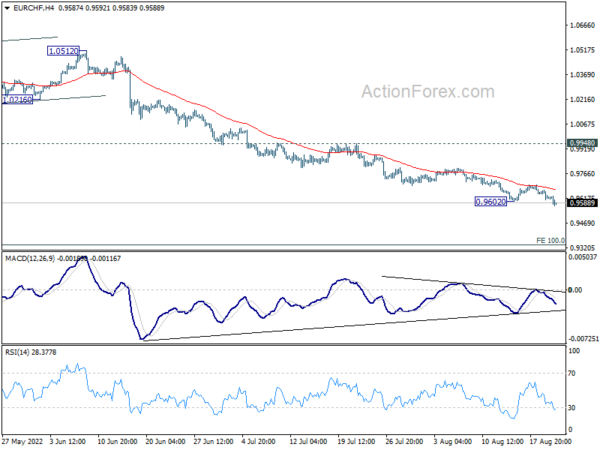

Euro Selloff Continues after Poor PMIs

Euro’s selloff continues today after poor PMI data and stays as the worst performer for the week. Swiss Franc is also weak for now, together with Sterling. Dollar remains the strongest one, but struggle to extend gains against commodity currencies....

Currency Pair of the Week: USD/CNH

With troubling economic data out of China leading to rate cuts, along with an expected hawkish speech from Fed Chairman Powell on Friday at the Jackson Hole Symposium, USD/CNH could be volatile this week. The US Dollar surged last week...

How will Jackson Hole Meeting Affect Markets?

What will happen? Federal Reserve Chair Jerome Powell will give a speech during the Jackson Hole Symposium on August 26 at 18:00 GMT+3. Analysts expect to hear statements about the future of interest rates and get hints regarding quantitative tightening...

Is GBPCAD Headed for the 2010 Low?

GBPCAD has been drifting south since August 2, when it hit resistance near 1.5760. That said, it has yet to clearly overcome the key support of 1.5350, a move which would not only confirm a forthcoming lower low, but also...

EUR/USD Playing with Parity, Risk-Off Intensifies

Risk off sentiment appears to be intensifying today. Selloff in particularly serious in German DAX, while FTSE and CAC are also down. US futures are also pointing to a lower open while 10-year yield is pressing 3% handle. In the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals