Dimon says confluence of inflation, Ukraine war may ‘dramatically increase risks ahead’ for U.S.

Jamie Dimon, CEO of JPMorgan Chase speaks to the Economic Club of New York in New York, January 16, 2019. Carlo Allegri | Reuters Jamie Dimon, CEO and chairman of the biggest U.S. bank by assets, pointed to a potentially...

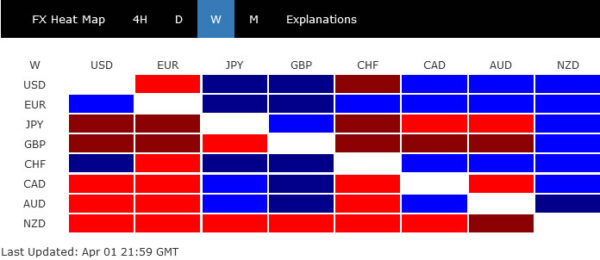

Yen Takes a Pause after Busy Week

The Japanese yen has started the week with slight gains, as USD/JPY is trading at 122.75 in the North American session. It was a rollercoaster week for the yen, which showed strong volatility throughout the week. USD/JPY posted considerable gains...

Crude Oil Already Considered Negative News

On Monday 4 April, the Brent price is “in the black”; the asset is trading at $105.40. This sharp decline in oil prices was caused by US President Joe Biden’s decision to “unleash” the country’s reserve oil tanks and sell...

Gold Consolidates Around 50% Fibonacci Level

Gold has stabilized around the 1,925 level, which is the 50.0% Fibonacci retracement of the near six-week rally from 1,780 until the 19-month high of 2,070. The rising simple moving averages (SMAs) continue to endorse the bullish trend in the...

Natural Gas Without Hysteria

The energy sector has retreated markedly from its highs in the first days of March but remains a hot topic for markets. Europe’s gas market survived several bouts of fear that it would be without Russian gas. However, we only...

Stock futures are flat after S&P 500 notches third straight week of gains

Traders on the floor of the NYSE, March 25, 2022. Source: NYSE U.S. stock index futures were flat during overnight trading Sunday, after the S&P 500 posted a third straight week of gains. Futures contracts tied to the Dow Jones...

As Wall Street banks embrace crypto, high-flying start-ups look to lure top finance talent

Wall Street has been beefing up hiring for digital asset teams. But some employees are walking away from name-brand institutions in search of more risk, and potentially, more reward. JPMorgan Chase, Morgan Stanley and Goldman Sachs are among the firms...

Yield Curve Inversion, Stocks Rallied, Euro Rebounded

There were a couple of developments of last week to note. Firstly, US yield curve inverted for the first time since 2019. There is no reason to panic for the moment, but deeper inversion could set the tone in the...

Weekly Economic & Financial Commentary: Soaring Price Gauges Turn Up the Pressure on the Fed

Summary United States: Soaring Price Gauges Turn Up the Pressure on the Fed The Fed’s difficult job got harder this week. Its preferred inflation gauge set another fresh 40-year record high, while the ISM prices paid measure shot up 11.5...

US: ISM Manufacturing Index Registers 22nd Consecutive Month of Expansion

The March ISM manufacturing index registered 57.1, missing expectations of a 59.0 print. The index fell 1.5 percentage points from the February reading of 58.6. New orders fell by 7.9 percentage points to 53.8, while new export orders fell by...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals