EURUSD Survives Above 1.1300, Neutral Phase

EURUSD is retreating from the 23.6% Fibonacci retracement level of the downward wave from 1.1908 to 1.1185 at 1.1355. The price is currently testing the Ichimoku cloud and is moving towards the flat 40- and 20-period simple moving averages (SMAs)....

GBP/USD – Divergences Remain

Time for a correction? The pound has continued to push lower in recent days but continues to lack momentum, which could point to further weakness in the sell-off. The most recent low came on reduced momentum again which suggests a...

The ‘Great Resignation’ slowed down in October, while job openings jumped

A help wanted sign is posted in the window of hardware store on September 16, 2021 in San Francisco, California. Justin Sullivan | Getty Images The so-called Great Resignation lost some steam in October, with the total number of workers...

AUD/USD Outlook: Bulls Are Taking A Breather After Strong Three-Day Advance

The Australian dollar is consolidating under new two-week high, hit after nearly 2.5% advance in past three days, sparked by decision of China’s central bank to cut the amount of cash that banks must hold in reserve, as the Aussie...

Consolidation Underway

The US indices gained on Wednesday, but the gains were more contained compared to the prior sessions, as the European indices posted losses. The S&P500 added 0.30% and the Dow was up 0.10%. Nasdaq led gains thanks to the rally...

Aussie Rises Further as Risk-On Sentiment Continues

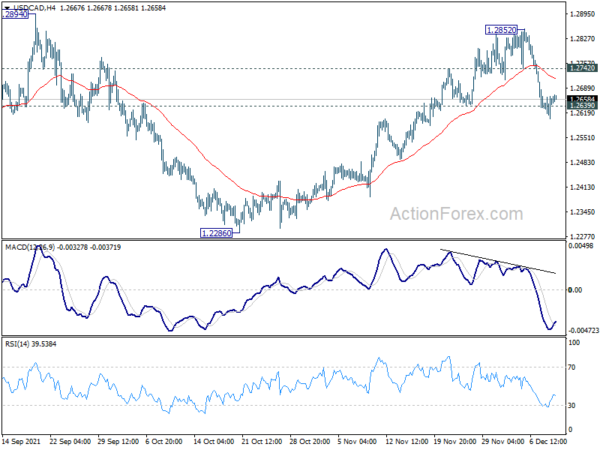

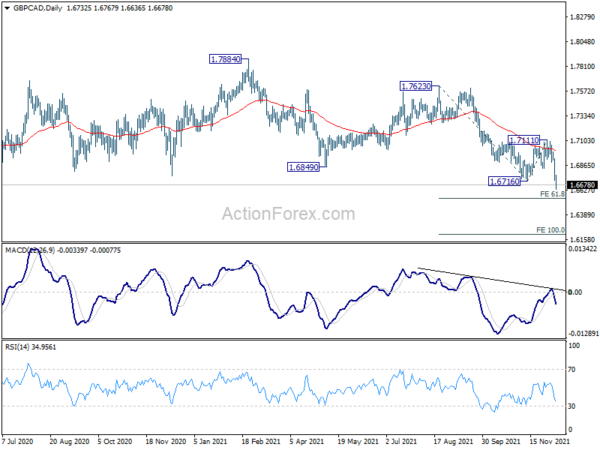

Market sentiment is generally positive in Asian session today. Australian and New Zealand Dollar are extending near term rebound. Other currencies are mixed, though. Canadian Dollar is paring some gains, after the non-eventful BoC rate decision. Sterling is trying to...

Stocks making the biggest moves after hours: GameStop, Lucid Group, RH & more

A man looks at GameStop at 6th Avenue on February 25, 2021 in New York. John Smith | Corbis News | Getty Images Check out the companies making headlines in after-hours trading: GameStop — Shares of the video game retailer...

ECB: Eurozone Monetary Policy to Remain Relatively Accommodative, For Now

Summary The European Central Bank’s (ECB) December 16 monetary policy announcement looms as a key event for market participants, as the central bank considers whether to bring its emergency asset purchase program to an end. Economic trends are mixed heading...

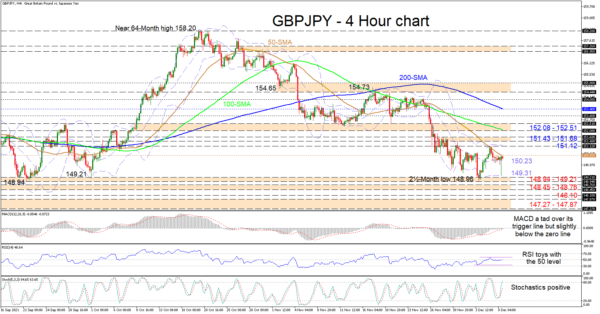

GBPJPY’s Guiding Forces Fade but Bearish Bias Lingers

GBPJPY is trading around the mid-Bollinger band at 150.23, curbed by the 50-period simple moving average (SMA), which continues to hamper advances even after the bounce around the 149.00 mark. The falling SMAs continue to endorse the pair’s negative trajectory...

Sterling Tumbles as UK Said to Return to Restrictions, Pfizer News Lifts Sentiments

Much volatility is seen in the markets today, in particular in Sterling. The Pound tumbled sharply on news that the UK Government to going to activate a plan B and impose some restrictions as soon as on Wednesday, due to...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals