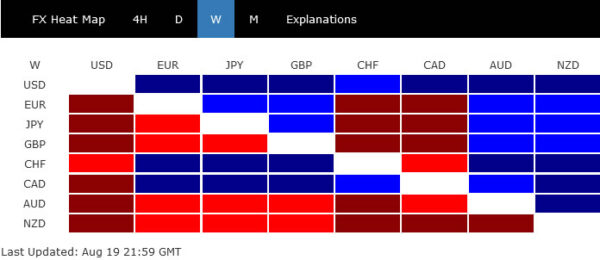

Dollar Rally Rejuvenated as Risk-on Sentiment Lost Steam, Yields Jumped

Dollar ended as the strongest one, closing notably higher against all other major currencies, as risk-on sentiment lost steam while treasury yields surged. The late momentum was rather impressive and argues that the greenback might be ready for breakouts. While...

The Weekly Bottom Line: How Quickly to Raise Rates? That Is the Question

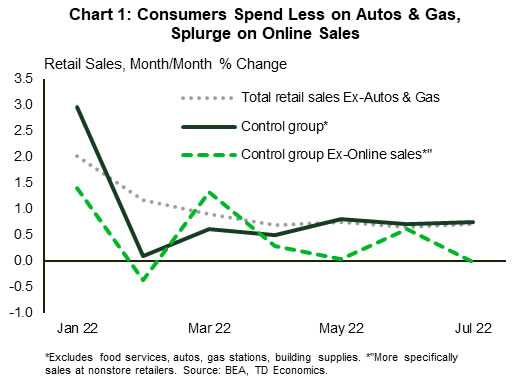

U.S. Highlights Total retail sales were flat in July, marking a deceleration from June’s pace. However, sales in the control group, which exclude several volatile categories and are used in calculating GDP, rose a sturdy 0.8% m/m. Housing continued to...

Week Ahead: US Core PCE and Jackson Hole Symposium to Dominate Headlines

Could the US Dollar finally settle down this week? Perhaps. But it might only be until Friday when Fed Chairman Powell speaks at the Jackson Hole Symposium. Can you recall a more volatile August for the US Dollar? Last week,...

Inflation peaking? 10 common consumer items where prices are falling

A customer shops for eggs in a Kroger grocery store on August 15, 2022 in Houston, Texas. Brandon Bell | Getty Images July’s consumer price index report finally showed a sign of potential relief – inflation ticked up less than...

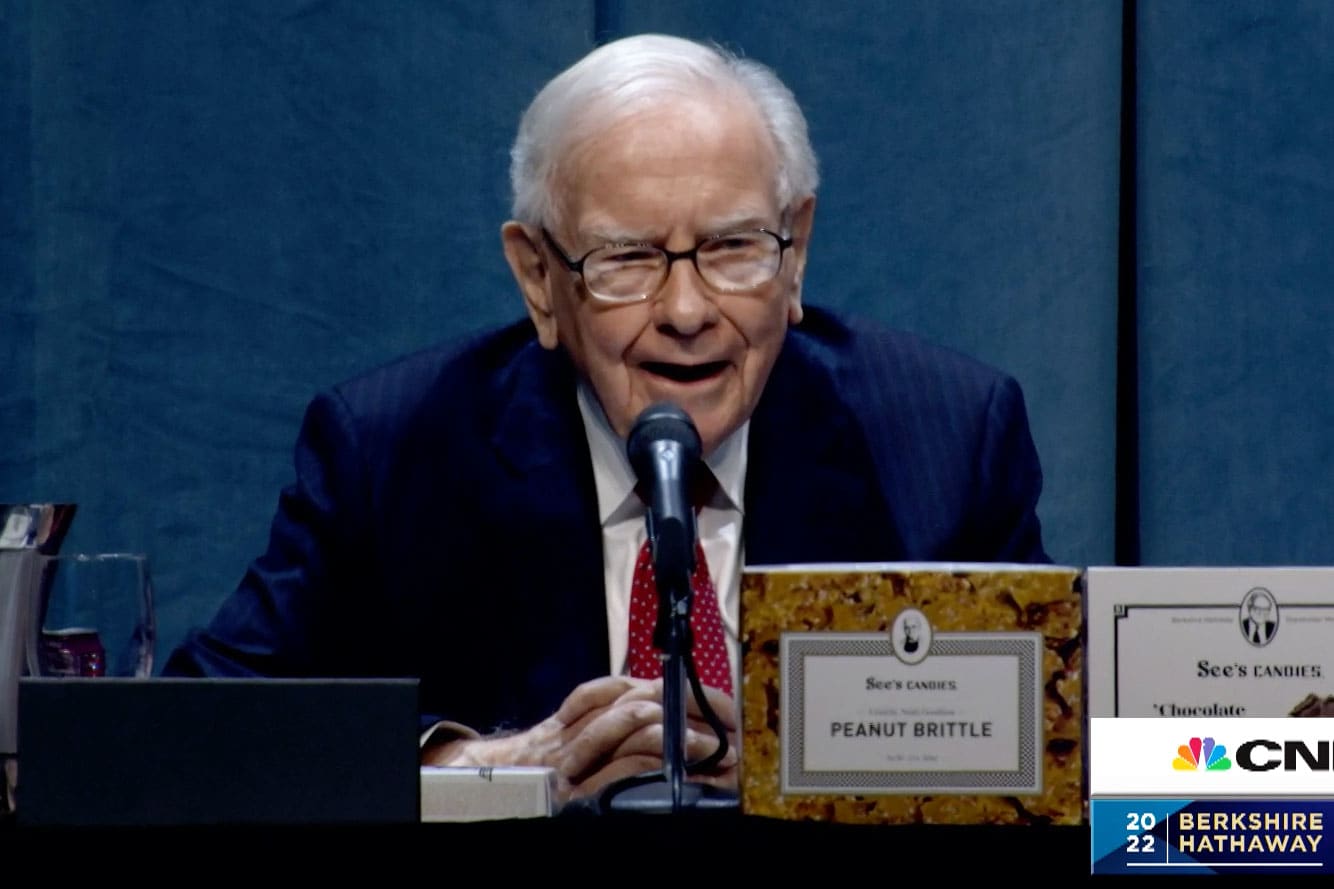

Warren Buffett gets permission to buy up to half of Occidental Petroleum, boosting the shares

Warren Buffett at press conference during the Berkshire Hathaway Shareholders Meeting, April 30, 2022. CNBC Warren Buffett’s Berkshire Hathaway on Friday received regulatory approval to purchase up to 50% of oil giant Occidental Petroleum. Shares of Occidental jumped 10% on...

Weekly Economic & Financial Commentary: The Fed Still Has More Work to Do

Summary United States: Expansion Not Yet Heading to the Gallows An increase in real retail sales by our estimates and a rebound in industrial production in July offered evidence beyond recent jobs data that the U.S. economy is not yet...

GBP/USD: Bears Accelerate Towards 2022 Low, On Track for the Biggest Weekly Fall in Nearly Two Years

Cable extends sharp fall after eventual break of pivotal 1.20 support, pressured by growing concerns about inflation-growth puzzle which boosts fears that the economy is heading into recession and fresh hawkish comments from Fed policymakers. Soured sentiment adds to bearish...

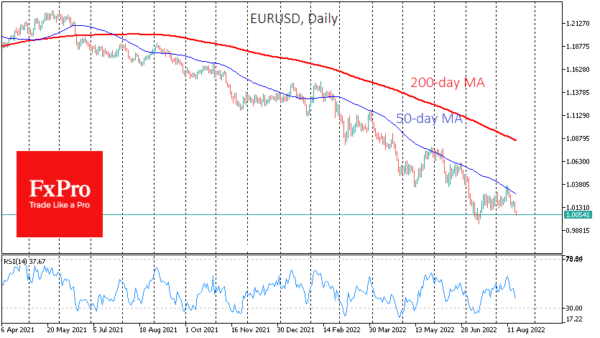

Dollar Returns to Growth after a Summer Respite

The US dollar has quite expectedly accelerated its rise. EURUSD is trading less than 50 pips from parity, which it managed to defend in mid-July, having retreated from 20-year lows. GBPUSD has also quickly returned to July lows, losing more...

EUR/USD Started a Fresh Decline from $1.0180

The Euro started a fresh decline from well above the 1.0180 level against the US Dollar. The EUR/USD pair traded below the 1.0150 support zone to move into a bearish zone. There was a move below a connecting bullish trend...

Dollar Continues Strong Rally, Swiss Franc Catching Up

Dollar rally continues today and it’s set to end the week on a high note. Risk aversion and rising benchmark yield are both helping the greenback. Swiss Franc is also strengthening a lot. Selling focuses are mainly concentrated on Sterling,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals