Week Ahead: Coronavirus, MOAR Powell, and US Treasury Auctions

After a jam packed, Central Bank dominated week, things will begin to slow down as spring arrives. There were no major surprises from the FOMC, BOE, and BOJ last week, however the peripheral central banks of Turkey and Norway were...

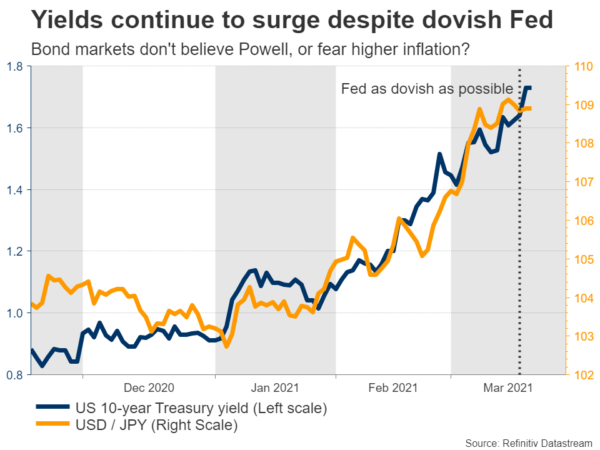

Week Ahead: Financial Markets Remain Fixated with Bond Market Moves and Brace for Lots of Central Bank Speak

The focus for the upcoming week will stay with the bond market. Financial markets are worried with how high Treasury yields can go. Treasuries have declined for seven straight weeks and that has triggered been the primary driver for US...

Visa says the DOJ plans to probe its debit card practices, shares fall 6%

Visa shares dropped sharply Friday after a report said the Justice Department has opened an investigation into its debit card business and possible anticompetitive practices. The company said Friday afternoon that investigators have started to collect information on Visa debit...

Powell says the Fed is committed to using all its tools to promote recovery

Federal Reserve Chair Jerome Powell arrives for a news conference following the Federal Open Market Committee meeting in Washington, December 11, 2019. Joshua Roberts | Reuters Federal Reserve Chairman Jerome Powell reiterated his commitment to an “all-in” approach to the...

Stocks making the biggest moves midday: Visa, Nike, FedEx & more

Andrew Harrer | Bloomberg | Getty Images Check out the companies making headlines in midday trading. Visa — Shares of the payment processor fell 4.7% in midday trading after a report said the Justice Department is investigating whether business practices...

Week Ahead – European PMIs to Chart the Euro’s Course

It seems like a relatively calm week for global markets. The sole central bank meeting will be that of the Swiss National Bank, which will likely be thrilled about the recent demolition of the franc. There is also an overload...

EUR/GBP Near its Breaking Point

When the ECB met last week, Christine Lagarde and friends said that the ECB would significantly pick up the pace of bond buying under its Pandemic Emergency Purchase Program (PEPP). This week, the BOE met. Andrew Baily and his gang...

WTI Oil Outlook: Oil May Fall Further on Weakened Sentiment and Formation of Reversal Pattern

WTI oil trades within a choppy consolidation on Friday but remains biased lower following a massive losses on Thursday, when the price fell by 7.6%, making the biggest one day drop since 21 Apr 2020. A new wave of coronavirus...

The Fed will not extend a pandemic-crisis rule that had allowed banks to relax capital levels

The Federal Reserve on Friday declined to extend a pandemic-era rule that relaxed the amount of capital banks had to maintain against Treasurys and other holdings, in a move that could upset Wall Street and the bond market. In a...

Dollar and Yen Firm as Investors Stay Cautious

Dollar is generally firmer as markets enter into US session. Futures point to a flat open, but investors are clearly on guard of selloff before the weekend. Cautiousness is keeping Yen afloat too, even though Swiss Franc is lagging behind....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals