U.S. economy is ‘on the brink’ of a complete recovery, says Richmond Fed’s Barkin

Pedestrians walk outside the New York Stock Exchange in the U.S. Daniel Acker | Bloomberg | Getty Images The U.S. economy is recovering from the Covid-19 recession, but some economic “scarring” may take a long time to heal, said Richmond...

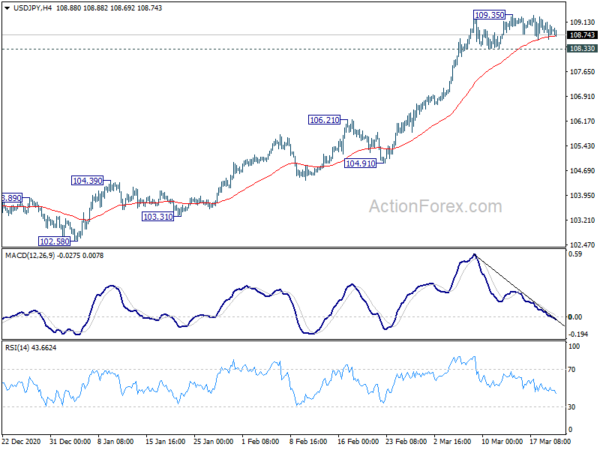

Yen Mildly Higher While Nikkei Tumbles, SNB a Focus in the Week

Nikkei trades sharply lower today as selloff continues after BoJ decide to exclude Nikkei-linked ETF from its purchases. Though, Topix is also trading down deeply. The Japanese markets are weighed down by news that a fire-damaged automotive semiconductor plant is...

Sentiments Turned Cautious on Yields and Infections, But Stay Positive

US treasury yield jumped last week after Fed gave way to more yield strength. In the background, there were some concerns over resurgence of coronavirus infections in some countries like France, Brazil and India. There was also risk of slower...

The Fed can fight inflation, but it may come at the cost of future growth

Gas prices are displayed at a Speedway gas station on March 03, 2021 in Martinez, California. Justin Sullivan | Getty Images One of the main reasons Federal Reserve officials don’t fear inflation these days is the belief that they have...

Weekly Economic & Financial Commentary: Still on Track for a Robust Recovery Even After Soft Data This Week

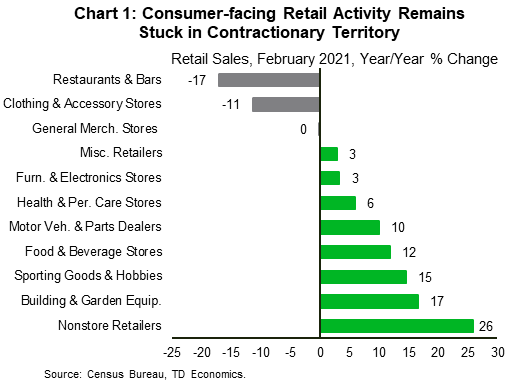

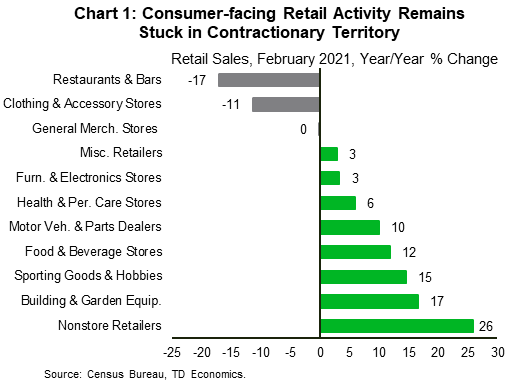

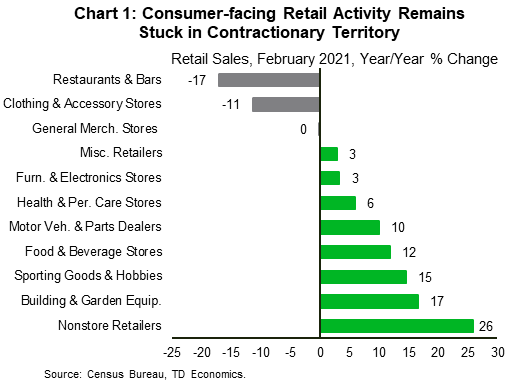

U.S. Review Still on Track for a Robust Recovery Even After Soft Data This Week The worse-than-expected outcomes for February retail sales, industrial production and housing starts were in part due to the severe winter weather that hit much of...

Forward Guidance: Race Between Vaccine Rollout and Virus Spread Heating Up

It would not be at all surprising to see flash Canadian wholesale and manufacturing sale reports for February soften albeit after very solid January gains (wholesale sales rose 4.0%, manufacturing up 3.1% in January). The latter will likely continue to...

The Weekly Bottom Line: Spring is Just Around the Corner

U.S. Highlights Most Federal Open Market Committee members see no interest rate hikes until at least 2024 despite a sharp upgrade to the growth outlook. Retail sales weakened on the back of frigid temperatures, but additional support to households through...

The Weekly Bottom Line: Spring is Just Around the Corner

U.S. Highlights Most Federal Open Market Committee members see no interest rate hikes until at least 2024 despite a sharp upgrade to the growth outlook. Retail sales weakened on the back of frigid temperatures, but additional support to households through...

The Weekly Bottom Line: Spring is Just Around the Corner

U.S. Highlights Most Federal Open Market Committee members see no interest rate hikes until at least 2024 despite a sharp upgrade to the growth outlook. Retail sales weakened on the back of frigid temperatures, but additional support to households through...

Week Ahead: Coronavirus, MOAR Powell, and US Treasury Auctions

After a jam packed, Central Bank dominated week, things will begin to slow down as spring arrives. There were no major surprises from the FOMC, BOE, and BOJ last week, however the peripheral central banks of Turkey and Norway were...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals