European PMIs: Is a Recession Coming for the Euro?

The Eurozone economy is losing power. A recession has become a real possibility and the upcoming PMI business surveys on Friday will tell investors exactly how high that risk is. The French TV debate between Macron and Le Pen on...

PBoC Steps in as Chinese Economy Slows

Market movers today Today, the IMF releases its latest take on the global economy also known as the World Economic Outlook. We are looking forward to reading the IMF’s assessment of the impact of the Russian invasion, Western sanctions and...

GBP/USD Vulnerable to a Drop Below 1.3000

Key Highlights GBP/USD is struggling to clear the 1.3150 resistance zone. A crucial bearish trend line is forming with resistance near 1.3120 on the 4-hours chart. EUR/USD is still trading in a bearish zone below 1.0920. Gold price extended gains,...

Homebuilder sentiment drops for fourth straight month, as rising rates push housing to ‘an inflection point’

A contractor uses a hammer while working on townhouse under construction at the PulteGroup Metro housing development in Milpitas, California. David Paul Morris | Bloomberg | Getty Images Sharply rising mortgage rates are taking their toll on the nation’s homebuilders,...

Market will break out of slump due to peaking inflation, Evercore ISI predicts

The market slump may be in its final innings. According to Evercore ISI’s Julian Emanuel, stocks should start grinding higher due to peaking inflation. He cites a positive trend going back to the last time stocks and bonds fell together:...

EUR/USD Pair Moved into a Bearish Zone Below $1.0880

The Euro started a fresh decline from the 1.0925 resistance zone against the US Dollar. The EUR/USD pair declined below the 1.0880 level to move into a bearish zone. The price even traded below the 1.0800 level and the 50...

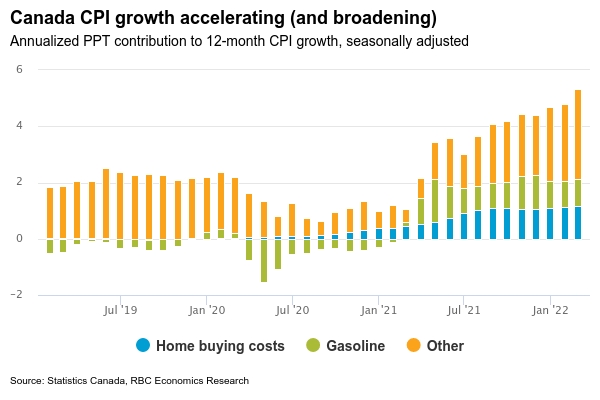

Canadian March Inflation to Breach 6%

Next week’s Canadian CPI report is expected to show a further acceleration to 6% in March. That would top the 5.7% February reading that was already the highest since 1991. Soaring gasoline prices are expected to account for almost a...

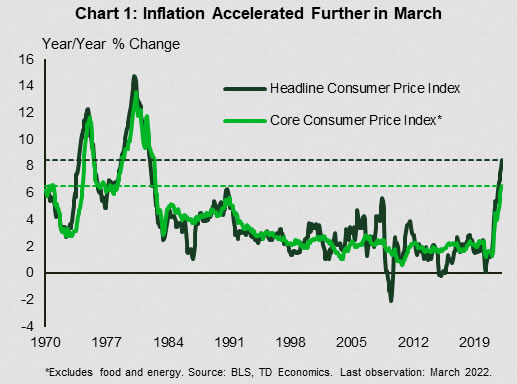

The Weekly Bottom Line: Inflation Surge Continues

U.S. Highlights Overall inflation as measured by the CPI accelerated to 8.5% year-over-year (y/y) in March, marking yet another multi-decade high. Core inflation, which excludes food and energy, ticked up a tenth of a percentage point to 6.5% y/y. Small...

USD/JPY Hits New Multi-Year High, 130 Next?

Key Highlights USD/JPY started a fresh surge and traded above 125.00. A major bullish trend line is forming with support near 125.75 on the 4-hours chart. It traded to a new multi-year high at 126.59 and might continue to rise....

Retail sales rose 0.5% in March amid inflation jump; import prices hit 11-year high

Customers pushing shopping carts shop at a supermarket on April 12, 2022 in San Mateo County, California. Liu Guanguan | China News Service | Getty Images Consumers continued to spend in March even as inflation rose to its highest level...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals