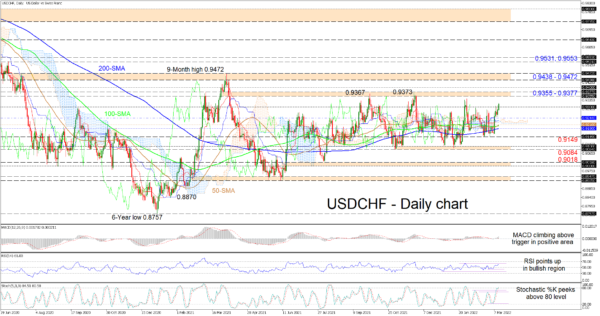

USDCHF Ascends Above Cloud, Moves Beyond 0.93 Mark

USDCHF has climbed above the 0.9300 handle, extending the latest surge in upward forces, and is now eyeing the 0.9355-0.9377 resistance barrier, which includes the September and November 2021 highs. The minor upturn in the simple moving averages (SMAs) confirm...

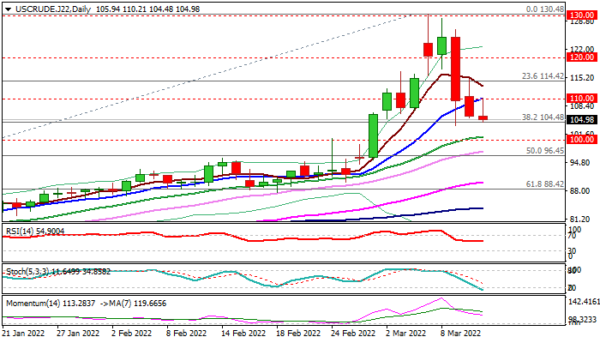

WTI Oil on Track for Strong Weekly Drop on Improved Sentiment

WTI oil price edged higher on Friday but remains below $110 per barrel for now, after falling sharply in past two days on optimism of de-escalation of the conflict in Ukraine and easing concerns about stronger disruption of global oil...

Canadian Dollar Shot Up by All-Round Strong Job Report, Yen Weakness Continues

Canadian Dollar surges sharply after employment data blows past expectations. Sterling and Euro are firm slightly firmer but there is no clear upside momentum. On the other hand, selloff in Yen is still persisting. Dollar is mixed for now. In...

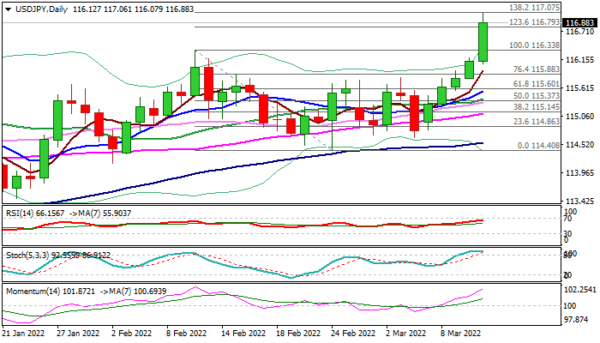

USD/JPY Outlook: The Pair Could Extend to 2017 High in Dollar-Positive Environment

The USDJPY accelerated strongly higher on Friday (up around 0.7% in Asia/Europe), extending steep rally into fifth straight day. Strong US inflation data (Feb CPI soared to the highest since 1982) fuel expectations for Fed rate hike in the next...

EUR/USD Consolidating Near 1.1010

The Euro started a decent recovery wave above 1.0920 against the US Dollar. The EUR/USD pair traded above the 1.1050 resistance level and the 50 hourly simple moving average. However, it failed to clear the 1.1120 resistance and started a...

GBPUSD marks yet more lower lows as bearish forces linger

GBPUSD continues its downward trend, reaching levels last seen back in November 2020 as negative momentum persists. Moreover, the pair continues to record successive higher lows and lower highs, reflecting an overall bearish outlook. Short-term momentum oscillators indicate a negative...

Yen Under Pressure on Rate Outlook and Rising Yield, USD/JPY Breakout

Yen is under some broad based pressure in Asia session despite some mild risk aversion sentiment. BoJ is clear to lag behind other major central bank in raising interest rates, due to the still underperforming inflation. Rally in global treasury...

Crude Oil Price Reverse Gains And Faces Resistance

Key Highlights Crude oil price surged to $131 before there was a sharp decline. It broke a major bullish trend line at $118.50 on the 4-hours chart. EUR/USD corrected losses and climbed above 1.1020. Gold price stayed above the $1,975...

Goldman Sachs shutters Russia business, first major Wall Street bank to leave after Ukraine war

A sign is displayed in the reception area of Goldman Sachs in Sydney, Australia. David Gray | Reuters Goldman Sachs says it is exiting Russia, becoming the first major global investment bank to do so after the country invaded its...

Inflation rose 7.9% in February, as food and energy costs push prices to highest in more than 40 years

Inflation grew worse in February amid the escalating crisis in Ukraine and price pressures that became more entrenched. The consumer price index, which measures a wide-ranging basket of goods and services, increased 7.9% over the past 12 months, a fresh...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals